Here at Process Street, we’re always talking about the importance of workflows.

Here at Process Street, we’re always talking about the importance of workflows.

Workflows help you define what work you do and the order in which you do it.

According to the Powering Productivity report from Planview, poor processes and workflows are the number 1 cause of inefficiencies in organizations. Plus, the Chaos Theory report from Projectplace revealed project managers lost 2 hours 45 minutes each week due to poor workflows.

When you document your workflows and improve them, you optimize your work. This results in better work done more quickly.

It’s one of the simplest ways to improve the performance of your own work, or that of an organization. From basic workflows with only a couple of steps to company wide workflows with multiple stakeholders and variables.

This principle remains true in countless use cases and industries but is most powerful in areas where work benefits from standardized practices.

This brings us to an area of business where standardization is a true sign of quality: accounting.

Effective accounting practices require a strong understanding of how information flows throughout your business.

In this article, we’re going to look at:

- What is the accounting cycle?

- What is a workflow?

- How to construct processes for your accounting activities

- 11 accounting processes you can try today

What is the accounting cycle?

The accounting cycle is one of the central workflows of accounting. It follows from when a transaction is first documented to when a financial statement is submitted. The cycle starts fresh every accounting period and is the backbone of solid accounting structure.

Accounting Explained describes the cycle like so:

Accounting cycle is a step-by-step process of recording, classification and summarization of economic transactions of a business. It generates useful financial information in the form of financial statements including income statement, balance sheet, cash flow statement and statement of changes in equity.

The time period principle requires that a business should prepare its financial statements on periodic basis. Therefore accounting cycle is followed once during each accounting period. Accounting Cycle starts from the recording of individual transactions and ends on the preparation of financial statements and closing entries.

This cycle is then broken down into a series of different steps.

There is some disagreement as to whether the cycle should be considered as 8 steps or 9 or even 10. The number 10 is optional.

The cycle goes as follows:

- Analyze and record transactions via journal entries

- Post journal entries to ledger accounts

- Prepare unadjusted trial balance

- Prepare adjusting entries at the end of the period

- Prepare adjusted trial balance

- Prepare financial statements

- Close temporary accounts via closing entries

- Prepare post-closing trial balance

Analyze and record transactions via journal entries

Any transactions that are deemed relevant to the business or business operations are recorded.

For each of these, you will produce or gather the relevant business documents or source documents.

As Accounting Coach makes clear, these are the regular documents you would expect to accumulate during your operations:

For example, a company’s source document for the recording of merchandise purchased is the supplier’s invoice supported by the company’s purchase order and receiving ticket. A company’s source documents for its weekly payroll are the employees’ time cards. A manufacturer’s production records will also include source documents such as materials requisition forms.

You record the details of these transactions in your journal.

A journal is a chronological list of transactions, and information is often recorded twice; as debited and credited.

You may use a singular general journal, or you may have a series of specialized journals alongside it for regular transactions; sales, etc.

Post journal entries to ledger accounts

The ledger shows us the changes made to each of our accounts in relation to past transactions and current balances.

This is also known as the Books of Final Entry. Which, I think we can all agree, is a much cooler name.

The ledger is a kind of authoritative record of transactions and their impact on company finances over the accounting period.

Accounting Verse provide the following example to illustrate how this happens:

For example, all journal entry debits and credits made to Cash would be transferred into the Cash account in the ledger. We will be able to calculate the increases and decreases in cash; thus, the ending balance of Cash can be determined.

Prepare unadjusted trial balance

The first step here is to extract all the different account balances from the ledger and arrange them in another report.

Then you add the debit balances and credit balances. Your total debits and total credits should be equal.

If they’re not equal, you make what’s called a correcting entry to rectify or reverse the mistakes. You have to also check that everything is correct even in the event of equality between debits and credits. If multiple mistakes have been made on either side, the two could appear equal yet have mistakes within them, such as double posting.

