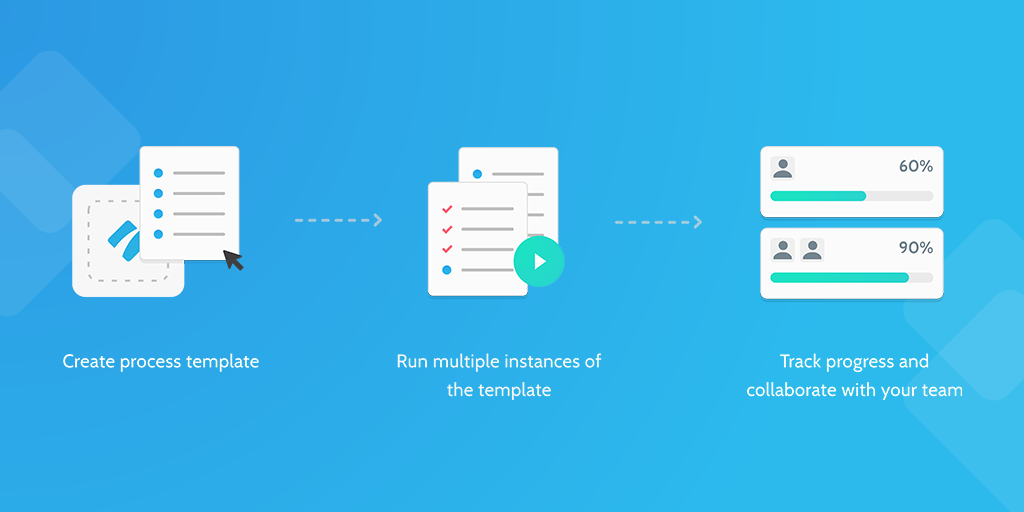

Consider whether or not you have full buy-in from your employees? People tend to not like or welcome change. Often, to be worthwhile the potential gain has to be twice the potential loss of trying something new.

An easy way to work around this is to have an experimental period. For a change that you think would make a meaningful positive impact on your business, consider if a trial run of the product, service, or new procedure will win people over.

The benefits of doing an experiment rather than rolling in a big change are:

- demonstrating that things don’t have to be perfect

- give you solid data specific to your situation on whether it will work or not

- it's easier to say yes to a trial - easier to get people (even yourself) on board

- allows you to change your mind

When doing a trial experiment keep in mind