The accounts receivable process makes sure your company collects payment for the goods or services it provides.

An effective process for managing your receivables is the cornerstone of maintaining a healthy cash flow in a busy business environment.

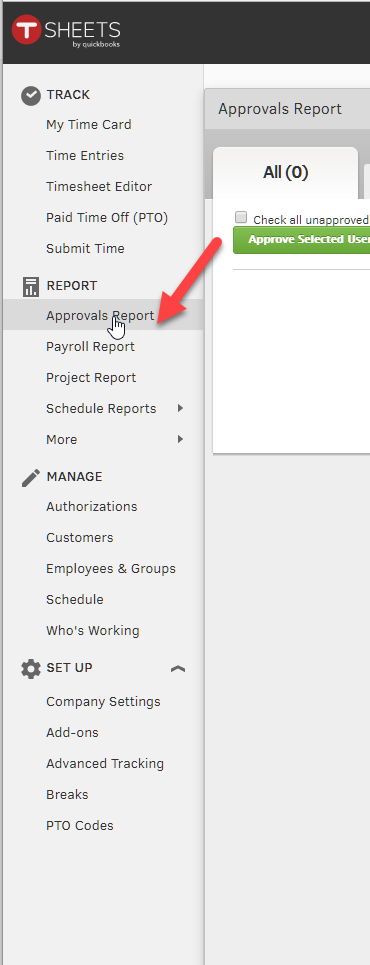

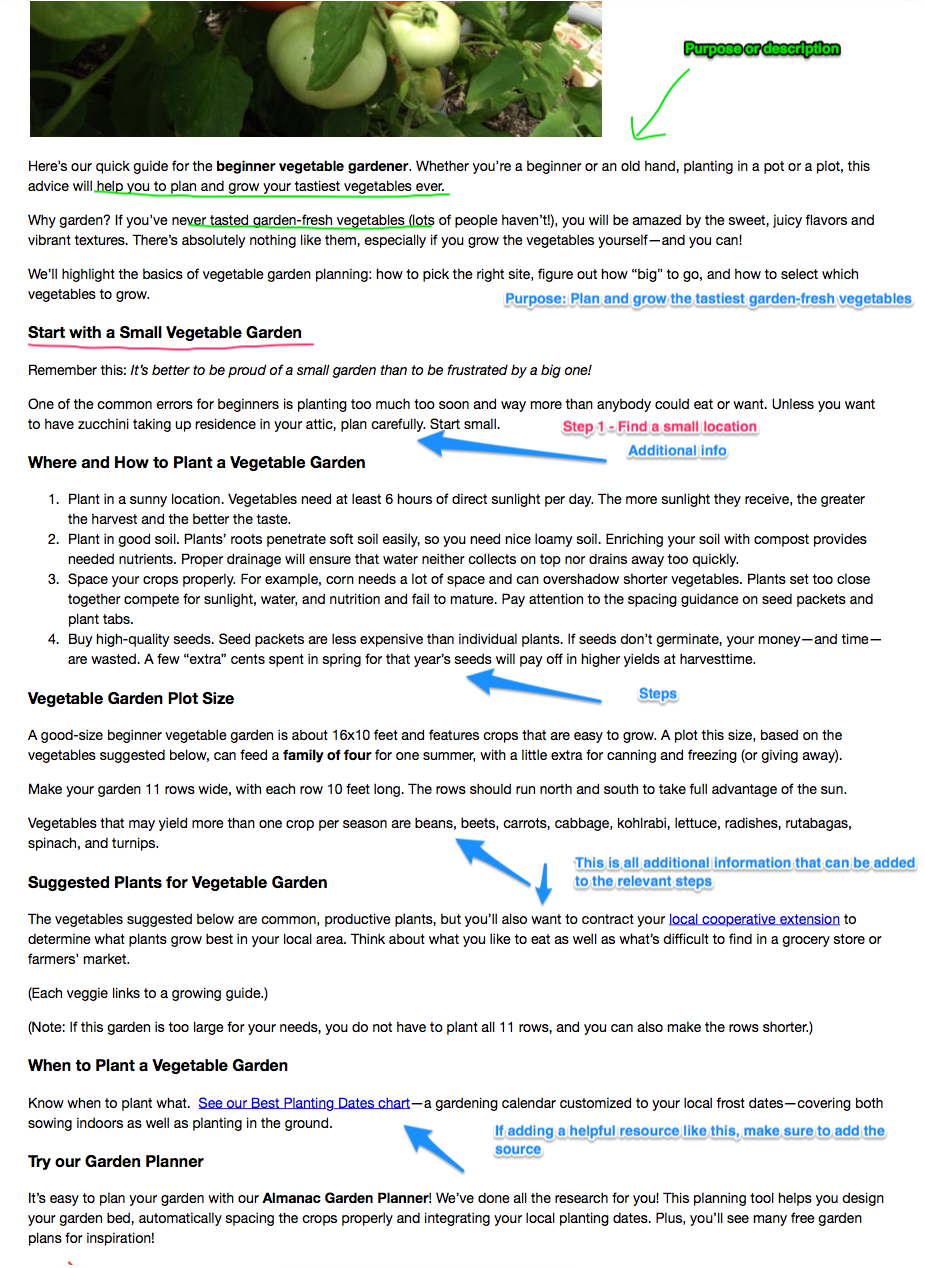

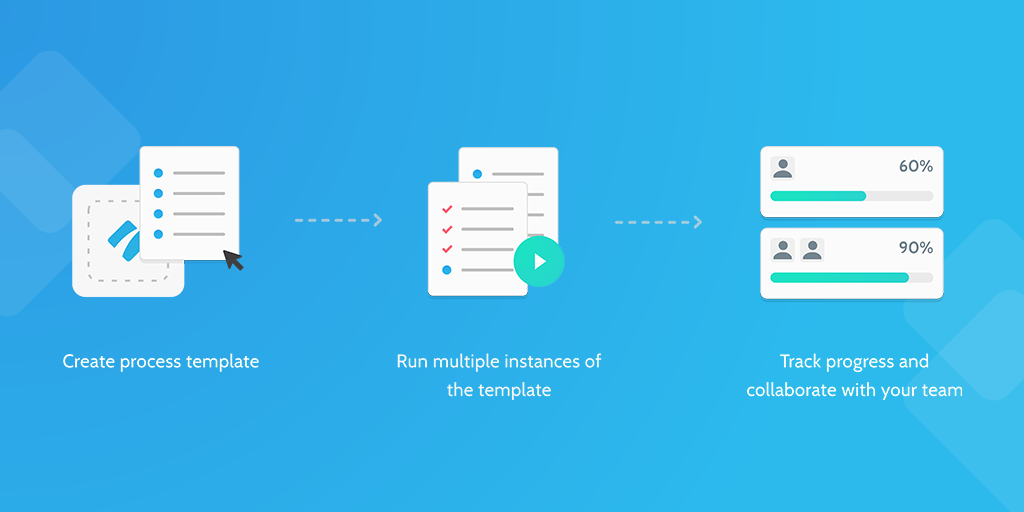

This checklist will help you check your client is able to pay, informs them of the necessary steps for payment, and covers best practices for accounting for the incoming payments.

For a video overview of an accounts receivable process, check out the link below.