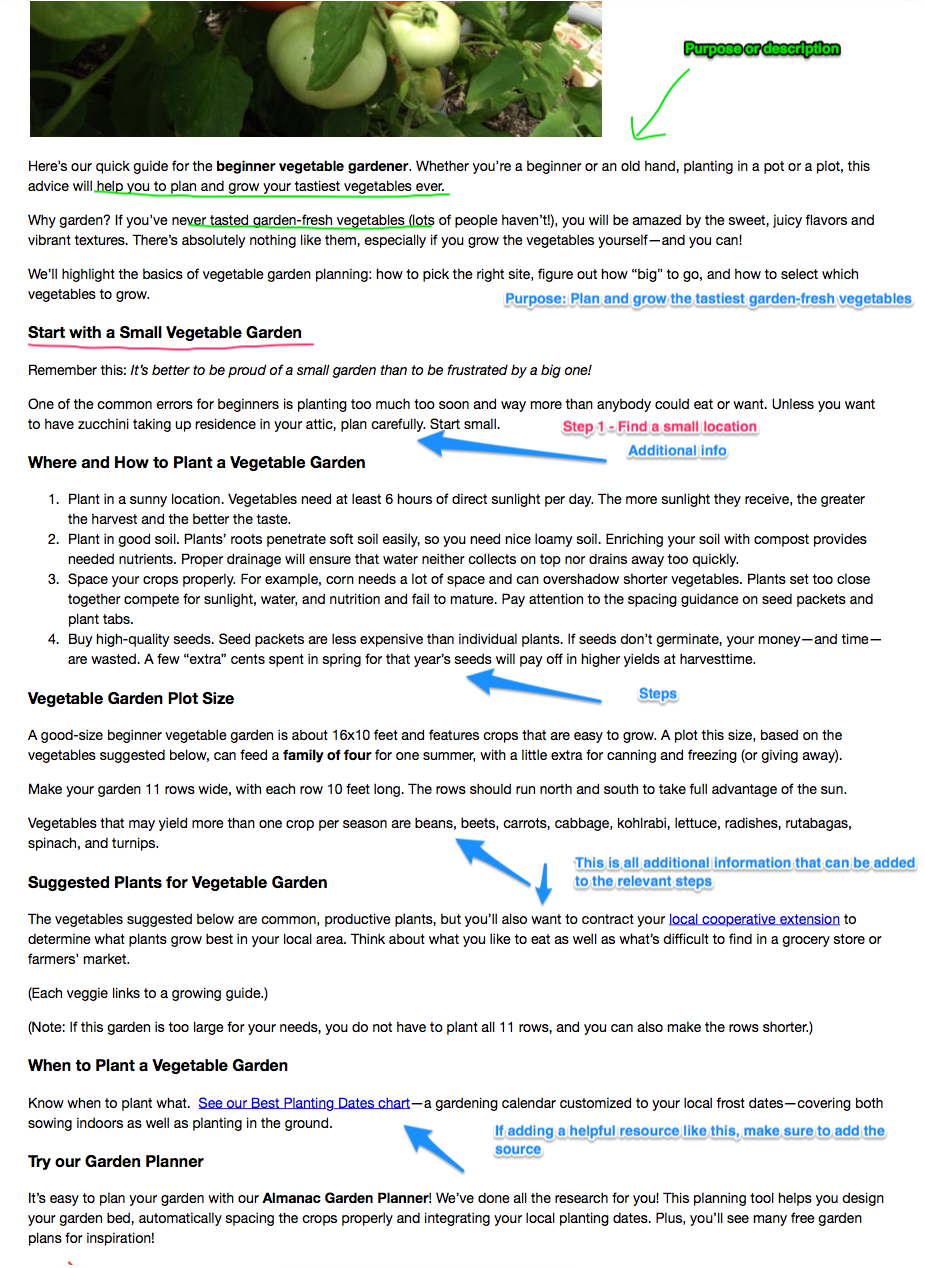

The purpose of accounts payable is to provide checks and balances for all outgoing payments to vendors for their goods or services.

The aim of this process is to make certain that only bills which are legitimate are paid, and sufficient security is built into the process.

Three key factors to be checked when preparing to make payments:

- what the company had ordered

- what the company has received

- all unit costs and calculations are correct.

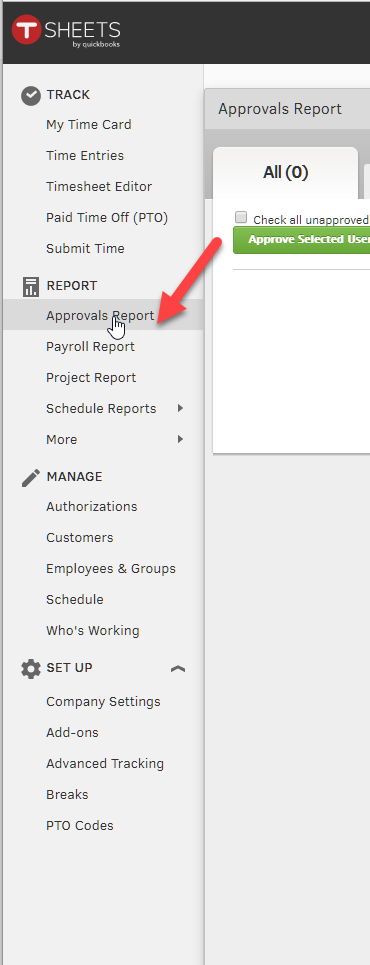

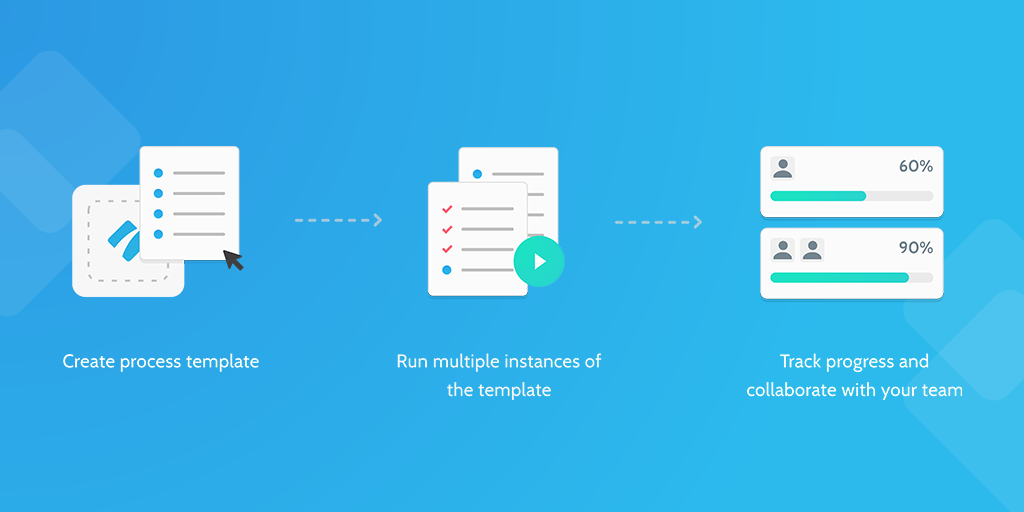

To provide inbuilt security, this checklist is optimized to an accounting department where the process can be split across 4 different people. If you are a sole trader or a smaller operation, you can adapt this checklist to suit your needs.

It is important to keep your process secure to avoid double payment of bills, non-payment of bills, fraudulent payments, and payments of incorrect invoices.

Watch this video for more information: