“Global stock markets post biggest falls since the 2008 financial crisis.” – The Guardian, 9th of March 2020

Business risk can come out of no where at any time.

It was a Tuesday morning and my phone buzzed me out of my groggy, lethargic state, flashing open the above notification. The Coronavirus had hit businesses and our economy hard, potentially costing 2.7 trillion globally.

A viral risk, that went viral. Was something like this not foreseeable?

In this Process Street article, we turn our attention to the concept of business risk. As we write this article, the corona crisis is unfolding. We were warned about the risk of a virus outbreak but it appears we weren’t as prepared for it as we could have been.

But viruses are not the only risk we face. The 2020 Global Risk Report from the World Economic Forum (WEF) highlights a host of other risks, which we’ll turn our attention to in this article.

To get started, click on the relevant subheaders below to spring to that section. Alternatively, scroll down to read all we have to say regarding the concept of business risk.

- Confront business risk with a risk management process

- Business risk: What is it and why risk items need to be identified

- Business risks: Global business risks from the World Economic Forum

- What is a risk management process and how do we use it?

- Incorporating the Global 2020 Risk Report results within your risk management process

- Risk item 1: Extreme weather, cause, and economic effect

- Risk item 2: Climate action failures, cause, and economic effect

- Risk item 3: Biodiversity loss, cause, and economic effect

- Risk assessment: Why sustainability is part of a good risk assessment

- Sustainability risk management: How you can document your processes with Process Street

Belts and braces on, let’s jump to it!

Confront business risk with a risk management process

Without beating around the bush, I want to present Process Street’s Risk Management Process, ready for you to use right now for free.

You can sign up to Process Street here, and access our Risk Management Process today.

Business risk: What is it and why risk items need to be identified

Business risk is concerned with lowered profits and business failure, identifying factors that could contribute. Anything that could cause a business to miss its targets or goals is considered a business risk.

Before we look into the 2020 Global Risk Report results, I will identify smaller-scale business risks that you need to be aware of. I will present these risks alongside valid risk response strategies, to illustrate the process of risk management from risk identification and onwards.

Business risk #1: Employee sickness

Employee sickness results in manpower shortage costs. Companies would rather not incur these costs but they’re very difficult to mitigate.

However, these are typically short-term costs which prevent risk escalation, and will, therefore, offset larger costs down the line (i.e. the spread of illness through your work-force, human error, and poor productivity).

For instance, in light of the Coronavirus, companies across the globe stopped foreign travel, from Nestle to the local businesses around my area. Some companies shut down office spaces, with employees logging in to work remotely. This is deemed as an appropriate risk response in light of the viral outbreak. It is a way of mitigating a risk that cannot be avoided completely.

Providing comprehensive health coverage – if you’re in America – is an important way to reduce the risk your business faces from health and sickness ups and downs, nevermind contagious illnesses.

Beyond that, encouraging your workforce to be fit and healthy is another way to mitigate the risk of employee sickness, e.g. providing healthy meal choices and promoting exercise. For example, you could create a checklist such as Process Street’s Fitness Planner, and distribute this around for employee use.

Click here to access the Fitness Planner checklist.

Business risk #2: Unhappy customers

This risk is self-explanatory. Without customers, you have no business. You need to keep up-to-date with the changing consumer landscape and be aware of new competition coming into the <ahref=”https: www.process.st=”” marketing-process=”” “target=”blank”>market. This will help you determine the demand for your product or service.</ahref=”https:>

Gaining insight into your customers’ thought processes is key. Use our Customer Feedback Survey for continuous evaluation of market needs.

Click here to access our Customer Feedback Survey Process.

Business risk #3: Competitors ♂️

Competition is not a bad thing. This shows demand for your product. However, more competition means you need to be extra diligent you’re providing more value. Make sure to continually assess and keep ahead of your competition.

SWOT analysis – assessing business Strengths, Weaknesses, Opportunities, and Threats – is a refined strategy that enables competition identification and impact evaluation. Process Street’s SWOT Analysis Template will guide you through this process.

Click here to access our SWOT Analysis Template.

Business risk #4: Disruptions

Disrupters are like competitors but take another form. For instance, Airbnb is a disruptor of the leisure industry. You cannot prevent disruption. However, by continually evaluating the market you can look for trends, to persistently improve and respond to different consumer needs. Once again, in this situation market assessment via SWOT analysis is a good risk response.

