Process Steet’s Financial Audit Checklist acts as an internal guide, to aid you through the financial auditing process.

The checklist can be run from the financial audit procedures beginning, to the end when a final financial audit report is produced.

Process Steet’s Financial Audit Checklist has condensed the financial audit procedure into the following tasks:

- Engagement acceptance

- Planning

- Audit testing

- Account analysis

- Substantive Procedures

- Reporting

The earliest surviving mention of a financial audit like procedure dates back to the 13th century. As a procedure, financial auditing has progressed through the years to become what is currently a thorough assessment.

Financial auditing is the process of evaluating an organization's financial reports and financial reporting processes in an objective and independent manner.

Regular financial audits substantially benefit business performance by:

- Ensuring consistent, up-to-date, detailed overviews of business workings.

- Providing additional perspectives to ensure on-going full compliance.

- Improving credit ratings.

- Improving reliability.

- Creating certainty in regards to business projection.

- Promoting accountability.

For FTSE 350 companies, regular financial audits have aided the continual improvement of the companies financial reports and processes. With 56% of audit results classified as either good or requiring limited improvement in 2011/12, rising to 81% in 2016/17.

As such, regular financial auditing plays a vital role in the improvement and thus business success.

With this in mind, it is fundamental to deliver a comprehensive financial audit report, which requires a precise, accurate, and reliable audit assessment.

The aim of Process Steet’s Financial Audit Checklist is to enforce this precision, accuracy, and reliability during the financial auditing process.

