Accounting is a time-consuming, complex, frustrating, and criminally boring part of running a business.

It’s precisely this kind of tedium which inspired Monty Python to riff on the profession several times, with accountants getting so frustrated that they do everything from becoming pirates (sailing the wide accountancy in a moving building) to try to switch to lion taming.

However, accounting and bookkeeping is also a vital part of running a business if you want to abide by the law and track your finances. No matter how tedious it might seem it’s vital to know what money is coming in, where it’s being spent, and whether you’re earning a net profit come the end of the financial year.

That’s why I decided to take a dive into the best accounting software available to make this review. It’s Xero vs QuickBooks vs Freshbooks, with no stone left unturned.

So, if the thought of sending your next invoice or calculating a cash flow report fills you with dread, sit back and relax as I take you through the software you can use to make accounting easy in your small-to-mid-sized business.

When do you need an accounting app?

If you own a business you need to be on top of your finances. Whether you’re running a one-person operation or a multi-million dollar corporation, if you’re not recording your payments and expenses you won’t even know how much money you’re earning, let alone comply with tax laws and avoid heavy fines or jail time.

Hell, even if you’re self-employed and don’t have a team, you still need to log your clients’ payments, prepare your taxes, and create balance sheet statements.

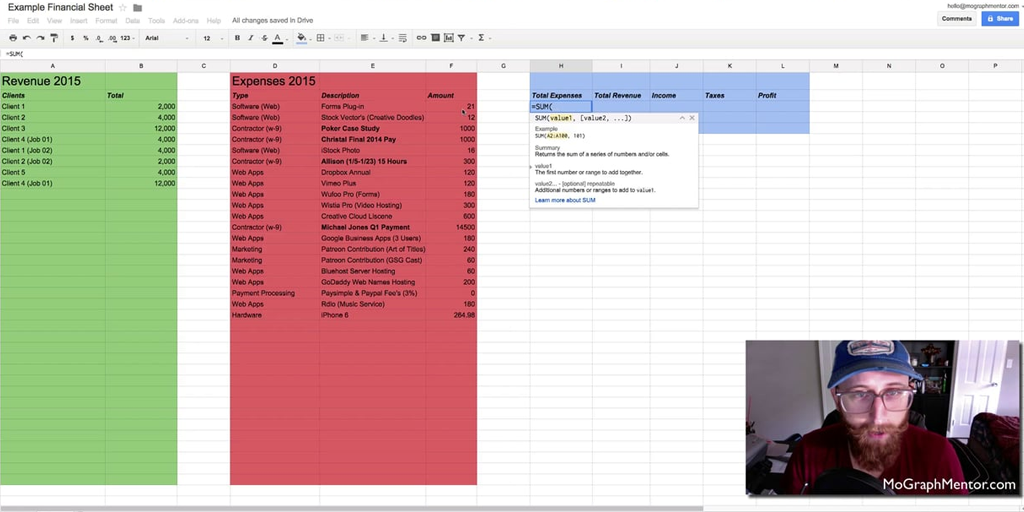

Usually, this would be accomplished either by hiring an in-house accountant or bookkeeper to help you keep track of everything. In turn, they would probably use a spreadsheet or (gasp) pen and paper records to track your cash flow and log your expenses.

By using an accounting app and following set accounting processes you can skip the middleman and easily organize your finances yourself. Whether you’re sick of losing records, chasing up invoices, or just want a central hub through which you can manage your accounts, there’s an app to perfectly suit your needs.

Instead of having to jump between several documents or services to manage your invoices, payroll, taxes, and accounts in general, these apps give you a central hub from which you can organize everything easily.

Sound good?

Great.

Now all you need to do is choose the app that’s right for you. To do that, we’re looking at three of the top contenders for the title of “best accounting app”: FreshBooks, QuickBooks, and Xero.

TLDR: The best accounting app

I know that not everyone has the time (or wants) to read the in-depth breakdown, so if you’re just looking for a quick summary of the three apps we’re looking at today, take a look at our one-sentence reviews below!

FreshBooks – with its slick design and thorough tutorials, FreshBooks is perfect for small businesses looking to organize everything to do with their invoices.

QuickBooks – the best accounting software for small businesses, QuickBooks has everything you could need to easily deal with all of your finances. While mid-sized business can use it perfectly well, it quickly becomes expensive due to the extra cost of payroll services.

Xero – while a little pricey compared to other options, Xero is a fantastic all-in-one accounting app for small-to-mid-sized businesses.

Accounting app features

FreshBooks

FreshBooks has pretty much everything most users could want out of their accounting software, but there a couple of areas where it is overshadowed by other apps (notably, anything that doesn’t in some way relate to invoicing).

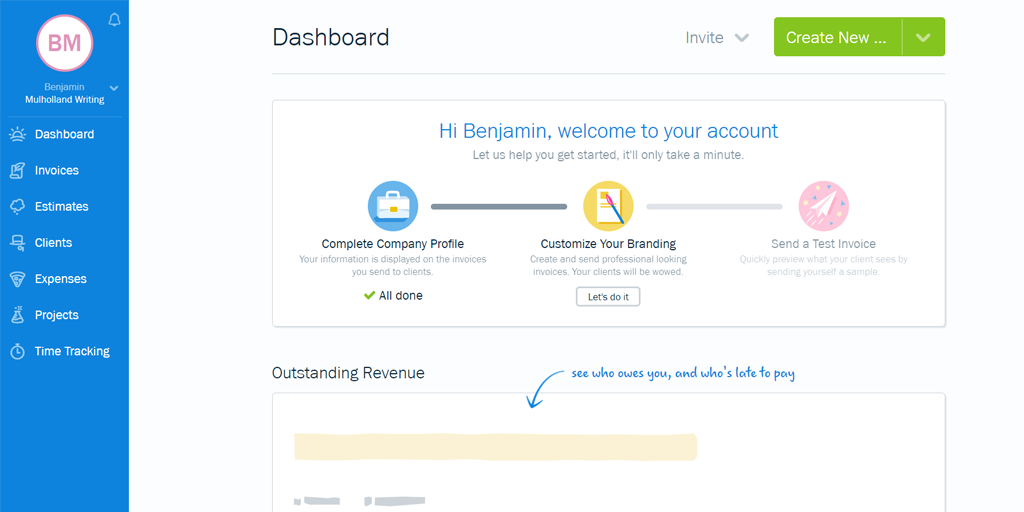

First up, FreshBooks provides a handy dashboard with overview reports of your outstanding revenue, overall profit, and expenses. This lets you quickly see the big picture of your business’ finances without having to dig into individual reports or invoices.

Speaking of which, Freshbooks’ invoicing feature is among the best in the business, letting you customise everything from your logo to the color scheme and font used. Not only that, but the same is true of estimates for projects – these can be created in the same way and then converted into invoices once the payment is due.

By saving information such as your various clients’ details and the specifics of particular items you charge for (eg, the taxes and price of an item), you can rapidly fill out new invoices without having to re-enter information in full. If you get paid for regular services then you can even set up recurring invoices to automatically generate and save yourself the trouble.

Expenses are also easy to log and track, as FreshBooks can be directly linked to your bank account. Once you’ve identified an expense, you can set FreshBooks to automatically recognize, pull in, and format future expenses from the same vendor.

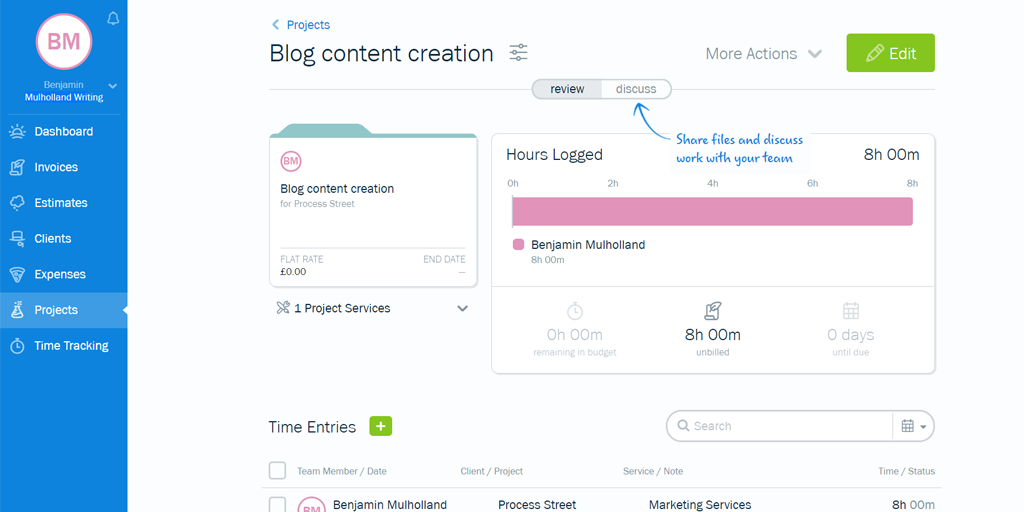

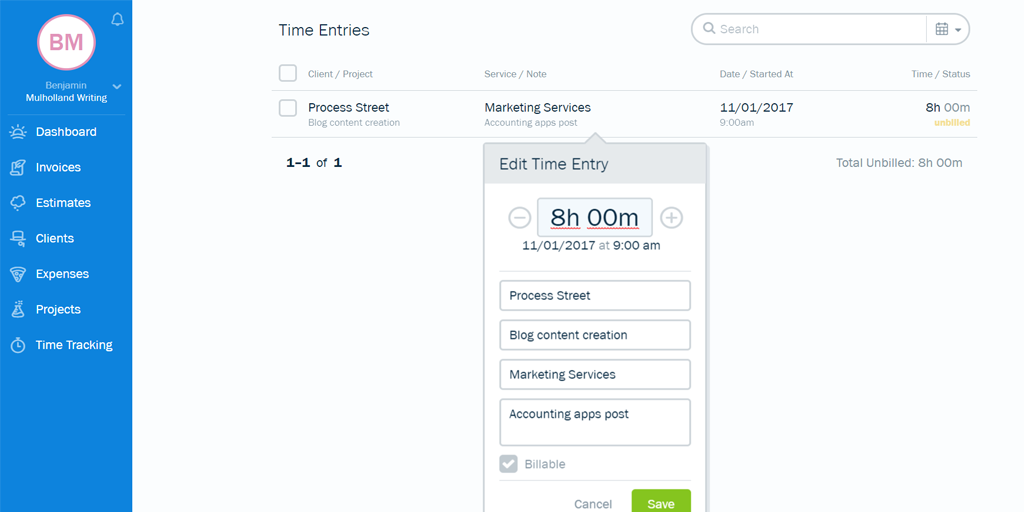

That’s to say nothing of the ability to create and track projects, and the fact that you and your team can track the time you spend on any given item (including billable time).

All of these features combined with the new slick design, overviews of everything from expenses to outstanding payments, and integrations with hundreds of other apps make it a powerful contender to be the best accounting app.

Unfortunately, there are a few drawbacks.

Back in September of 2016, FreshBooks made the bold decision to start from scratch and redesign its service, and both versions of the app are currently available. While the new version is infinitely better in terms of being easier to use (more on that later) and a better user experience overall, there are still a few visual bugs which can be confusing.

It’s also noticeable how little FreshBooks focuses on your employees.

While your team can freely track the time that they work for, there’s no direct way of dealing with the payroll of your employees, other than logging them as you would any other expense. While it’s true that you can get around this using FreshBooks’ integration with apps like Gusto, compared to the other two apps in this post it suddenly seems like less of the complete accounting suite it first appears to be.

Finally, if you’re looking for an even simpler solution to solely create your invoices, you’re probably better creating your own invoice generator than signing up and paying for a FreshBooks plan. It’s a fantastic piece of kit, but even this can be too complicated for some peoples’ needs.

QuickBooks

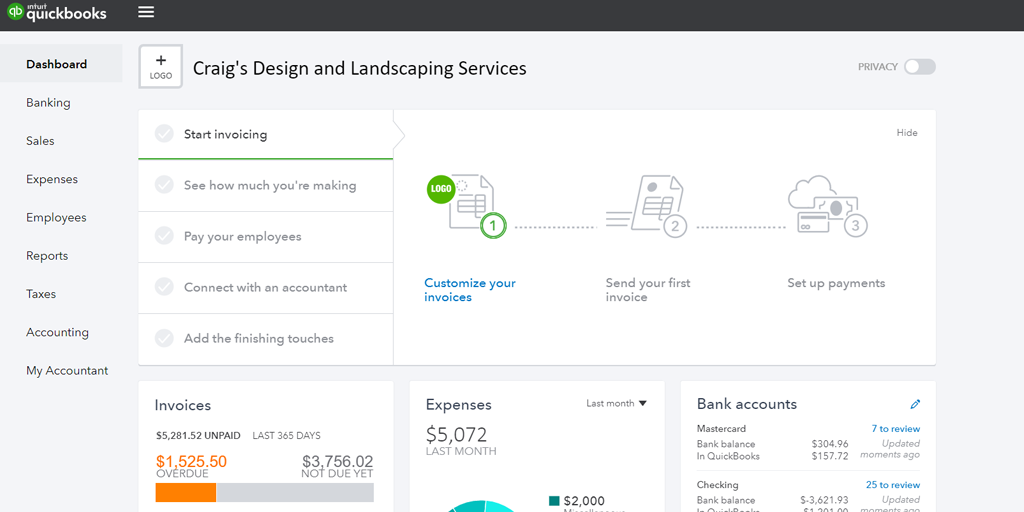

Quickbooks, on the other hand, has pretty much every feature a small-to-mid-sized business could possibly want out of accounting software, albeit at the cost of being less beginner-friendly.

At a basic level, Quickbooks allows you to customize and send invoices, track and automatically log your expenses, generate reports, sort out your employee payroll (on all but the cheapest payment plan), see an overview of your taxes, and even invite your accountant to work directly within the program to take even more pressure off you.

While it may sound like I’m skimming over these features, the truth is that many of them (especially the invoicing and expenses) work identically to their equivalent in FreshBooks and Xero, the former of which I’ve already gone through in detail above.

However, setting QuickBooks aside from its competitors is the far more detailed overviews given on its dashboard, along with the fact that Freshbooks can’t be used to track your current stock levels, organize payroll, or create budgets to follow.

While these might sound like small changes, they make all the difference in turning QuickBooks into a fully-fledged accounting suite rather than an invoicing app with a few extra features.

QuickBooks has a strong app ecosystem with third-party apps that can support you with tasks like syncing eCommerce data with accounting, cash flow forecasting, and account-level data backup and recovery.

The only real issue with Quickbooks is that the sheer spread of features can be a little overwhelming at first, and learning how to fully use the app can be difficult. However, if you’re willing to sit down, go through the helpful video tutorials and knowledge base, and really get to grips with what’s on offer, QuickBooks could easily become your one-stop app for everything to do with your finances.

Xero

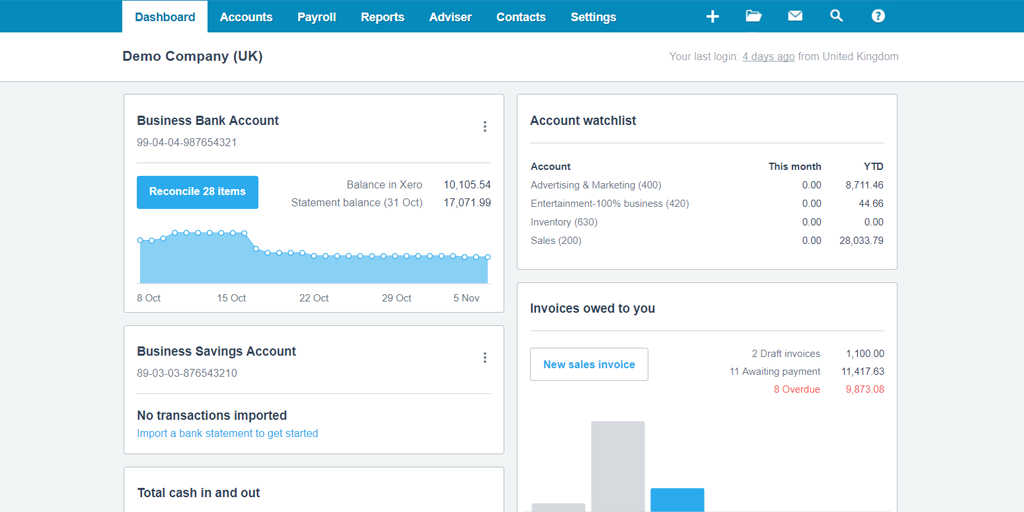

Xero has an almost identical feature set to QuickBooks, albeit allowing you to give unlimited users access to your account instead of a maximum of five. Naturally, this makes Xero a better choice for larger teams (small-to-mid-sized businesses).

They’re so similar, in fact, that there’s very little more to say about Xero in particular or how these features work – everything’s been covered by the QuickBooks entry.

https://www.youtube.com/watch?v=p1toSjyIhuQ

So, instead, here’s a summary of the features on offer across all plans.

Xero makes your tax digital and simplifies business tasks overall. Xero has invoicing, reporting, estimate creation, lets you invite accountant to work with you, connect your bank account, track expenses, see reports of cashflow and outstanding invoices and bills, track inventory, create budgets, and create extensive payroll settings (including workplace pension, taxes, and time off).

Much like QuickBooks, it’s everything you’d want from an accounting app, with the main difference being their pricing models.

Ease of use

FreshBooks

As I’ve already mentioned, FreshBooks is fantastically easy to use thanks to its complete overhaul and redesign. Every feature works logically and avoids drowning you in extensive dropdown menus, although this could admittedly be due to the smaller number of features available.

However, I will say that unless you know about the two separate versions of FreshBooks it’s incredibly easy to stumble into signing up to the Classic version instead of the modern one.

It’s true that the modern FreshBooks is lacking a couple of features from the original (and so you may still want to use Classic instead), but that version is also much more confusing to use thanks to its modern design. It’s not too difficult to get the hang of, but it’s certainly clunkier and more intimidating than the more modern interface.

QuickBooks

QuickBooks is the middle ground of the apps in this post; it’s not quite as beginner-friendly as FreshBooks, but once you watch a few of the help videos it’s easy to get started thanks to the service’s slick design.