Business risk #5: Cybersecurity risks

Despite the huge benefits technology provides in business, it also imposes security risks, with data breaches being commonplace. Keeping your data secure should be a priority. In an event of a breach, you can rely on cyber risk insurance.

However, you don’t want to be in the position to need cyber risk insurance to begin with. One simple step you can take to boost your security is to employ an organization-wide password manager.

If you want to assess what password managers might fit your needs, you can check out this article by Consumers Advocate. The research team spent hundreds of hours assessing the pros and cons of the industry, researching AES-256 encryption and two-factor authenticators, as well as looking into dark web surveillance. You can find it here:

Having a detailed response strategy in the event of a breach is recommended for risk mitigation. For instance, your response could reflect Process Street’s IT Security Incident Response Plan. This is a lean workflow for fast incident response.

Click here to access our IT Security Response Plan.

Business Risk #6: Compliance risks

All companies will have to follow a set of regulations, depending on the industry and the country of operation. Make sure to consult an expert for compliance information. You can then create checklists to audit your business operations against compliance standards.

To exemplify this I have embedded our ISO 14001 Environmental Management Self Audit Checklist below. You can run this checklist to perform an internal audit on an Environmental Management System (EMS) against the requirements set out in ISO 14001:2015.

Click here to access the ISO 14001 Environmental Management Self Audit Checklist.

Use an effective risk management process with an actionable response

For ultimate risk management and control, best practice includes running an effective risk management process for risk identification and review, like our Risk Management Process checklist provided above ⬆.

During the risk management process, you will ask what processes need to be in place as a risk response strategy? I have provided examples of risk response strategies by detailing some of Process Street’s checklists alongside the identified risk items. You can create any checklist to document, refine and adapt your risk response strategy with Process Street for free.

Moving on from these local acting risks, we stand back to observe the big picture. We are concerned with risks operating on a global scale, which have rippling effects on the country, region, business, and consumer economics.

Business risks: Global business risks from the World Economic Forum

The Global Risk Report is an annual study, published by the World Economic Forum. The report describes yearly changes occurring in the global risk landscape by surveying top business, governmental and non-profit leaders.