The trial balance is just to test the equality of credits and debits, so don’t get too hung up on it as a measure of overall accounting correctness at this stage.

Prepare adjusting entries at the end of the period

This sounds more complex than it is.

In this stage, you’re simply accounting for things that didn’t get chance to go into the books.

Perhaps they’re expenses incurred yesterday or another kind of transaction which isn’t in the documents you’re reviewing. The adjusting entries are there to tidy up those loose ends.

Prepare adjusted trial balance

Accounting Verse sum this up succinctly:

An adjusted trial balance may be prepared after adjusting entries are made and before the financial statements are prepared. This is to test if the debits are equal to credits after adjusting entries are made.

You’re just recalculating the trial balance with consideration of the adjusting entries.

Prepare financial statements

The financial statement is not the last stage of the process, but it is in many ways the key output of the process.

A complete set of financial statements is made up of: (1) Statement of Comprehensive Income (Income Statement and Other Comprehensive Income), (2) Statement of Changes in Equity, (3) Statement of Financial Position or Balance Sheet, (4) Statement of Cash Flows, and (5) Notes to Financial Statements.

You should only begin the financial statement when the previous steps have been undertaken; when credits and debits are equal, and adjusting entries have been taken into consideration.

This serves as your official summary for the accounting period.

Close temporary accounts via closing entries

Some of your accounts are temporary or nominal accounts, whereas others are permanent or real accounts.

A balance sheet account, for example, would be a real or permanent account. Along with asset accounts or liability accounts.

Temporary accounts include income, expenses, or withdrawing accounts. These accounts are closed to a summary account at the end of the accounting period.

You can think of these accounts as being related to owner’s equity in certain environments, or you can think of them in regards to useful information. No one needs to know you claimed $5 for a sandwich any more, but it is pertinent to know that the company owns a building no matter the accounting period.

Prepare post-closing trial balance

The post closing trial balance is just a recalculation of the balance once closed accounts have been removed.

Like always, credits and debits should still be equal.

Now you’re ready to begin a new accounting period.

What is a workflow?

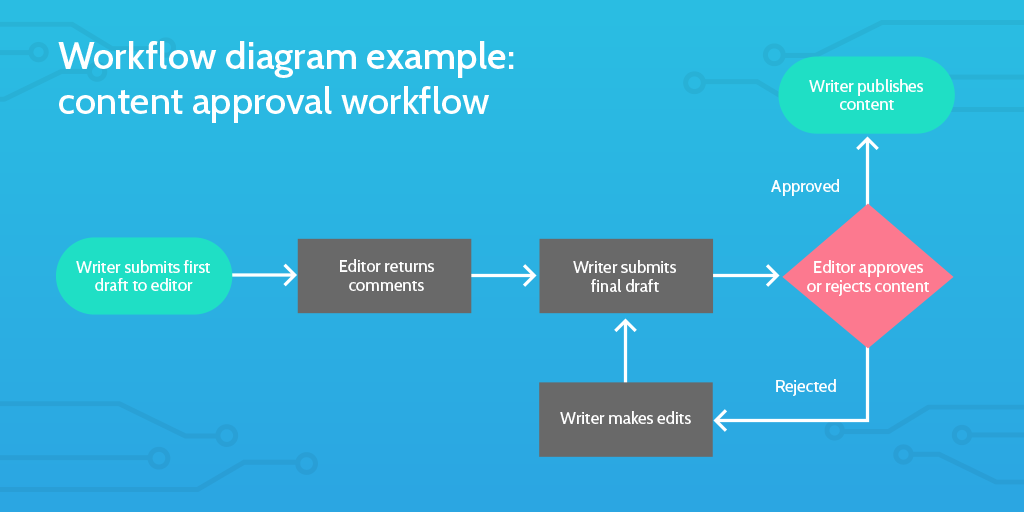

A workflow is a representation of sequential steps required to turn resources into products or services.