All in all, for the features you’re getting I’d say that QuickBooks does the best it can. When you’re dealing with a full accounting suite there’s bound to be a slight overwhelm when it comes to using it for the first time (especially if you’re not an accountant or experienced with the financial side of owning a business), and QuickBooks does the best it can to make sure that you’re on your feet in no time.

Xero

Xero is also intimidating due to its feature list and status as a full piece of accounting software, but unfortunately it doesn’t fare as well as QuickBooks in getting you up to speed.

Xero’s design is great, but as soon as you hover over your submenus for the first time it’s easy to get lost and have no clue where to start. This isn’t helped by the fact that Xero is truly web-based in that the entire page has to reload for each different section of the software, rather than in QuickBooks where the top elements and sidebar persist at all times.

It’s a minor gripe in the grand scheme of things, but considering the steep learning curve of the software these small design quicks can make all the difference between providing a fluid and easy user experience or a disjointed and difficult obstacle.

I must stress again, however, that once that initial barrier is broken, Xero is easy and intuitive to use.

Pricing plans

FreshBooks

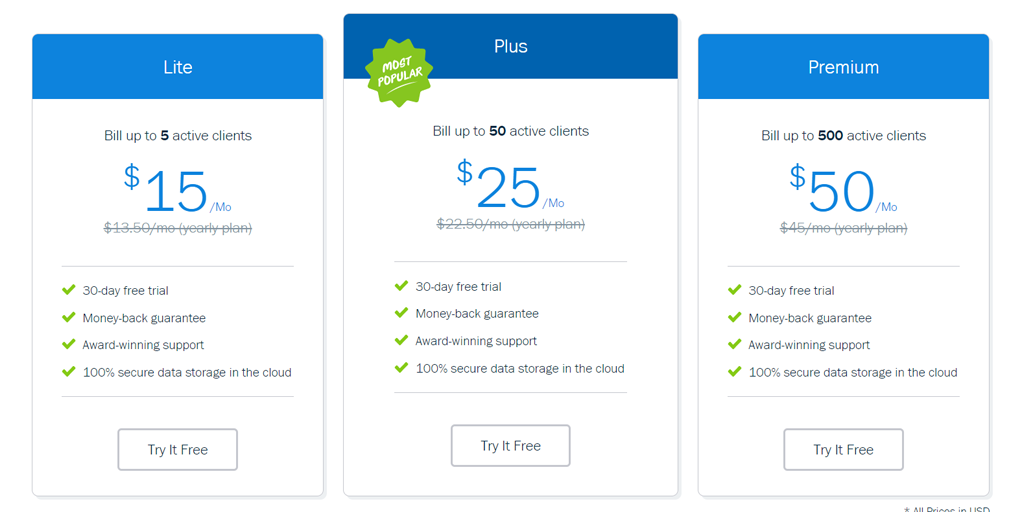

As with the other apps in this post, FreshBooks comes with a 30-day free trial and then the option to upgrade to one of three paid plans.

If you try out FreshBooks for the 30 days and then decide not to upgrade, your invoices, expenses, and “other data” will be stored securely for if you decide to return, which is a nice little addition to an already very user-friendly product.

FreshBooks’ plans also do not have any kind of feature limit – you’ll get the full product no matter what you pay for it. Instead, the limitations come entirely by the number of active clients you want to bill.

The pricing plans are:

- $15/month for the “Lite” plan, which lets you bill up to 5 active clients

- $25/month for “Plus” plan, in which you can bill up to 50 active clients

- $50/month for “Premium” plan, which ups the barrier to billing up to 500 active clients

This further enforces the idea of FreshBooks being more of a piece of invoicing software than a full accounting suite – their main price point is the number of clients you’re billing, rather than locking off features such as payroll (which they don’t offer).

QuickBooks

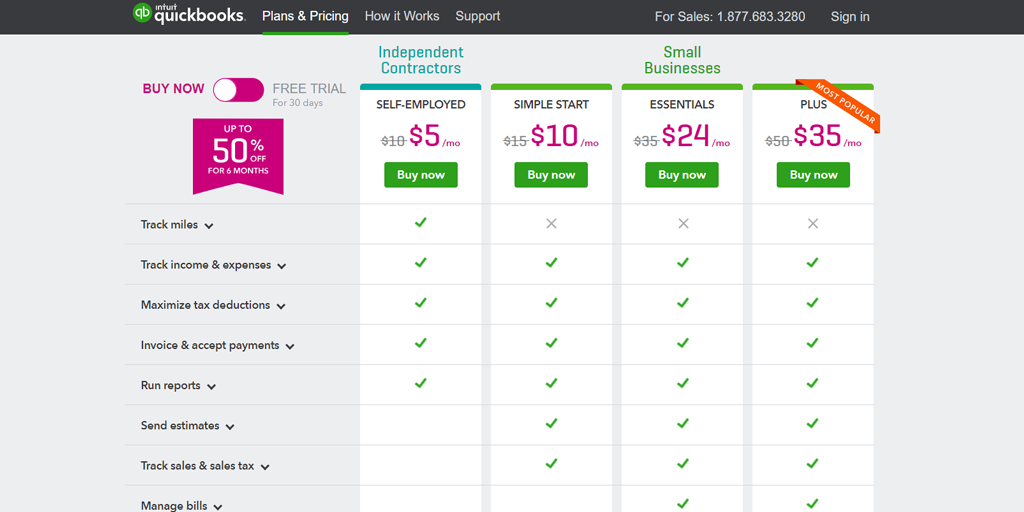

QuickBooks offers a 30-day free trial, after which you’ll have to choose from four separate paid plans ranging from $10/month all the way up to $50/month.

These plans differ based on the features you’ll need access to and the number of users you want to give access to your account. In general, the smaller your operation and the fewer employees you have, the cheaper the plan you’ll want to get.

The pricing plans are:

- $10/month for the “Self-Employed” plan, which lets you track miles (exclusive to this plan), log and organize income, expenses, tax categories, invoices, payment, and basic reports.

- $15/month for the”Simple Start” plan, which has all previous features (minus mileage tracking), along with sending estimates and converting them into invoices, automatically calculating taxes, letting you accept credit cards using the mobile app, and further integrations with tools like Shopify.

- $35/month for the “Essentials” plan, which is the simple start plan but with the ability to track, manage, and pay bills, give two other users access to QuickBooks with variable permission levels, and time tracking.

- $50/month for the “Plus” plan which is the essentials plan but allowing four extra users (instead of two), letting you track your inventory, create and manage budgets, and pay independent contractors.

It’s also worth noting that payroll is billed entirely separately from these plans. If you want to have payroll services in Quickbooks, there are two options:

- $39/month + $2/employee/month for “Enhanced Payroll”, which lets you pay both your employees and taxes related to them within QuickBooks, along with printing and filing W2s come the end of the year.

- $99/month + $2/employee/month for “Full Service Payroll”, which essentially hands off your payroll and taxes to dedicated experts, who then handle those duties for you and pay any penalties for false filings themselves.

Xero

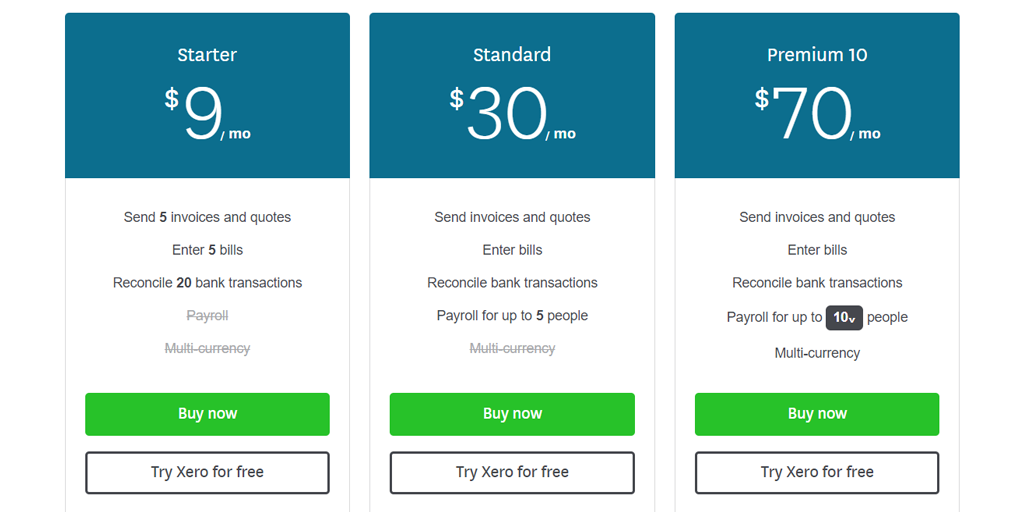

Here’s where the difference between QuickBooks and Xero becomes clear. Instead of limiting the features you have access to on cheaper plans, Xero is a little more expensive in general but focuses on limiting the number of employees you can have on payroll.

In other words, this is where Xero shows its face as a tool aimed at small-to-mid-sized businesses, rather than just small ones.

