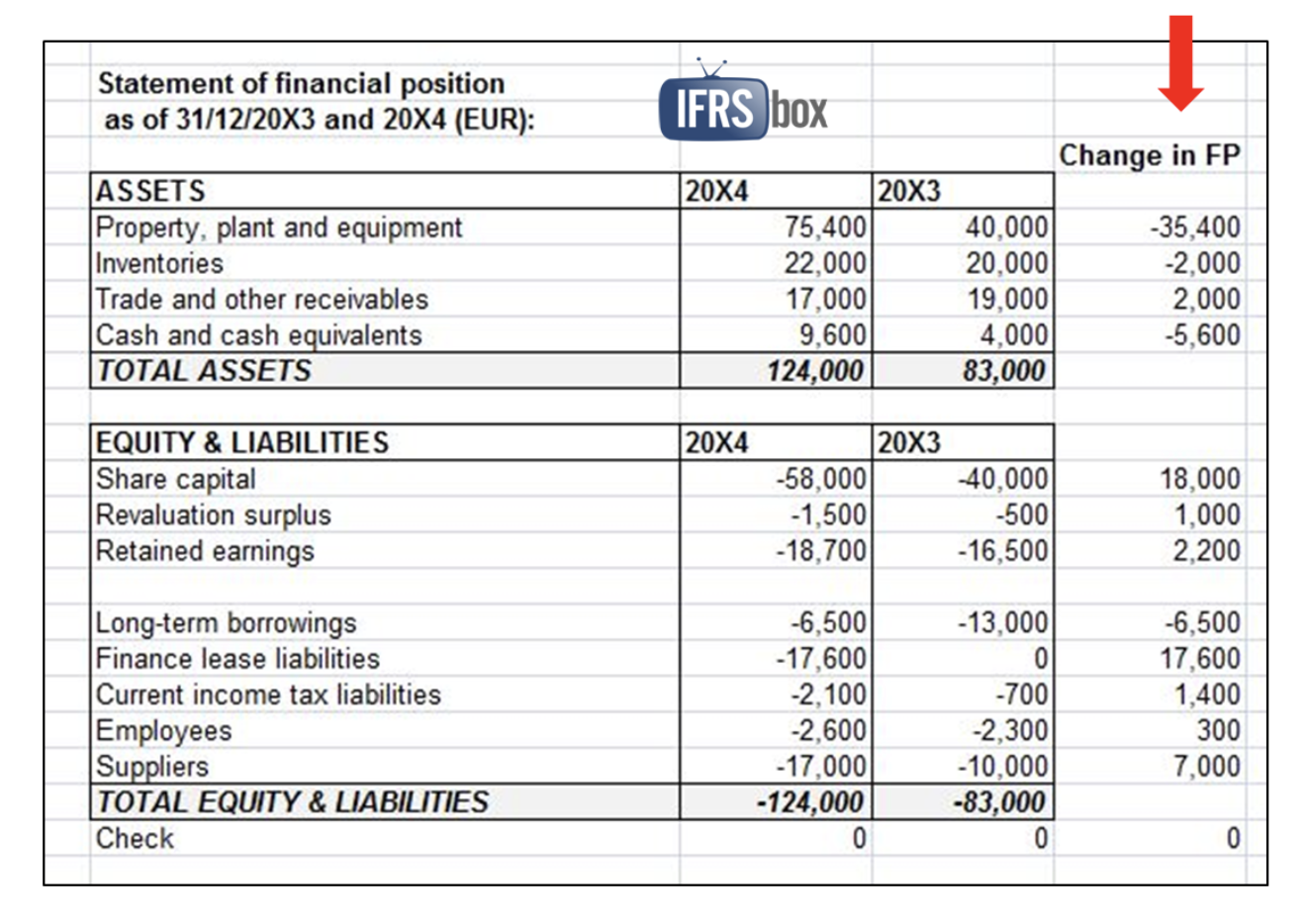

The cash flow report is an essential part of business accounting.

The cash flow report, along with the income statement and balance sheet, is one of the documents which makes up the financial statement or annual report.

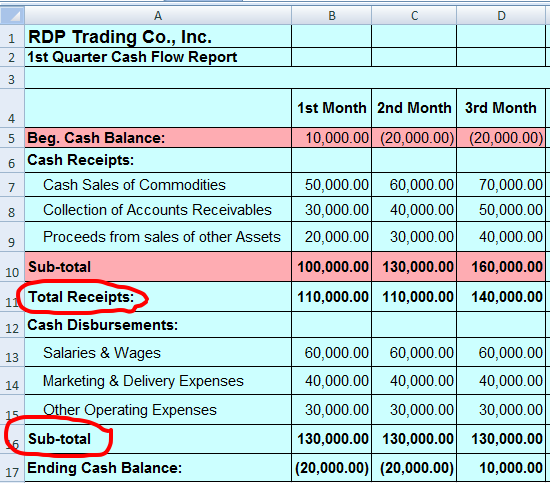

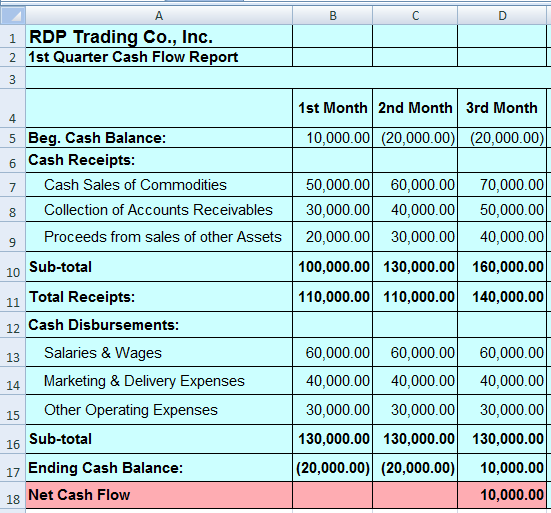

The primary concern of the cash flow report is to present an overview of the financial activity in the company over the designated period.

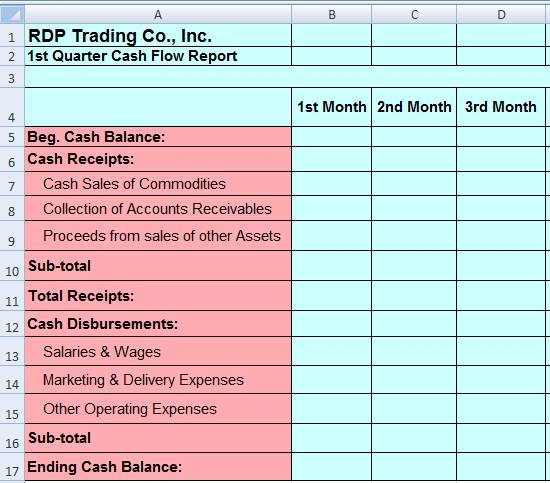

In this checklist, you'll be guided through the structure and method of creating a quarterly cash flow report.

Watch the short video below for a brief overview of the cash flow statement.