Every decision in an M&A is dependent on a number of variables. Making the right decision in the moment may not be the right decision down the road, but making no decision at all is worse.

The most impactful decision, though, is how the two companies will integrate (or not) once the deal closes. To some extent, this will be determined by your motivation for starting the M&A process to begin with. The similarities and differences between your business model and the business model of the company you’re acquiring will play a large role as well.

In this Process Street post, I’ll do a quick rundown of the two primary strategies, tuck-in and bolt-on, as well as everything you need to know in order to determine which is the strategy for your business.

- Round 1: Tuck-in vs. bolt-on: Debrief

- Round 2: Tuck-in vs. bolt-on: Pros

- Round 3: Tuck-in vs. bolt-on: Cons

Round 1: Tuck-in vs. bolt-on: Debrief

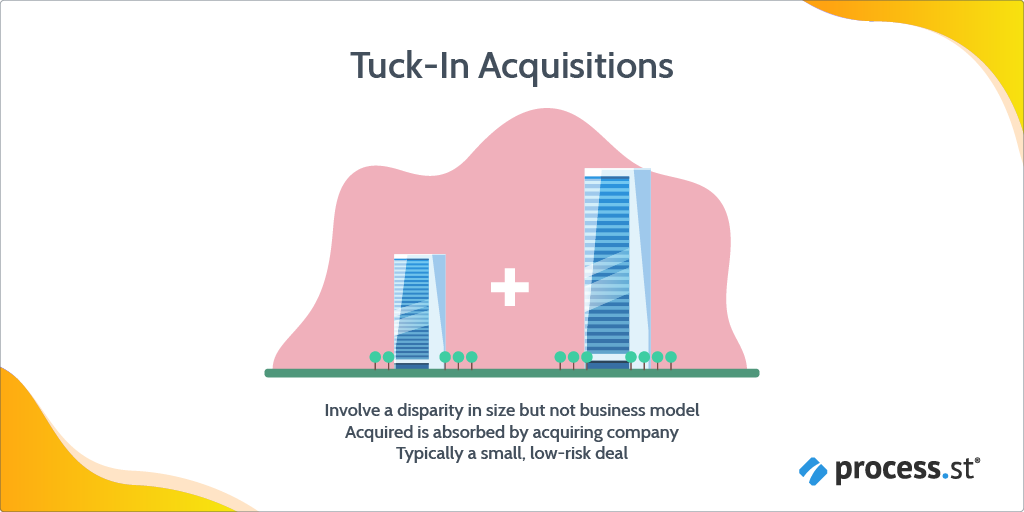

Tuck-in acquisitions

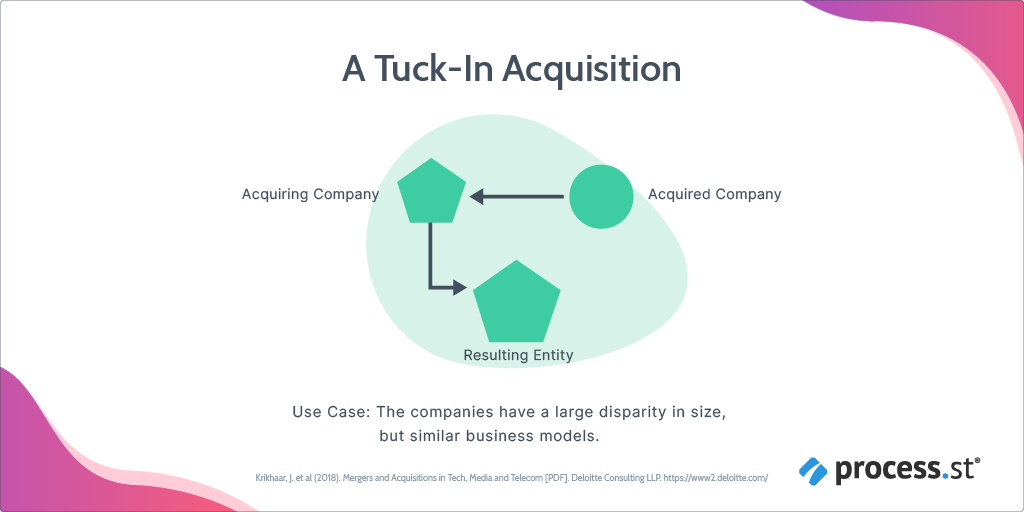

As the name suggests, a tuck-in acquisition involves the smaller organization being “tucked in” to the larger organization. More bluntly, the acquiring company completely absorbs the acquired organization, which typically ceases to exist from that point on.

In the average tuck-in acquisition, the two companies will have a large disparity in size, but their business models and industries will be relatively similar. This makes it easier for the acquired company to be assimilated into the larger organization. Additionally, since the acquired companies are often quite small, tuck-in transactions are relatively more low-risk than mergers.

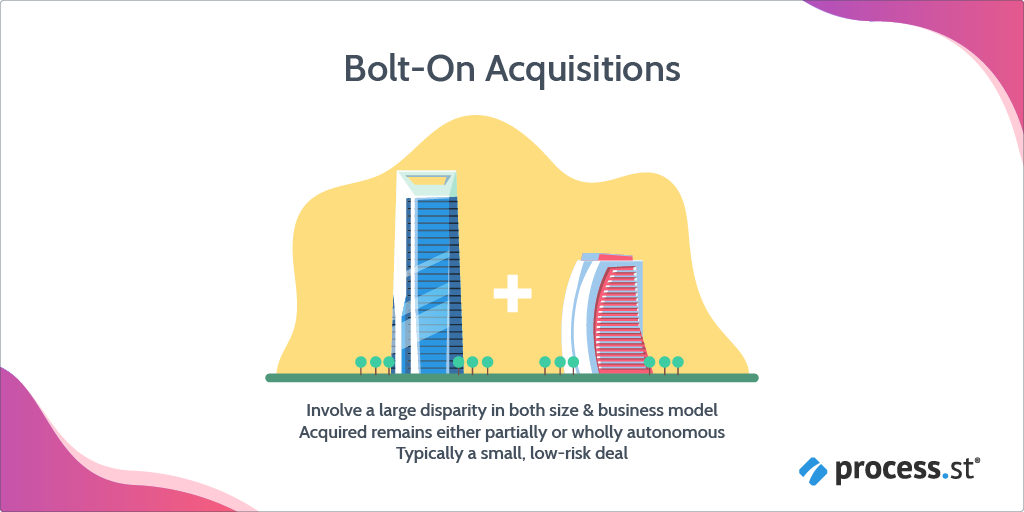

Bolt-on acquisitions

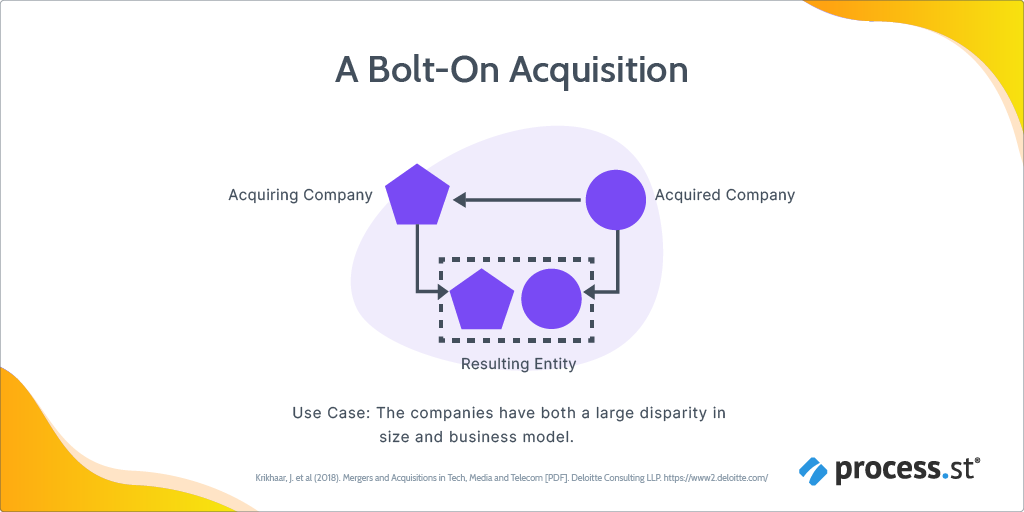

Again, “bolt-on” is a fairly accurate description of this type of acquisition. Rather than the acquiring company fully absorbing the acquired, the smaller organization becomes a subsidiary or “bolted on” to the larger organization.