The pricing plans are:

- $9/month for the “Starter” plan, which only lets you send five invoices and quotes, enter five bills, and doesn’t give access to payroll or multi-currency transactions

- $30/month for the “Standard” plan, which uncaps your invoices, quotes and bills, and allows payroll for up to five people (but still not multi-currency)

- $70/month for the “Premium 10” plan, which adds multi-currency, and increases payroll to up to 10 people

- $90/month for the “Premium 20” plan, which increases payroll to 20 people

- $180/month for the “Premium 100” plan, which increases payroll to 100 people

As with Xero and QuickBooks, Xero also has a free trial which lasts 30 days to let you get to grips with the app and its features.

Support services

FreshBooks

Personally, I had a great experience with customer support. Even though the thing I asked for wasn’t available, the team themselves were extremely polite and helpful, and recommended other support materials to help me smooth out any other teething problems with the service.

I was even passed on to the marketing team to see if there was anything extra they could sort out! I didn’t actually contact them, but when it comes to support, it’s often the thought that they’re going the extra mile that counts. It doesn’t take long to write a single sentence and to pass on a message, but the impression it leaves can be lasting, even if you can’t help the person you’re talking to.

QuickBooks

QuickBooks’ email support team were also very helpful in my experience. They both managed to quickly resolve the questions I had and were friendly to boot.

Again, even though it takes a little extra time to do so, the impression that just a line or two of extra conversation can give will last a long time.

I will say, however, that apparently the phone lines for customer support don’t perform well, either with long wait times or just being unhelpful. This is relying on information from user reviews, but it features commonly enough for it to feature in this comparison.

Xero

Xero’s online support avenue was also helpful, albeit a little less conversational than the other services. This isn’t so much a bad thing as one that makes them a little less memorable.

In my experience there wasn’t anything wrong with the support team’s ability or speed, it’s just that I found the others to have a little more personality. Like it or not, that kind of thing can make the difference between a good support experience and one that’s rather forgettable.

User reviews

FreshBooks

Freshbooks was generally very highly rated, although the mobile app reviews are very mixed (more on that in a moment).

Complaints with the main app seem to be focused on two things in particular. First, that FreshBooks isn’t an all-in-one accounting suite as many believe it is advertised, but is instead a thorough piece of invoicing software.

Other than that, the most common complaint is that FreshBooks doesn’t support dual-entry accounting. That in itself isn’t a massive issue (or even necessary at all), but it does mean that balancing your books is a little more difficult.

As for more technical issues, the mobile app appears to suffer from bugs and crashes far more than the desktop version, leading the user reviews to be far more mixed.

However, to their credit, many of the negative reviews have replies from the FreshBooks team, all trying to solve any issues or at the very least apologizing for the inconvenience. It might not change the review score, but it’s nice to see them take an active approach with user feedback.