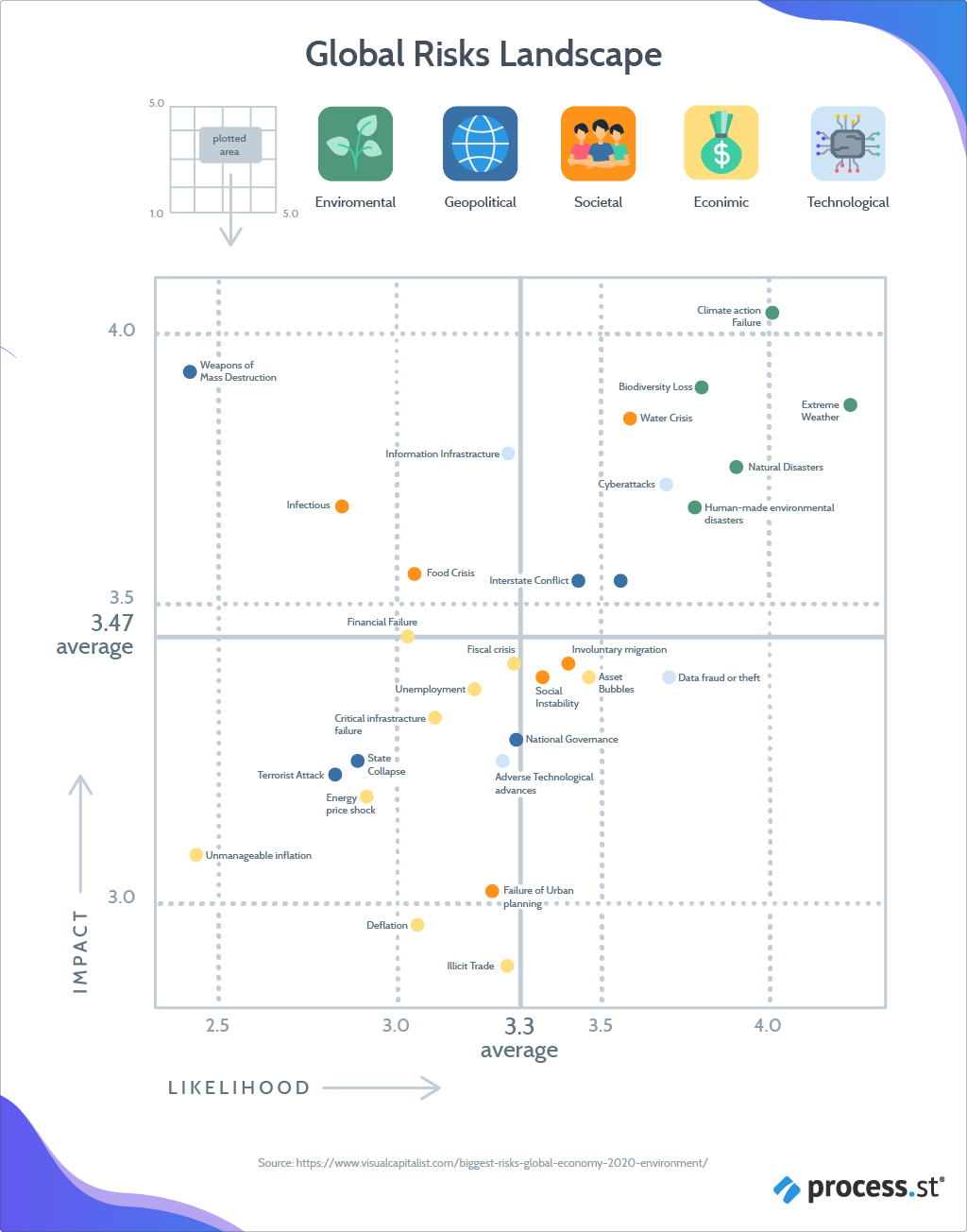

Painting this risk landscape for the year 2020, without the knowledge of what was to come, the report ranks various risks and provides detail for each.

Considering impact alongside likelihood the report details the top 3 risks to our economy:

- Extreme weather ⛈

- Climate action failure

- Biodiversity loss

Surprised?

According to the paper Changes in the global value of ecosystem services by Costanza et al. (2014), the annual global estimated value of our ecosystems and the services they provide was $145 trillion in 1997, and that wealth is at threat. The authors claim that wealth has already fallen in real terms by 20 trillion in the last 14 years (falling to $125 trillion) via human-centered ecosystem degradation.

This degradation is increasing in rate, squandering fundamental economic value which supports our businesses today.

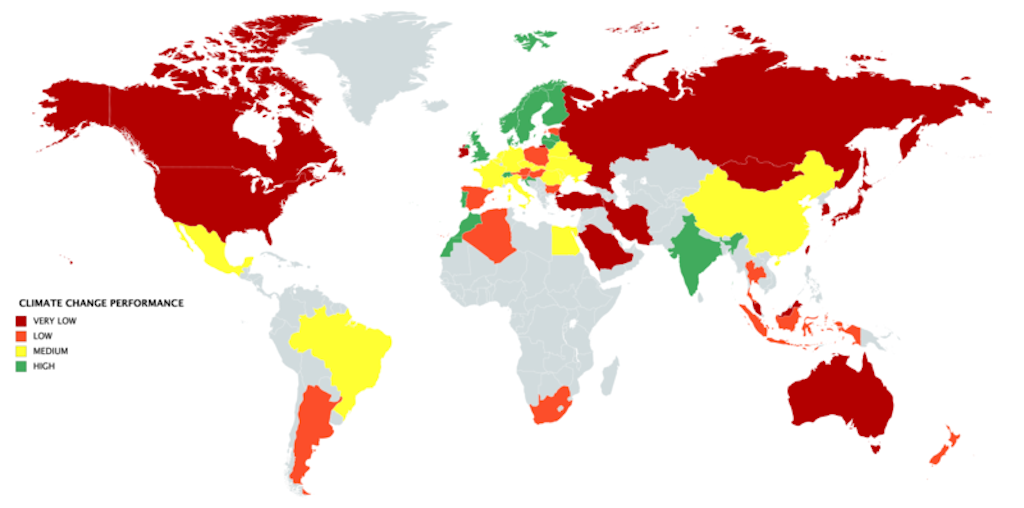

In light of the 2020 Global Risk Report, risk management strategies need to be in place to address these top environmental business risks.