In this setup, the acquired company retains its own identity and branding. The bigger company does this to make more money. For example, private equity companies will use bolt-on acquisitions to add value to their portfolio companies before selling them.

Like a tuck-in acquisition, bolt-ons tend to be relatively small, low-risk deals involving companies with a large disparity in both size and business model. Bolt-on tends to be the tool of choice when a company wants to expand into a new market – with either product or geography – and acquire an already-established brand to do so.

The Coca-Cola Company is as fond of bolt-on acquisitions as Apple is of tuck-ins. With its first acquisition of Minute Maid in 1960 and its most recent acquisition of Organic & Raw Trading Co. (manufacturer of Australia’s MOCHO Kombucha) in 2018, Coca-Cola has a well-established tradition of expansion through bolt-ons.

In truth, it’s not a bad strategy and often ends up benefiting both companies.

There is no single bolt-on model, though. With each acquisition, it’s up to the acquired and acquiring to determine which systems will be integrated and which won’t. This can result in the acquired remaining completely autonomous, becoming partially integrated, or the creation of a hybrid approach designed to maximize synergistic returns.

Round 2: Tuck-in vs. bolt-on: Pros

Advantages of tuck-in acquisitions

There are a number of reasons that a tuck-in acquisition would be appealing to a large company. Particularly in the tech and energy sectors where unique resources and capabilities make or break a company, tuck-in acquisitions are a prime method for securing additional resources.

Apple, for example, acquires a new company on average every 2-3 weeks. These acquisitions are rarely – if ever – publicized since Apple prioritizes talent acquisitions. Basically, Apple executives spot a team of engineers doing some pretty neat things, so they use a tuck-in acquisition to recruit the entire team in one fell swoop.

While by no means the only company to employ this method, Apple is probably the most prolific. Talent acquisitions aren’t the only asset on offer, either. Tuck-in acquisitions are also used to acquire new tech, new IP, or new assets that will enable the acquiring company to diversify or expand its offerings.

A side bonus of all these new resources? Raising capital becomes a lot easier since there’s a broader pool of assets to use as collateral for future loans.

Next on the list: market dominance.

What better way to eliminate the competition than simply buy them out?

This strategy is quite common in high-competition markets, where competitors are eager for anything that will give them that an advantage over another company. Absorbing a smaller firm within the same market offers the acquiring company three main advantages:

- Increased market presence;

- Reduction of competitors’ market share;

- Diversification in product and/or service offerings.

There are some obstacles to this strategy, but I’ll cover those in the next section.

Finally, tuck-in acquisitions are pretty good at achieving an increased return on investment. In addition to the acquired company increasing the acquiring company’s market share, the company’s overall returns also increase, which helps in terms of meeting shareholders’ expectations.

Advantages of bolt-on acquisitions

As I said previously, private equity firms often use bolt-ons to improve their portfolios before selling. This adds new customers, product lines, geographies, or IP to the existing company, which significantly increases its value.

Bolt-on acquisitions are also a good growth strategy. The cumulative effect of multiple bolt-on acquisitions makes it possible for the acquiring organization to speed up its growth over a short period of time.

Integration is often much easier as bolt-ons primarily involve small companies, and not all of the systems in those companies need to be integrated. As a result, there are also fewer potential conflicts in terms of company culture, infrastructure, and technology since it isn’t always necessary to combine these systems if they’re incompatible.

In addition, smaller companies are more willing to join bolt-on acquisitions that allow them to retain their original identity and autonomy, particularly since they stand to gain as well. The larger company is able to expand its market, product line, or capability by leveraging the smaller company’s established reputation. Meanwhile the smaller company gains via the economies of scale and increased resources of the larger company.

Round 3: Tuck-in vs. bolt-on: Cons

Disadvantages of tuck-in acquisitions

Those are all some pretty compelling reasons to go for a tuck-in acquisition, but don’t get too far ahead of yourself: there are some big disadvantages, too.