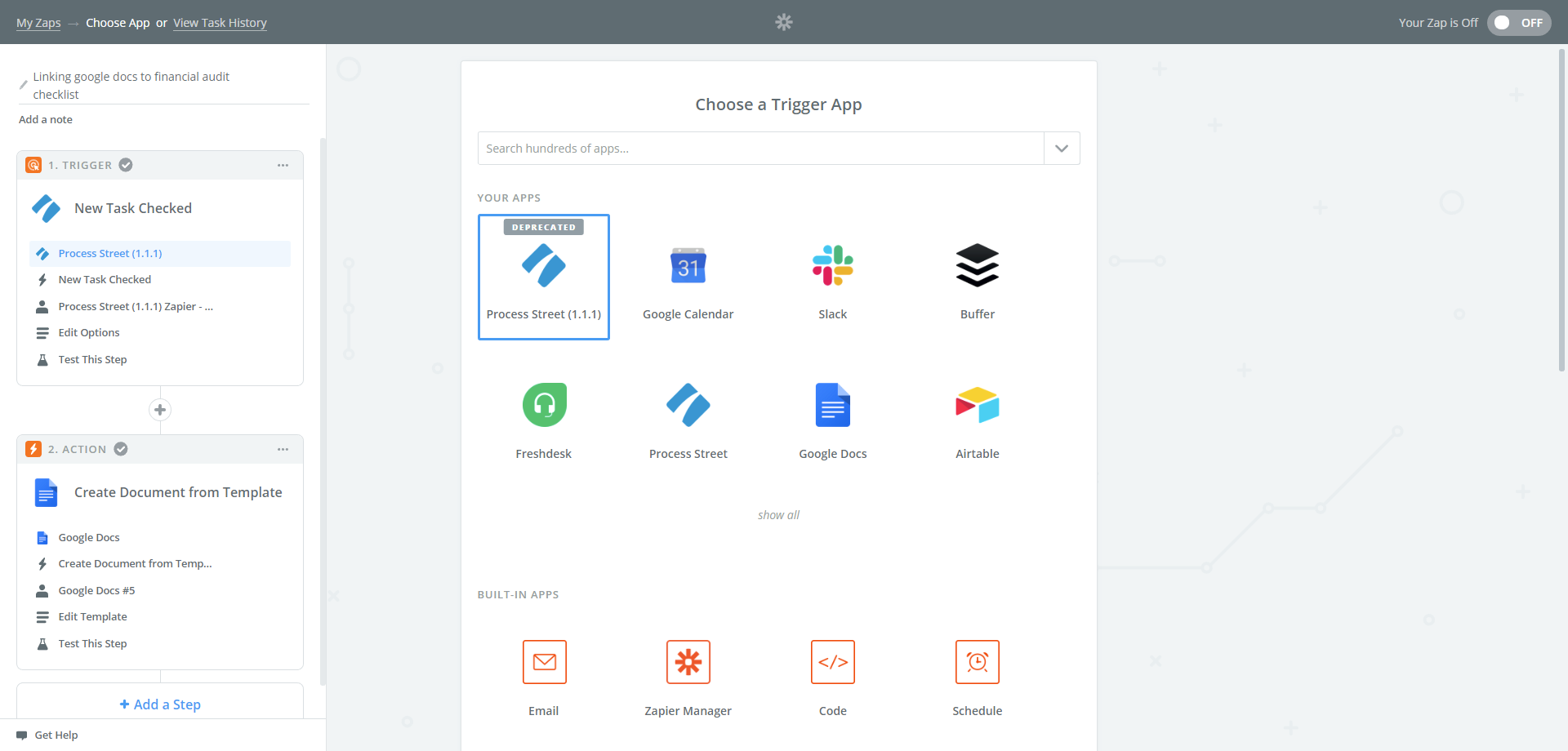

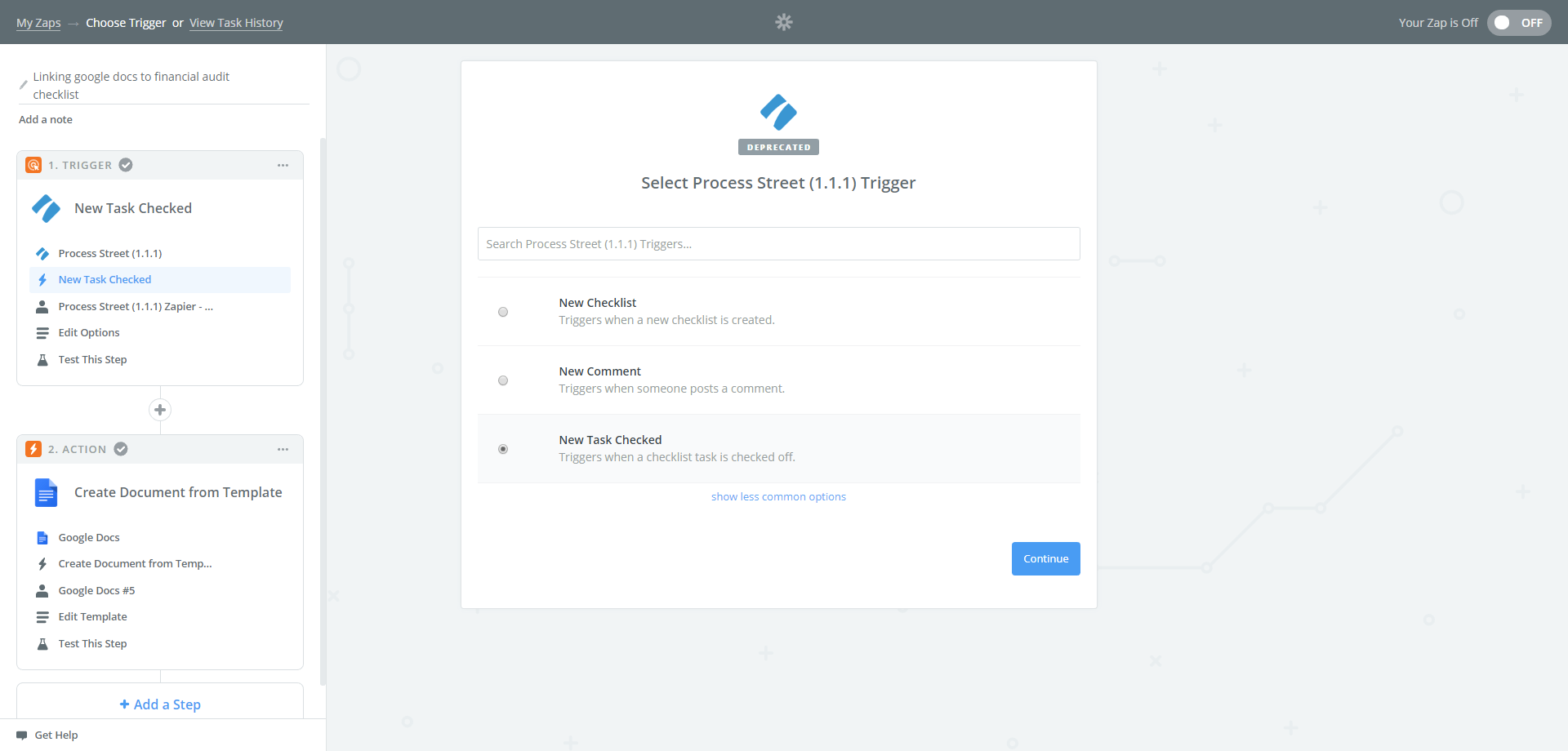

Process Steet does this by utilizing the power of the checklist.

Effective checklists are noted to increase precision, accuracy, and reliability.

Process Steet’s Financial Audit Checklist has been meticulously and effectively designed for you, to deliver a financial audit report to the required standard.

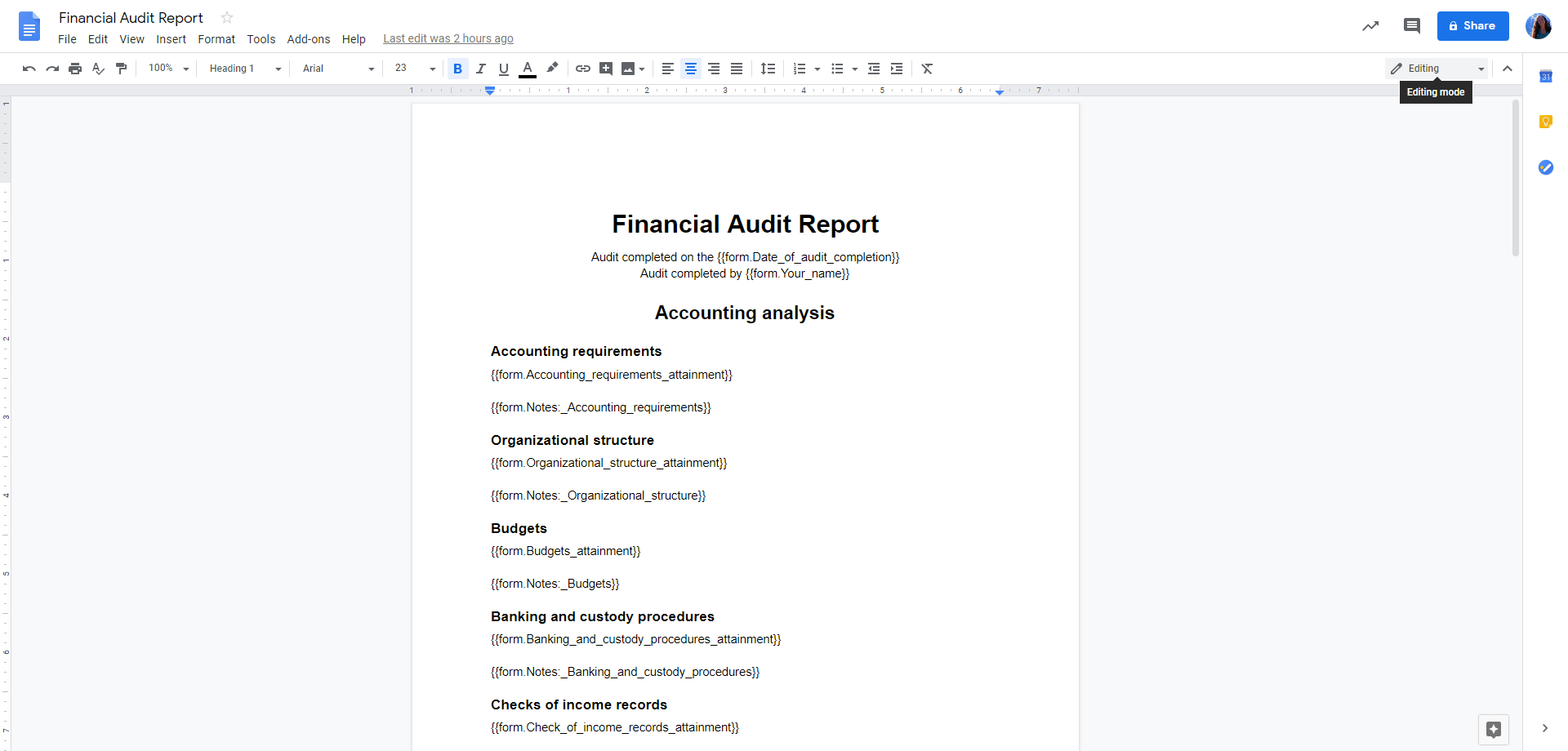

As you work through this template, you will be presented with specialized questions given as form fields. Different form fields are used throughout the checklist, such as subtasks, dropdown menus, short answers, long answers, and weblinks.

