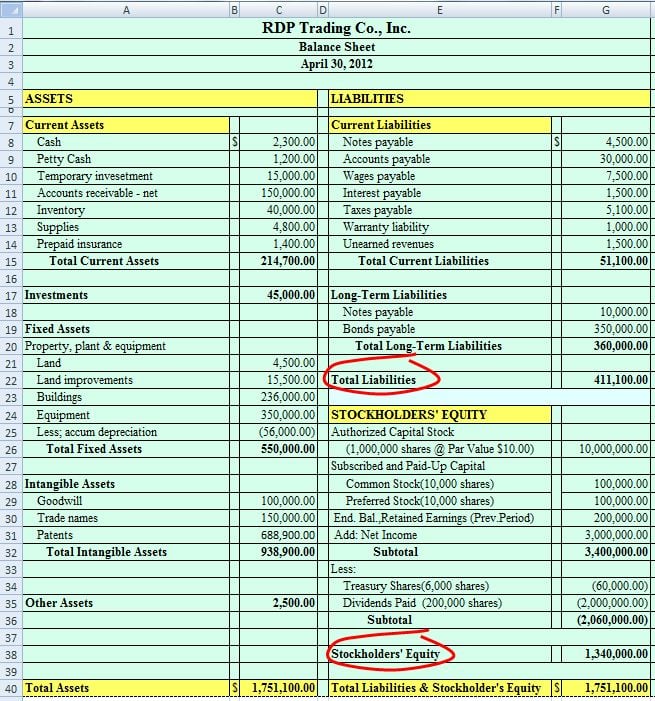

Assets are simply defined as anything that the business has ownership of by its acquisition at a certain point in time and recorded in its financial history.

Record the relevant assets in the form fields below.

Examples of assets that are reported on a company's balance sheet include:

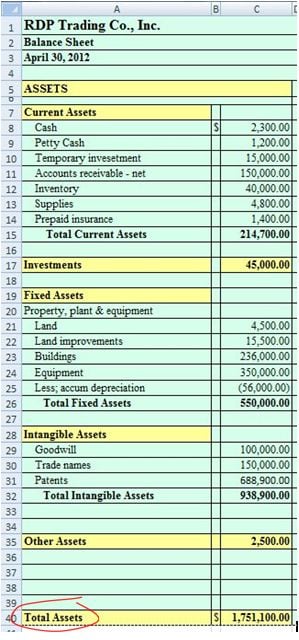

Current Assets

Current assets are those that can be converted into cash within one year of the business's normal operating cycle.

- Cash

- Accounts receivables (A/R)

- Inventory

- Notes receivables (N/R)

- Prepaid expenses

- Other current assets

Investments

Investments are assets investments whose maturities exceed one year.

Examples:

- Bond sinking fund

- Funds held for construction

- Cash surrender value of life insurance policy

- Long-term investments in stocks and bonds

Returns on these investments can be realized over the long-term considering that its payback period is more than a year.

Fixed Assets

Fixed assets, otherwise known as long-term assets, are those assets holdings with a long-term physical value such as land, buildings, and machinery.

List of fixed assets:

- Land

- Buildings

- Machinery and equipment

- Furniture and fixtures

- Leasehold improvements

With the exemption of landholdings, these long-term assets are subjected to depreciation charges that must be taken into account by applying the depreciation method of accounting.

Intangible Assets

Intangible Assets are those assets with significant long-term value without any physicality whose benefits extends a few years or beyond. It is usually recorded at cost based on a specified period of time in the balance sheet.

List of Intangibles:

- Research and development

- Patents

- Market research

- Goodwill

- Organizational expense

Some of these intangibles are amortized over their estimated useful life.

Other Assets

- Deposits (maturity of more than one year)

- Notes Receivables from Third Parties

- Bond Issue Costs amortized to expense over the life of the bond.

- Other Deferred Costs (Unamortized Bond Issue Cost)