A workflow is a representation of sequential steps required to turn resources into products or services.

Wikipedia choose to use an even more baffling definition:

A workflow consists of an orchestrated and repeatable pattern of business activity enabled by the systematic organization of resources into processes that transform materials, provide services, or process information It can be depicted as a sequence of operations, declared as work of a person or group, an organization of staff, or one or more simple or complex mechanisms.

But we don’t need to use such a clunky description. Benjamin Brandall provides us with a short and sweet version which anyone can understand of what a workflow is:

Workflows are the way people get work done, and can be illustrated as series of steps that need to be completed sequentially in a diagram or checklist.

It’s all about understanding that certain tasks need to be completed first in order for other tasks to be completed. This then helps define an order in which tasks can be done. How you arrange this order determines your workflow.

Effective accounting requires being able to provide transparency and evidence for how funds are managed. The steps and procedures you take in normal accounting work are workflows.

You can’t make a bank deposit without having counted the cash. You can’t run a three way match before other people have been involved in the process. It would be ridiculous.

Accounting relies on the implementation of effective workflows.

Victoria Cameron and Laura Redmond, in their article Workflow in your Accounting Practice, reiterate the importance of workflow management within the field:

Whether you are performing work yourself or delegating to staff, managing workflow for your practice is critical.

Critical. But where are these workflows? What work comes under this category?

Well, pretty much all of it.

Cameron and Redmond lay out four areas where workflows need to be implemented:

- Identify uses of technology to improve external and internal communications

- Define how to organize staff task management systems and task resources for supporting the task completion

- Analyze and allocate practice resources

- Recognize the need to be deliberate about integrating systems

These are distinct areas but there is still considerable depth in each. Many of the processes in these systems might not be accounting-specific.

Processes which fall under the scope of “external and internal communications” could be any of the following:

- Blog Pre-Publish Checklist

- Privileged Password Management

- Email Server Security

- High Touch Client Onboarding

- Customer Support Process Checklist

So, though we’re going to focus on accounting-specific workflows and processes, it is important to recognize that your business does so much more than just accounting. Leveraging workflows for these other tasks is not just recommended, but industry best practice.