What is a risk management process and how do we use it?

A risk management process is a set of steps taken to identify, monitor and manage potential risks for the negative consequences to be minimized.

The aim of risk management is for a company to only take on risks that will help goal attainment, whilst keeping other risks under control. Taking this concept, and aligning it alongside the 2020 Global Risk Report results, we understand the report’s top 3 risks need to be confronted for any business to bloom.

For this, you need a succinct risk management process, one that can be stringently followed, adapted and enforced. Like our already mentioned Risk Management Process checklist.

You can use our Risk Management Process checklist to define your action plan; to safeguard your business against the imposing environmental risks engulfing our economy today.

Click here to access our Risk Management Process.

Reviewing the Global 2020 top 3 risk items using Process Street’s Risk Management Process

Under task 9: Identify Risks, to re-cap, your 3 risks to be addressed are:

- Extreme weather ⛈

- Climate action failure

- Biodiversity loss

The following steps within this checklist guide you through the assessment of risk impact and likelihood, to determine your response strategy.

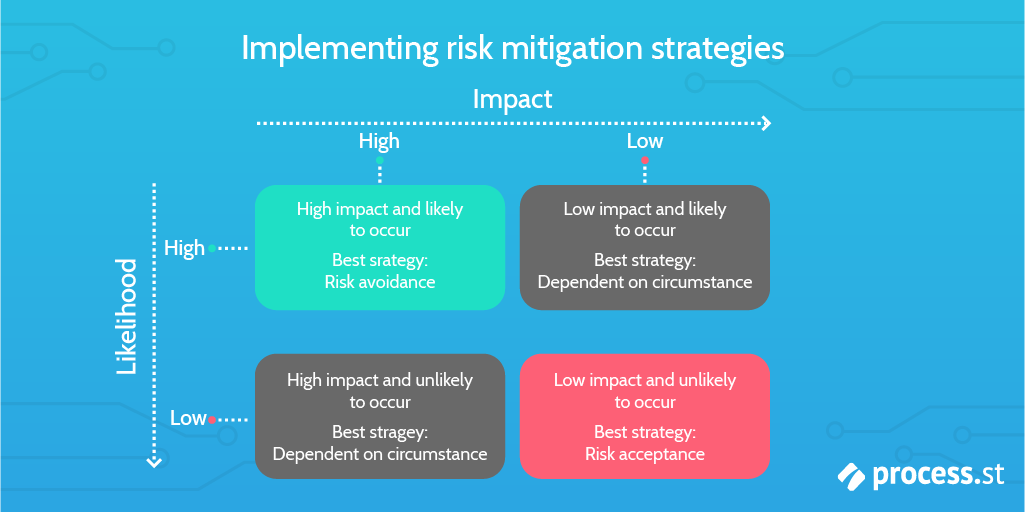

It must be noted that a response strategy of acceptance/retention is not a viable solution. As you can tell from the image above, risk acceptance is only acceptable when risk impact and likelihood are low. In this case, they are both high (see the image below).

Top economic concerns in terms of likelihood of risk from 2007 (07) – 2020 (20). Top global risks in terms of likelihood are all environmental.

Top economic concerns in terms of impact of risk from 2007 (07) – 2020 (20). Top global risks in terms of impact are predominantly environmental.

The only viable response in this scenario would be risk avoidance

To find out more about risk management, what strategy should be applied and when read:

- Risk Mitigation: What It Is and How to Implement It (Free Templates)

- The Ultimate Risk Management Guide: Everything You Need to Know

To help you strategize your risk management response, I will provide further detail on the top 3 risks given in the 2020 Global Risk Report. Understanding these risks, their causes and the economic effect is vital for an effective response strategy. You will be provided with our Sustainability Risk Management Checklist to help guide you.

Incorporating the Global 2020 Risk Report results within your risk management process

The Global Risk Report of 2020 is one of great significance, foreshadowing a worrying trend. You see, it is the first time in the report’s history that environmental issues comprised the top five risks in terms of likelihood. Extreme weather dethroned weapons of mass destruction from the top spot.

Concentrating on the top 3 risk items – regarding likelihood and impact – I will provide the following details:

- Cause and economic effect

- What can be done

With this information, you will be in a good position to formulate your risk management response.