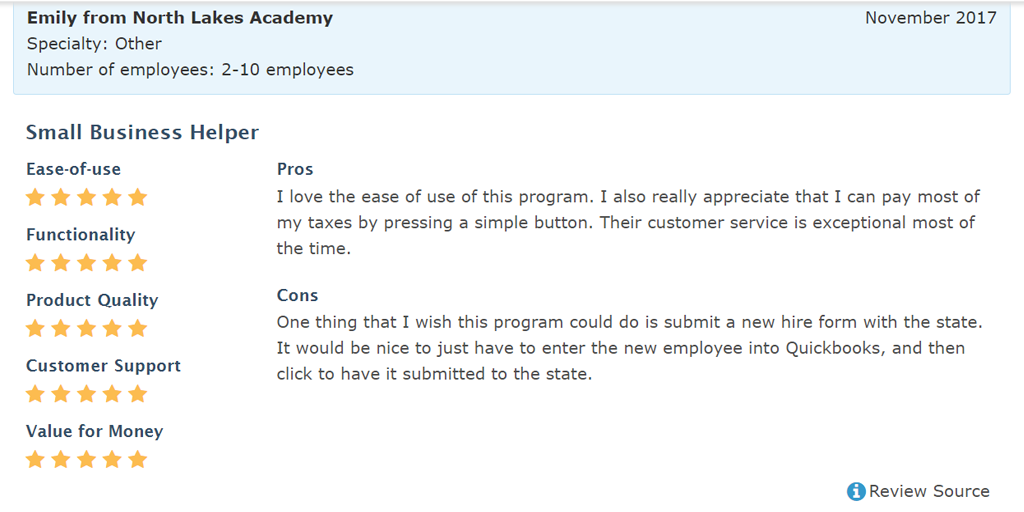

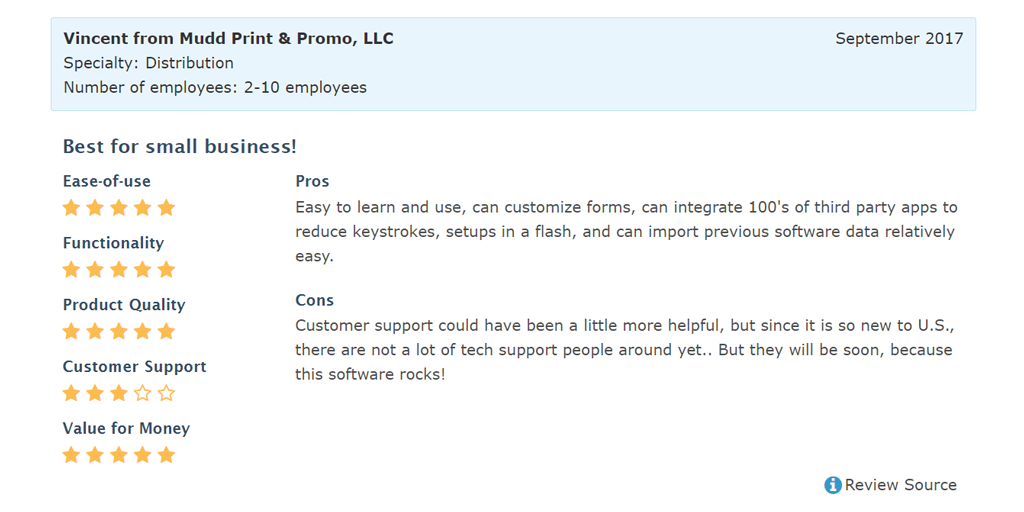

QuickBooks

Reviews of QuickBooks are also largely positive, although several users do note that it can be a little difficult to use at first.

As for the main complaints with the service, the most common are that the phone service for customer support needs to be improved, that some users don’t like the pricing plan (having to pay extra for payroll and the general feature lock on cheaper plans), and that their Android app doesn’t work quite as smoothly as their iOS or desktop ones.

However, much like FreshBooks, QuickBooks can be seen to have replied to the vast majority of negative reviews and a couple of glowing positive ones too. While the user is typically asked for more information or referred to an email address to continue the conversation, it’s once again good to see that QuickBooks are paying attention in this way.

Xero

Once again, reviews of Xero are mostly positive all around, albeit this time with a few more caveats when it comes to the mobile apps.

The basic service gets largely the same feedback as I’ve already given it – a great service that’s a little hard to learn, could do with being slightly more user-friendly, and the pricing is a little steep for smaller businesses. Overall, however, it’s smooth sailing for the regular service.

Unfortunately, both the iOS app and Android app have much more mixed reviews. While they’re still mostly positive, there are a few key features that the mobile apps lack in the form of bills and reports.

This doesn’t affect your ability to quickly send or receive invoices while you’re on the go with your phone, but if you’re looking to use the entire span of accounting features without a computer, you’re going to be disappointed.

Which is best?

As with any comparison of close competitors, I can’t name a single one of these apps as “the best accounting software available”. They’re all best suited to different use cases.

FreshBooks is great for very small businesses who just want a quick and easy way to deal with their invoicing. It’s not a full accounting suite, but its pricing and ease of use make it great for serving as a quick and easy solution.

QuickBooks is a little harder to get up and running with, but a few tutorials later and you’ll have the best accounting software for small businesses on your hands. The main issue preventing this app from expanding to larger businesses is its pricing model; it’s already a little pricey if you want to unlock all features, but add to that a rising monthly cost for extra employees on payroll and the price can quickly skyrocket.

Xero, meanwhile, is great for small-to-mid-sized businesses, and particularly for those who have a smaller number of clients at any given time. Although their pricing is more expensive in general and their cheapest plan limits you to 5 invoices and quotes, above that they uncap almost all features and instead monetize based on the number of clients you have.

Plus, all three platforms integrate with a vast number of different apps to take advantage of business process automation. There’s very little between them in terms of helping out your workflow automation efforts, other than the fact that with FreshBooks you’ll be pretty much forced to use automation as a crutch to do what the app cannot.

Still, don’t take my word for it. Go out and try these apps for yourself!

If you do (or if you’d like to suggest another accounting app or service that we should cover too), I’d love to hear from you in the comments below. Until then, happy sailing the wide accountancy, and no, I will not apologize for that pun.

Workflows

Workflows Projects

Projects Data Sets

Data Sets Forms

Forms Pages

Pages Automations

Automations Analytics

Analytics Apps

Apps Integrations

Integrations

Property management

Property management

Human resources

Human resources

Customer management

Customer management

Information technology

Information technology

Ben Mulholland

Ben Mulholland is an Editor at Process Street, and winds down with a casual article or two on Mulholland Writing. Find him on Twitter here.