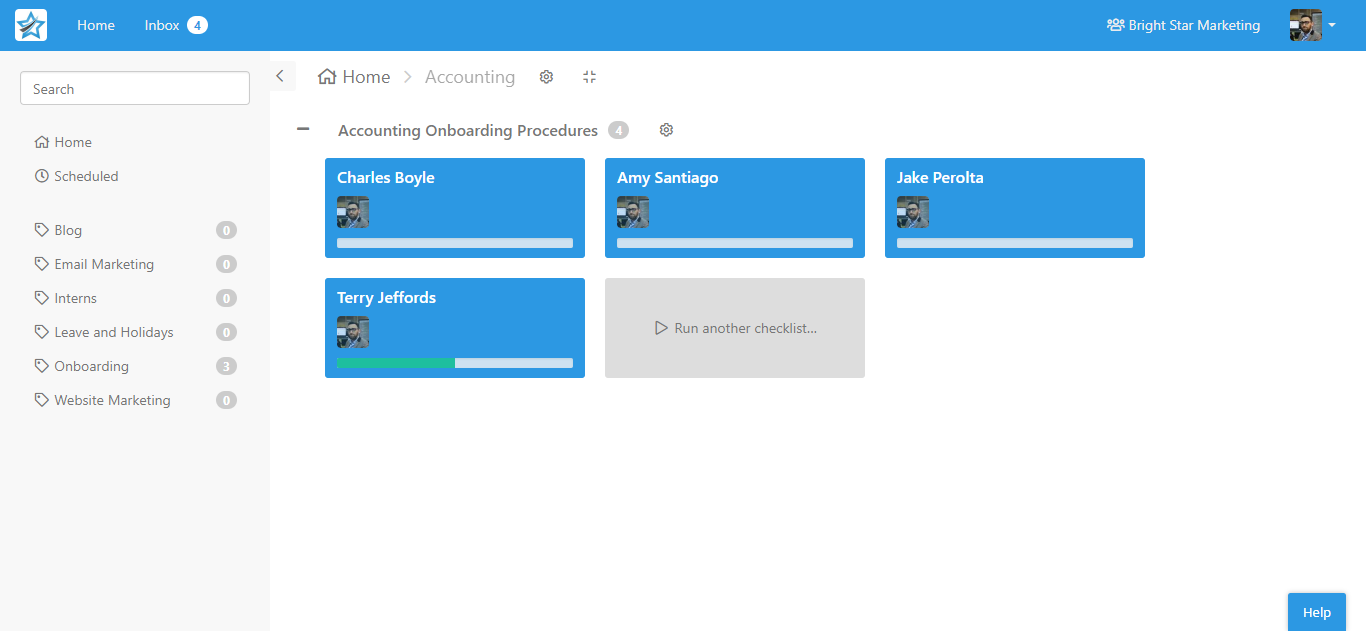

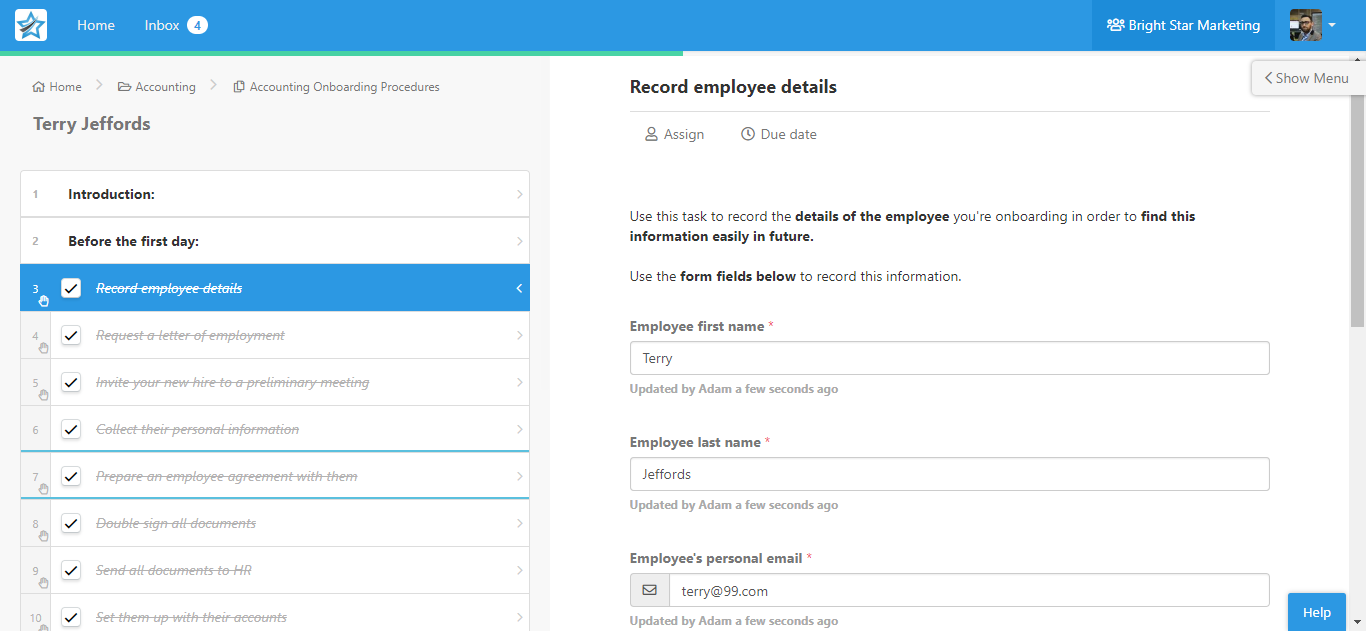

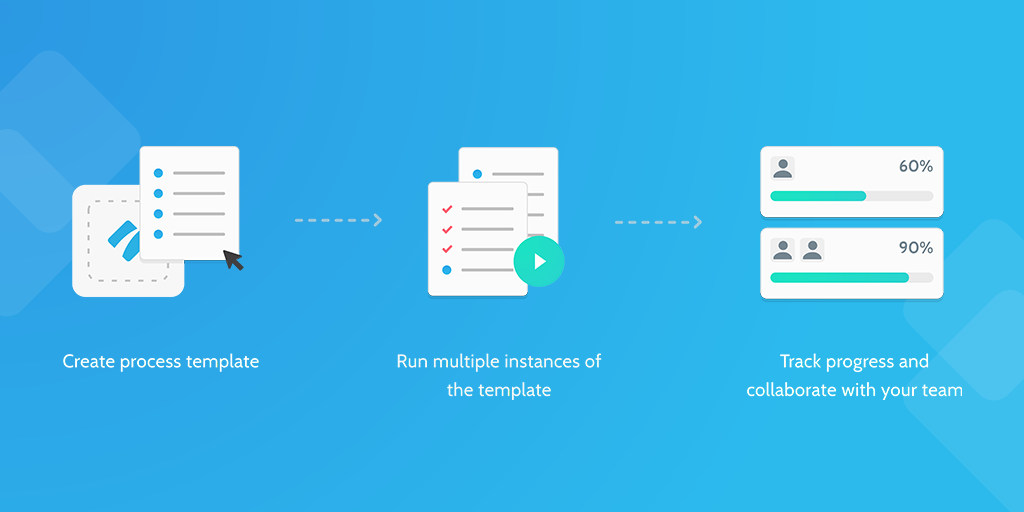

For example, in the above image you can see how you may run multiple onboarding checklists for new members of the accounting team.

For example, in the above image you can see how you may run multiple onboarding checklists for new members of the accounting team.

Each of these checklists will provide a step by step walk-through of the different tasks required to complete the onboarding process.

Each of these checklists will provide a step by step walk-through of the different tasks required to complete the onboarding process.

You could even create an automation with Zapier to run this checklist automatically from your human resources software, if you use one, as shown in the zap embed above.

Hiring and onboarding new staff isn’t accounting-specific; all companies do this. But it is an important part of running a successful organization, and a use case which you should have documented procedures for.

How to construct processes for your accounting activities

WSG Systems President William Cornfield’s article Making workflows work, in the Journal of Accountancy, lays out a clear 5 step system for bringing workflows effectively into your accounting business.

1. Record and understand all your existing workflows

Take the time to map out what your firm does and how it does it. Do you offer different services among clients? How do the steps differ between services and clients? Which steps are the same across all clients and services?

There are a couple of simple techniques we at Process Street recommend for this step:

- Create a really simple bullet point list for the different steps in a single workflow and build from there

- For digital flows, you can screen-record your computer as you do a task so you can see exactly the steps you take

- You can connect all these different workflows together through process mapping; you can use BPMN if you want to get technical with it.

However, Cornfield adds:

A thorough checklist is a good start, but it’s not a workflow process. You have to take the next steps.

And he’s right. You need to have a strategy with workflows at the centre.

Which leads us to…

2. Build a realistic workflow plan

Once you have a detailed checklist, the next task is to calculate the duration and work involved for each step.

This is where your practical expertise in the area is needed. Cornfield provides some key examples:

For example, intake on a standard Form 1040, U.S. Individual Income Tax Return, may be completed in 15 minutes by an experienced senior, but it may take 30 minutes or longer when it’s done by a less-experienced junior seeing a new client for the first time. Some clients might fill out the intake worksheet while others deliver a shoebox full of receipts.

It’s important to know what resources you have in the company and what your clients’ needs are.