Risk item 1: Extreme weather, cause, and economic effect ⛈

To define extreme weather, it is a term depicting unusual, severe or unseasonal weather. According to the World Meteorological Organization, we are all feeling the effects of weather extremes at a never-before-seen rate in documented human history.

Let’s take the year 2019-2020 as an example. In this one year, we have witnessed:

- June 2019: The greatest June heatwave in European history, with temperatures soaring above 45°C (113°F). The heatwave disrupted the continent’s economic backbone, damaging roads, railway tracks, and other physical structures.

- July 2018 – June 2019: The wettest 12-month period in U.S. continental history, with every state receiving above-average precipitation. The socio-economic impacts of this ripple through. For instance, crop growth significantly slowed during this period.

- June-September 2019: India’s wettest monsoon in 25 years, killing over 1600 people, caused by warmer than usual sea surface temperatures. These more extreme monsoon seasons are causing an economic slowdown of the continent.

- August 2019: The second strongest hurricane on record ravaged the Bahamas, costing the country $3.4 billion.

- August 2019: Hotter and dryer weather threatens our rainforests, Earth’s biodiversity centers. The events of August 2019 slammed this fact into the headlines, with over 7,200 square miles of forest pluming to the skyline in smoke. The G7 offered $20 million to combat the fires.

- October 2019: Typhoon Hagibis roared ashore on Japan’s coastline, killing 98 and costing the economy $15 billion, making it the most expensive typhoon in history. The review paper Tropical Cyclones and Climate Change Assessment: Part I. Detection and Attribution, identified human-caused climate change contributed to the event.

- November 2019: Australian bush fires of intense magnitude caused by an unusual, climate-change driven dry season, burnt 25.5 million acres of natural habitat. The economic cost of these fires is set to exceed $4.4 billion.

- February 2020: Temperature broke the 20°C (68°F) mark in Antarctica, a signal that something different is happening with our climate. Contributing to rising ocean waters, the melting of Antarctica’s ice sheet could cost trillions.

According to the National Oceanic and Atmospheric Administration, extreme weather has cost $1.6 trillion between 1980 and 2018 (~$4200 million a year). It is clear how extreme weather poses a threat to our economy and our businesses.

Before moving on to what can be done, it is crucial to understand the cause of this extreme weather. For this, we find ourselves explaining the cause of risk item 2 in conjunction. That is, Climate action failure and weather extremes are both related.

Notepads at the ready, prepare yourself for a brief lesson in science .

Risk item 2: Climate action failures, cause, and economic effect

Tapping into the Earth’s energy supplies, humans rip out fossil fuels, burning coal, oil and gas for energy to power our lavish lives of relative luxury. The problem with this is that we are disrupting the otherwise balanced carbon cycle. Probing into stored carbon sources that take millions of years to form.

It is here, at these fossil fuel extraction sites, that we begin our explanation for the cause of risk items: weather extremes and climate action failure.

The burning of fossil fuels releases greenhouse gases into the atmosphere. This forms a thick cloud of gaseous molecules, that, due to their molecular shape, lock in U.V. radiation from the sun. This warms our planet, termed as global warming. Note that global warming and climate change are terms for the same phenomenon and can be used interchangeably.

It’s misleading to suggest that 21st-century climate change is a natural phenomenon. Such arguments often rest on improper interpretation of climatic data, or cherry-picking data to suit an already drawn conclusion. Our climate naturally cycles between different global temperatures. We have therefore seen temperature highs and lows from life’s beginning – some ~3.5 billion years ago. These cycles occur regardless, without the unnatural release of greenhouse gases into the atmosphere. However, adding more greenhouse gases into the atmosphere exacerbates these natural cycles. Something we do not want to do. The impacts of a warmer climate bring about unwanted changes. Also, never before has the natural carbon cycle been broken – through the burning of fossil fuels – we are therefore entering unknown territory.

Could the consequences be good?

Judging from current events, for human society and our economy, no.

For more information on our planet’s natural climatic cycles and how they differ to human-attributed climate change read: Global Warming Natural Cycle.

Climate change (global warming) has complex effects. For instance, as the temperature of our planet increases, ice sheets start to melt. This bleeds freshwater into our oceans, diluting seawater. As a consequence, oceanic currents are altered, which are major climatic regulators. This is one example of how climate change causes weather extremes.

