Venture capitalism is the investing of money in unproven startup companies.

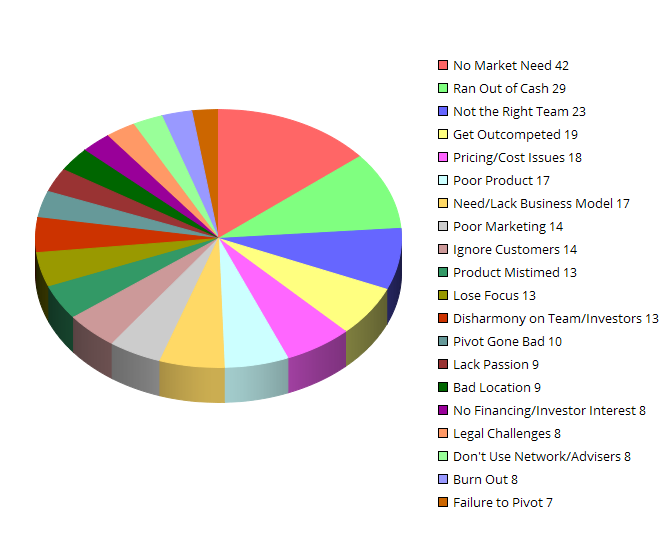

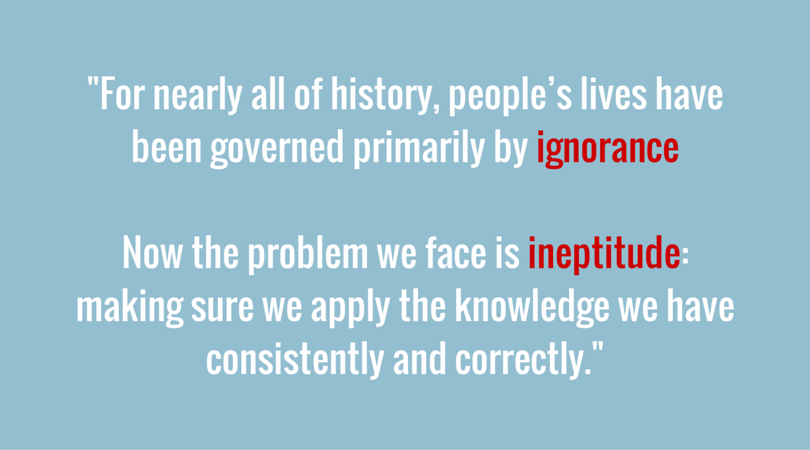

A successful venture capitalist has the ability to recognize one epic idea among a hundred good ones and a thousand terrible ones. While the selection process requires a lot of luck and can be almost compared to gambling, it can be made a lot safer if you take the right precautions.

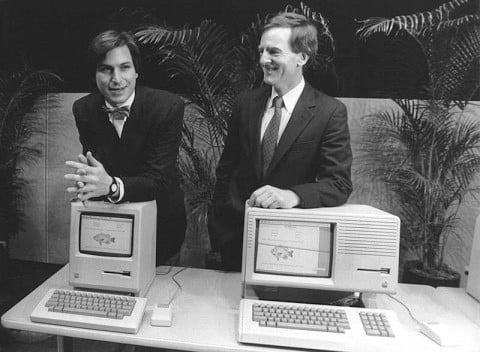

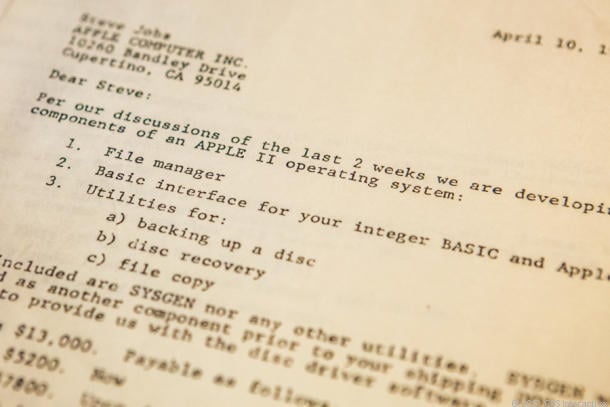

Timing is everything. If you travelled to the past and had the opportunity to invest in Microsoft when it was still a startup, you'd be crazy if you didn't. If you bought 100 shares at $21 each back in 1985, you'd turn $2100 into over $750,000 - a growth of over 35,000 percent. This is the dream for venture capitalists.

Are you willing to make a big investment in someone else's dream? If you make the right call, you could be the next Bill Gates. If not, you'll join the ranks of countless others who lose big on the venture capital lottery.