Your workflows need to be tailored to be able to balance these demands. Like credits and debits in an account.

Your strategic workflow plan should accommodate not just how a task is completed, but how the broader business functions.

3. Use the right software to organize your workflows

Even for smaller firms, the benefits of leveraging technology for workflow can outweigh the upfront costs. Firms can invest in resource scheduling and project management software to eliminate offline spreadsheets, confusing email threads, and cryptic Post-it notes.

There are many pieces of accounting software you may already use or may be looking into using. Some of the key industry leaders are:

But there are plenty of other options too. The key thing for your workflows might be to use a dedicated business process management tool like Process Street to organize your employees actions, while these accounting tools shoot the necessary data around from place to place.

Check out our comparison article to see which accounting software would be best for you: Xero vs QuickBooks vs FreshBooks: The Best Accounting Software (with Monty Python)

This keeps you optimized and means all important information can be accessed at the click of a button.

Even better, Process Street integrates with all the leading accounting software via the third-party automation tool Zapier.

This means you can run Process Street checklists directly from inside Freshbooks, for example.

Or, how about you start piecing all of the software you use together? Let me give you a quick example.

Hold on tight.

Your sales team uses Salesforce to find new clients. When they arrange a sales qualification call in Salesforce it automatically launches the relevant Process Street checklist for them to follow. As they work through that checklist on the call, they gather the client’s information and close the deal. This then sends that info into a Google Sheet for central records and automatically creates a new client in your Freshbooks account from this sheet entry. That new client in Freshbooks triggers a new contact in your Mailchimp account so that the new client is subscribed to your newsletter.

And breathe!

It sounds complex, but it isn’t. It would look like this:

Look at you! Now you’re building software workflows!

4. Expected the unexpected and make workflows flexible

Workflow scheduling with optimization will help your firm handle the curveballs thrown by clients and your own employees—when they are sick or miss work—by re-racking the schedule overnight so everyone is on the same page come the next day.

Real life doesn’t always flow as simply as a plan on a page.

Building flexibility into your processes allows you to adapt and regroup when something goes wrong.

5. Integrate time tracking for better billing

Employees dislike completing time sheets, and asking them to remember details about their work at the end of the day or week leads to bad data and fewer billable hours.

By using software you can automate much of the time-tracking aspect of the role. You could look to see when tasks were completed in Process Street to gain an understanding of the amount of time spent.

Or, you could integrate a tool like Process Street with dedicated time-tracking software like TimeDoctor via Zapier.

This helps you bill better as well as getting more done!

11 accounting processes you can try today

If all this talk of accounting processes and workflows has gotten you eager to implement your own, you’re in luck!

Below we have 11 accounting processes which you can implement in your business today.

You can take these templates and edit them to suit your specific business needs.

- Accounting Onboarding Procedures

- Creating an Invoice

- Bank Reconciliation Template

- Expense Management Process

- Accounts Receivable Process

- Accounts Payable Process

- Income (Profit and Loss) Statement Process

- Cash Flow Report

- Balance Sheet Statement Preparation Checklist

- Business Tax Preparation Checklist

- Annual Financial Report Template

But maybe you want more?

We’re always looking to help companies who want to improve their use of workflows and processes in their business.

So, if you have any specific processes you’d like to see us build for you to use, let us know in the comments below!

Workflows

Workflows Forms

Forms Data Sets

Data Sets Pages

Pages Process AI

Process AI Automations

Automations Analytics

Analytics Apps

Apps Integrations

Integrations

Property management

Property management

Human resources

Human resources

Customer management

Customer management

Information technology

Information technology

Adam Henshall

I manage the content for Process Street and dabble in other projects inc language exchange app Idyoma on the side. Living in Sevilla in the south of Spain, my current hobby is learning Spanish! @adam_h_h on Twitter. Subscribe to my email newsletter here on Substack: Trust The Process. Or come join the conversation on Reddit at r/ProcessManagement.