An explanation for weather extremes

To understand climate change and how it is related to weather extremes, the difference between climate and weather must be understood.

- Climate: Climate refers to the conditions remaining in an area, generally over a long time. For instance, Antarctica has a cold, dry climate. The U.K. (unfortunately for me) has a wet, cool climate. The U.S. as a huge continent has a variety of climates, however, the majority is continental with cold winters and hot summers. As the global average temperature increases, this is reflected in the rapid alteration of climates across the globe (climate change).

- Weather: Weather refers to the state of the atmosphere at a particular place and time. One day it could be raining. The next it could be sunny. Weather is directly related to climate, however, when talking about the weather, smaller scales in terms of time and space are being considered.

You can see that climate and weather are different terminologies. They are, however, linked.

The regulation of our weather is multidimensional, controlled by our climate and complex interactions between the Earth’s components. For instance:

Taking the U.K. as an example, climate change is predicted to cause the movement of the gulf stream – from melting ice sheets – which will bring colder weather extremes to us Brits.

Climate change induces warmer air temperatures increasing evaporation rates, leading to more precipitation.

Climate change warms sea surface temperatures, generating more intense, sustained hurricanes.

To learn more about our weather and how it is regulated read: Teaching Essential Principle Two; Climate is regulated by complex interactions among components of the Earth system

You can see how climate change and the failure to address it, leads straight to the risk item, weather extremes. The economic costs of not addressing climate change is therefore reflected in the $1.6 trillion costs of extreme weather. However, despite its cascading impacts, climate change as a threat is growing in severity due to improper action.

The economic cost of climate change

The global average temperature has increased around 1°C (33.8°F) since the start of the industrial revolution (1750). The World Meteorological Organization states we are on trend for a further 3-5°C (37.4-41°F) increase, the worst-case scenario regarding global warming. According to scientists Yangyang Xu and Veerabhadran Ramanathan, this would be catastrophic not only for our economy but for human existence as we know it.

Taking a more optimistic stance, what do you think would happen if we address climate change head-on, with huge investment, research, and innovation? What would our future look like?

A lot brighter, and a lot cooler I would say. For instance, a new report led by Microsoft founder Bill Gates, former UN Secretary-General Ban Ki-moon and World Bank Chief Executive Officer Kristalina Georgieva, concluded that investing $1.8 trillion by 2030 in action to climate change would yield $7.1 trillion in benefits.

Moving on from this study, we ask: What would climate action success rather than failure look like?

A target of 1.5 °C (34.7°F) was a best-case scenario, set to action climate change and control the impacts to manageable levels. Reaching this goal would signal climate action success.

However, according to studies, there is only a 5% chance of reaching this 1.5 °C (34.7°F) goal, with current installments pushing us past the threshold. Only through infrastructure retirement can we gain a 50% chance of remaining in this 1.5 °C (34.7°F) temperature limit.

Risk item 3: Biodiversity loss, cause, and economic effect

We can define biodiversity as a term for all life on earth, a measure of the species, habitats, and ecosystems across our planet.

If you are a child of the ’80s, I have some alarming news for you.

You were born into a world with twice as many wild animals as today. We are in an extinction crisis.

If the impacts of such was a question of aesthetics and ethics, and as a reader, such questions didn’t concern you, then I would say do not worry.

But, in truth, biodiversity loss comprises our economy, and therefore directly impacts you and your way of life.

Humans have destroyed and degraded great expanses of our home’s terrestrial, marine and aquatic ecosystems. For instance, 1.3 million square kilometers of natural forest has been lost between 1990 and 2006. 35% of natural wetlands have been lost since 1970-2015. 50% of coral reefs have died in the last 30 years. 60% of vertebrae species have been wiped out since 1970.

These striking changes have been driven by land use, over-exploitation of natural resources, pollution, invasive species, and climate change. It is truly a perfect storm whipping up a 6th mass extinction event. This time though, it is human-caused annihilation.

The cost of inaction to biodiversity loss is high. Between 1997, and 2011, the world is estimated to have lost up to $20 trillion per year from the loss of ecosystem services owing to the destruction of terrestrial habitats. Globally, the combined worth of our ecosystems is $140 trillion per year.

Biodiversity is fundamental for food security, poverty reduction, medical research, and equitable development. Everywhere you look, the impacts of biodiversity loss are already punching into the fabric of our economy.

Only when life is at its most varied, vigorous and biodiverse can we hope to survive.

- We need towering forests across 1/3 of the land’s surface to lock away carbon and keep our climate stable.

- We need millions of pollinators, billions of soil dwellers and megatons of plankton to keep the food we eat in supply.

- We need strange plants, buried deep in jungles to supply our medicines.

- We need coral reefs and mangrove swamps to protect our coastlines.

Our planet’s biodiversity provides all the things we need and for free. Biodiversity loss is catastrophic for nature and therefore ourselves.

Biodiversity loss and economic impact: A case study

Every ecosystem, every species across our planet is connected. Humans included. I vividly remember the day this was drilled into me. Sitting in a lecture theatre at the age of 21, nursing a bad hangover. Coffee in hand, I was half dazed trying to muster the spirit to listen. This didn’t take much, as the story I was about to be told would instigate an intense unease, fear and drive to do something.

Sea lion, seal, and sea otter populations are crashing. Theories were being flung here and there to try and explain these trends. What was causing these populations to decline rapidly?

Was it climate change?

Was it overexploitation of these species?

In truth, no consensus could be drawn. It was an utter mystery.

Until one revelation. A proposed cause, that the over-fishing of great whales was the source.

Whales are a prime food supply for killer whales. With the removal of this food, killer whales were eating their way down the food chain, targeting sea lions, sea otters, and seals. But the cascading impacts didn’t stop there.

Sea otters eat an animal called the sea urchin, meaning with sea otter decline came the rapid expansion of sea urchin populations. Sea urchins eat kelp forests, meaning as sea urchin populations increased, kelp forest expanses began to shrink.

All of this because great whales were being overexploited.

Kelp forests are a vital source of alginic acid (a chemical compound used in food, textile and pharmaceutical industries), they provide a home for many species of economic importance, are vital carbon dioxide sinks, and are a great source of scientific interest.

This case study exemplifies the intricacies of nature, how, like the toppling of domino pieces, one action causes many knock-on effects. There is no separation from a human-created world and the natural world. Whether we like it or not, both worlds are intertwined and dependant.

Biodiversity loss adversely impacts our economy. This is inevitable.

Risk assessment: Why sustainability is part of a good risk assessment

Risk assessments involve the identification of potential hazards and risk factors that could cause harm. Risk assessments are a key stage to your risk management process.

The 2020 Global Risk Report has done the risk assessment leg work for us, identifying 3 risks of utmost concern.

Weather extremes, climate action failure, and biodiversity loss are global risks. Despite their global relevance, these risks directly impact business when considering more local scales.

Managing these 3 global risks for your business comes down to creating a business that aligns economic, social and environmental needs. That is, you need a sustainability risk management process.

Managing business risk through sustainability risk management

Sustainability risk management is a business strategy aligning profit goals and environmental needs, with the aim of efficiency to sustain a business whilst preserving the environment.

Utilizing this approach offers a strategic road map to manage your environmental risks, and at Process Street we have detailed this roadmap into our Sustainability Risk Management Checklist.

In this checklist, sustainability risk management has been designed as a process, to help you:

- Improve awareness and the necessity of sustainability risk management

- Identify sustainability risks and opportunities

- Promote operational efficiencies

- Promote innovation

- Develop a risk management model, policies and guidelines that are company-specific

- Manage sustainability funds

- Integrate sustainability considerations into decision-making processes

- Proactively manage risk and achieve a competitive advantage

- Increase value and innovative capacities

- Move towards sustainable business practices

- Increase environmental, social and financial contributions

- Improve corporate reputation

- Promote corporate social investment, citizenship, and social responsibility

Click here to access our Sustainability Risk Management Checklist.

As you work through this checklist, you will come across the following features:

- Stop tasks to ensure task order

- Dynamic due dates, so no deadline is missed

- Conditional logic, creating a dynamic template that caters to your needs

- Role assignments, to ease task delegation within your team

- Approvals, allowing decision-makers to give the go-ahead (or rejection) on important items.