The first – and possibly most important – disadvantage is that, while a tuck-in may be low-risk, it can also be high cost. With this type of acquisition, you have asset acquisition costs, attorney fees, loan fees, regulatory fees, commissions – the list goes on.

If the due diligence is rushed through or not performed thoroughly, the overall cost will very likely exceed the initial projected expectations. Maybe you’re able to recoup those extra costs down the road, but then again, maybe you can’t.

While we’re talking about due diligence, there’s also the risk that the two companies can’t be integrated. Even if you do a meticulous audit of the company you want to acquire, there will always be details you won’t have access to until the signatures are dry. That leaves the possibility that the culture, technology, or infrastructure of the two companies is too incompatible to integrate.

If you end up underestimating the total costs, then learn that you can’t integrate your new acquisition, all you’ve gained is a very pricey write-off.

Now I need to bring up antitrust laws. The first antitrust law, the Sherman Act, was passed in 1890, and – albeit with some revisions – is one of the three core federal antitrust laws in effect today.

The Federal Trade Commission (FTC) is responsible for monitoring and protecting competition in various industries. In terms of mergers and acquisitions, antitrust laws are in place to ensure there is always adequate competition between companies and that no one company is able to create a monopoly.

The two most well-known instances of this are AT&T and Microsoft.

For nearly a century, Ma Bell held a monopoly over phone service in the U.S., despite several attempts to break up the company. In the late ‘70s, charges were again filed under the Sherman Antitrust Act. This time, AT&T wasn’t so successful, and per a settlement reached in 1982, AT&T separated into 7 “Baby Bells” with the intention of creating more competition for consumers.

In 2000, a US federal judge concluded that Microsoft had violated antitrust laws, and, as a result, should be separated into two distinct companies:

- One to oversee the Windows OS

- One to handle all other Microsoft software

Microsoft fared better than AT&T in their case, though. By 2001, Microsoft had reached a settlement with the U.S. Justice Department which introduced restrictions on exclusive dealing and required Microsoft to share their API with other software creators, but kept the company in one piece.

Long story short, gobble up as many start-ups as you like – just make sure you don’t eat all of the competition.

Disadvantages of bolt-on acquisitions

Naturally, with these positives come negatives. While you won’t have the same integration obstacles as a tuck-in acquisition, there can still be talent and culture conflicts. This tends to be the result when the pre-deal strategy is developed in isolation from the post-deal operations.

Let’s say you acquire a startup team with specialized skills. That’s great – you now have a team that specializes in that skill. But unless you figure out a way to spread that knowledge throughout your company, that team is all you have. So while you may not be completely a full integration post-merger, you do need to get your systems working together.

An inability to prioritize what should and shouldn’t be integrated can lead to friction between startup and corporate cultures, as well.

Adding too many bolt-ons to the acquiring company runs the risk of becoming a conglomerate. This in itself isn’t necessarily a bad thing, but it does open the door for a loss of focus, lack of efficiency, less transparency, and over-diversification of products and services.

As one final point regarding the disadvantages of bolt-on acquisitions, it is also possible that the bolt-on will ultimately end up cannibalizing the corporate entity’s market if proper management and strategy aren’t put in place.

Key takeaways on acquisition strategies

Tuck-in and bolt-on acquisitions both have their advantages and disadvantages. The deciding factor, however, will be how aligned the individual business models are with each other. You could choose to absorb an acquired company with a completely different business model from the main corporate entity, but it would be riskier and more difficult than applying a bolt-on strategy, at least initially.

As with any merger or acquisition, you need to carefully consider what your motivations are, what you hope to achieve, and what compromises you’re willing to make.

Are you more Apple or more Coca-Cola? What’s your experience with acquisitions been? Let us know in the comments!

Workflows

Workflows Forms

Forms Data Sets

Data Sets Pages

Pages Process AI

Process AI Automations

Automations Analytics

Analytics Apps

Apps Integrations

Integrations

Property management

Property management

Human resources

Human resources

Customer management

Customer management

Information technology

Information technology

Leks Drakos

Leks Drakos, Ph.D. is a rogue academic with a PhD from the University of Kent (Paris and Canterbury). Research interests include HR, DEIA, contemporary culture, post-apocalyptica, and monster studies. Twitter: @leksikality [he/him]