Know Your Customer (KYC) Checklist – Institutions & Non-Individuals

(The information on Section (A) and (B) must be obtained and retained for Institution & Non-Individuals notably limited liability company, partnership, sole-proprietorships, clubs & societies, non governmental organisations (NGO), ministries, departments & agencies (MDAs), trusts and others (specify) including their authorized signatories*, principal beneficial owners, directors and persons* with control over the company’s assets. (Note: Control is determined as owners entitled to exercise or control the exercise of 30% or more of voting rights)

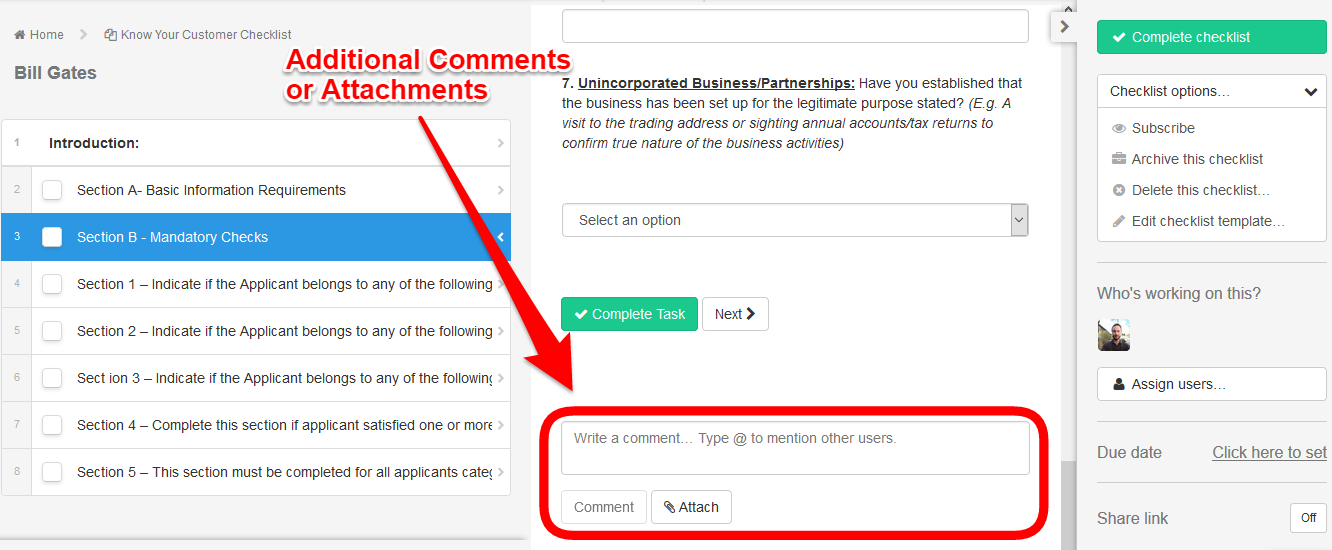

Any additional documentation or details can be uploaded via the Comments at the bottom of each Task