These features make our checklists superpowered. They create dynamic machines to guide your processes, with the right amount of complexity for ultimate management and control. Using this Sustainability Risk Management Checklist will bring you the following benefits:

- You will successfully balance and integrate economic, social and environmental performance.

- Fully integrate sustainability-based topics into business strategy, management, and organization at all levels.

- Optimize corporate value.

- Provide reasonable assurance to achieve corporate objectives utilizing the concept of a triple-bottom-line.

- Optimize corporate resources.

- Optimize corporate risk.

But of course, the main advantage is that you will proactively and effectively manage sustainability-based risks to your business. That includes weather extremes, climate action failure, and biodiversity loss.

Sustainability risk management: How you can document your processes with Process Street

Implementing sustainability risk management into your business is easier with documented processes. Documenting processes provides full transparency over your business operations so that they can be stringently analyzed and improved upon for your sustainability targets.

Like our Risk Management Process checklist and our Sustainability Risk Management Checklist, you can document any business process in Process Street.

For more information on how and why you should document your business processes via checklists read: How and Why to Document Your Workflows. This article explains the benefits documented workflows bring to a business.

For more information on how to create checklists using Process Street watch our below video.

Because we care about you, society and our planet, Process Street has a wealth of free resources available to assist your sustainable business. To reiterate, a sustainable business is one that considers the environment and society along with the economy. I have listed these resources below:

- 12 Inspection Checklists to Maximize Safety in the Work Place

- Office Safety Inspection Checklist

- Hotel Safety Inspection Checklist

- What is IS0 31000? Getting Started With Risk Management

- ISO 45001 Occupational Health and Safety (OHS) Audit

- Warehouse Safety Checklist

- 5 Free ISO 14001 Checklist Templates for Environmental Management

- Environmental Accounting Internal Audit

- Hotel Sustainability Audit

- What is Workplace Diversity? Improving Diversity in the Workplace (8 Free Templates)

- How to Build Better Employee Accountability with Processes

- How to Get, Process and Act on Employee Feedback

- Why You Should Unleash Collaboration and How to Do it

- GRI Standards 101: Foundation 2016 Checklist Template

- GRI Standards 102: General Disclosure 2016 Checklist Template

- GRI Standards 103: Management Approach 2016 Checklist Template

- Environmental Management System (EMS) Implementation Checklist Template

- Economic Sustainability to Success

- Greenwashing: What It Is and How to Stop It (Free Template)

Consider risks acting on both a global and local scale for successful risk management

In this article, we have covered a lot. We have looked at common local business risks, from employee sickness to cybersecurity threats. I explained how successful risk management requires an effective risk management process and an actionable response strategy.

We then considered risks of top concern, as detailed by business, governmental and non-profit leaders disclosed in the 2020 Global Risk Report. Weather extremes, climate action failure and biodiversity loss have far-reaching consequences that respect no boundaries. These are risks that need to be addressed in your risk management process. An effective response comes in the form of sustainability risk management, for which you are provided with a free template to guide you through this process.

On explaining the causes and economic effects of risks; extreme weather, climate change, and biodiversity loss, it should be apparent that the control of these risks is imperative, and in your hands. By actively supporting sustainability initiatives you will help drive a much-needed and urgent change. What is there to lose?

The crisis we’ve faced in 2020 was one we could have been prepared for, but weren’t. There’s still time to change our mindset and be more prepared for the other risks which threaten us.

Sign up to Process Street for free access to our business sustainability templates and move forward with innovation, an open mind, and positive change.

We hope this article has proven useful to you. How have you set out to manage sustainability risks? What risk management process do you follow? We would love to hear from you, so please comment in the section below.

Workflows

Workflows Forms

Forms Data Sets

Data Sets Pages

Pages Process AI

Process AI Automations

Automations Analytics

Analytics Apps

Apps Integrations

Integrations

Property management

Property management

Customer management

Customer management

Human resources

Human resources

Information technology

Information technology

Jane Courtnell

Hi there, I am a Junior Content Writer at Process Street. I graduated in Biology, specializing in Environmental Science at Imperial College London. During my degree, I developed an enthusiasm for writing to communicate environmental issues. I continued my studies at Imperial College's Business School, and with this, my writing progressed looking at sustainability in a business sense. When I am not writing I enjoy being in the mountains, running and rock climbing. Follow me at @JaneCourtnell.