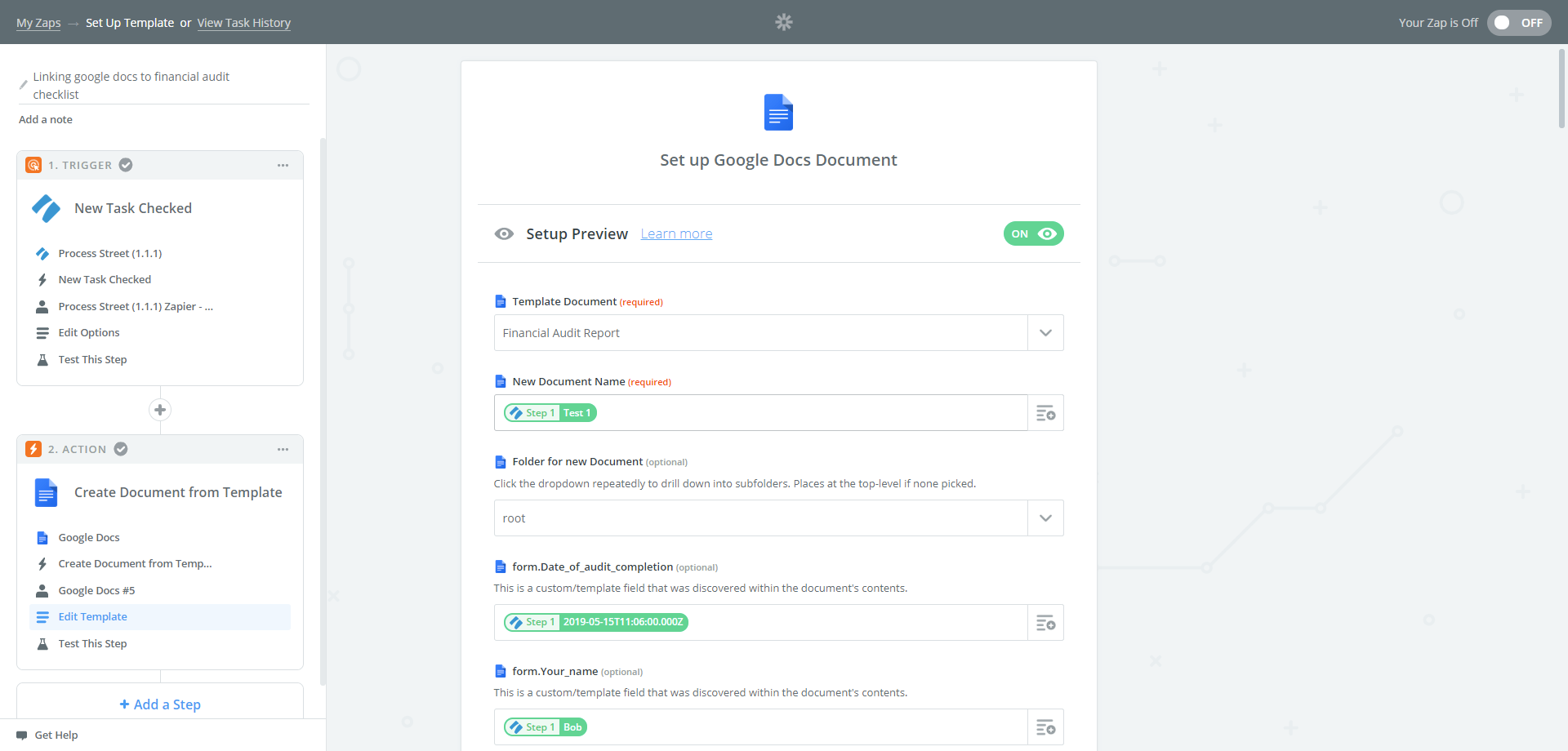

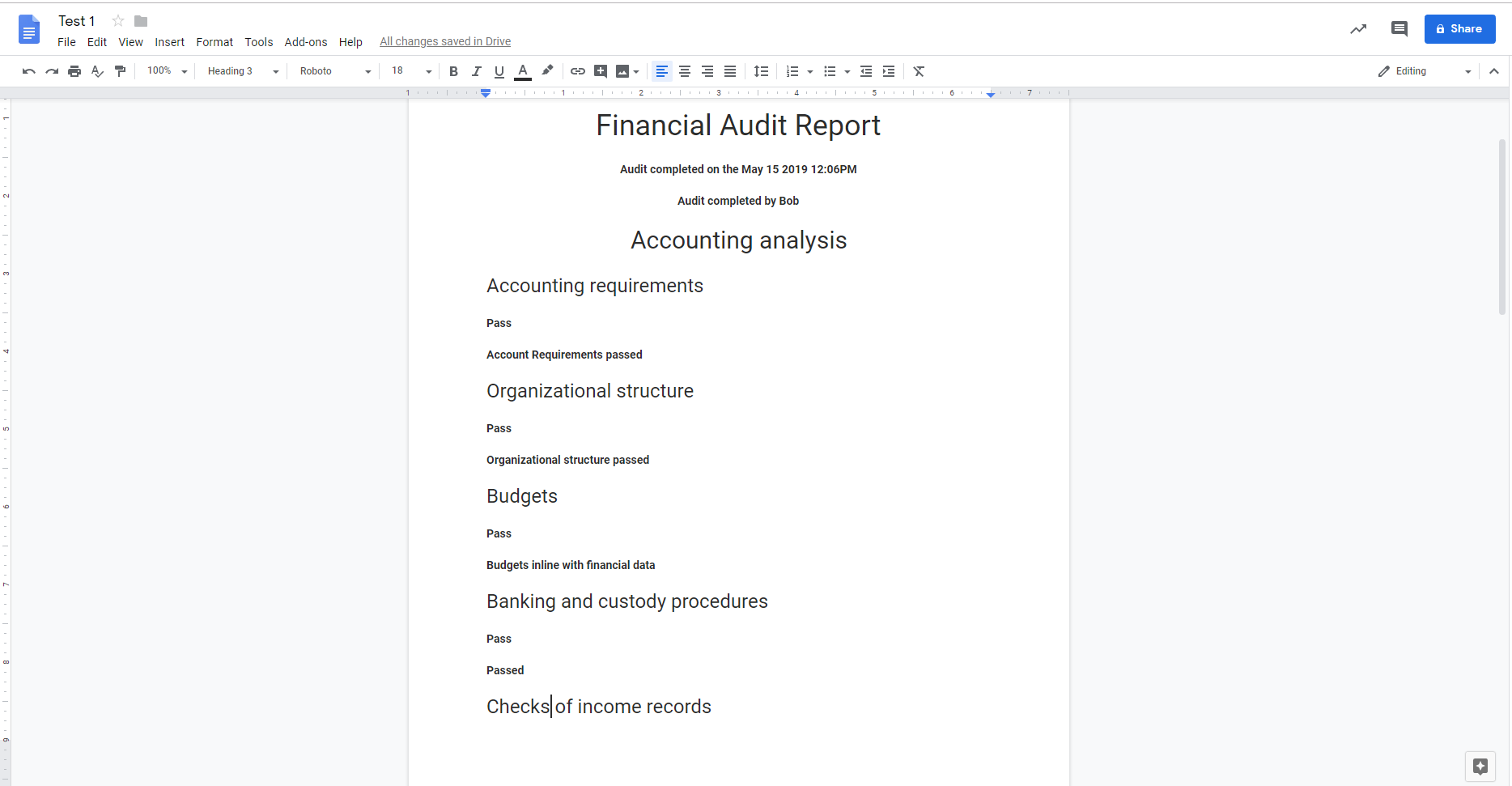

You can populate each form field with your own specific data. This data is compiled to produce a final audit report once the checklist is complete.

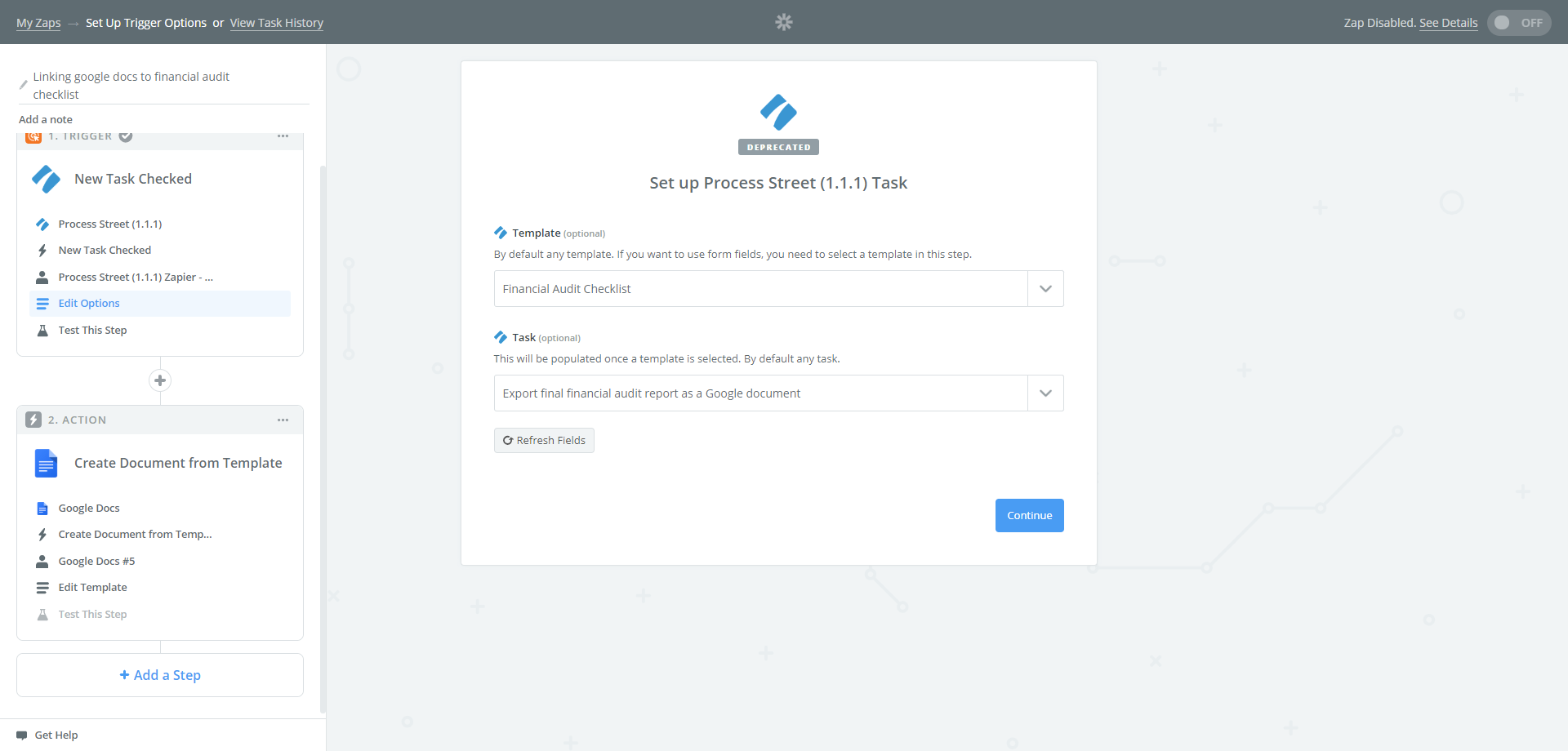

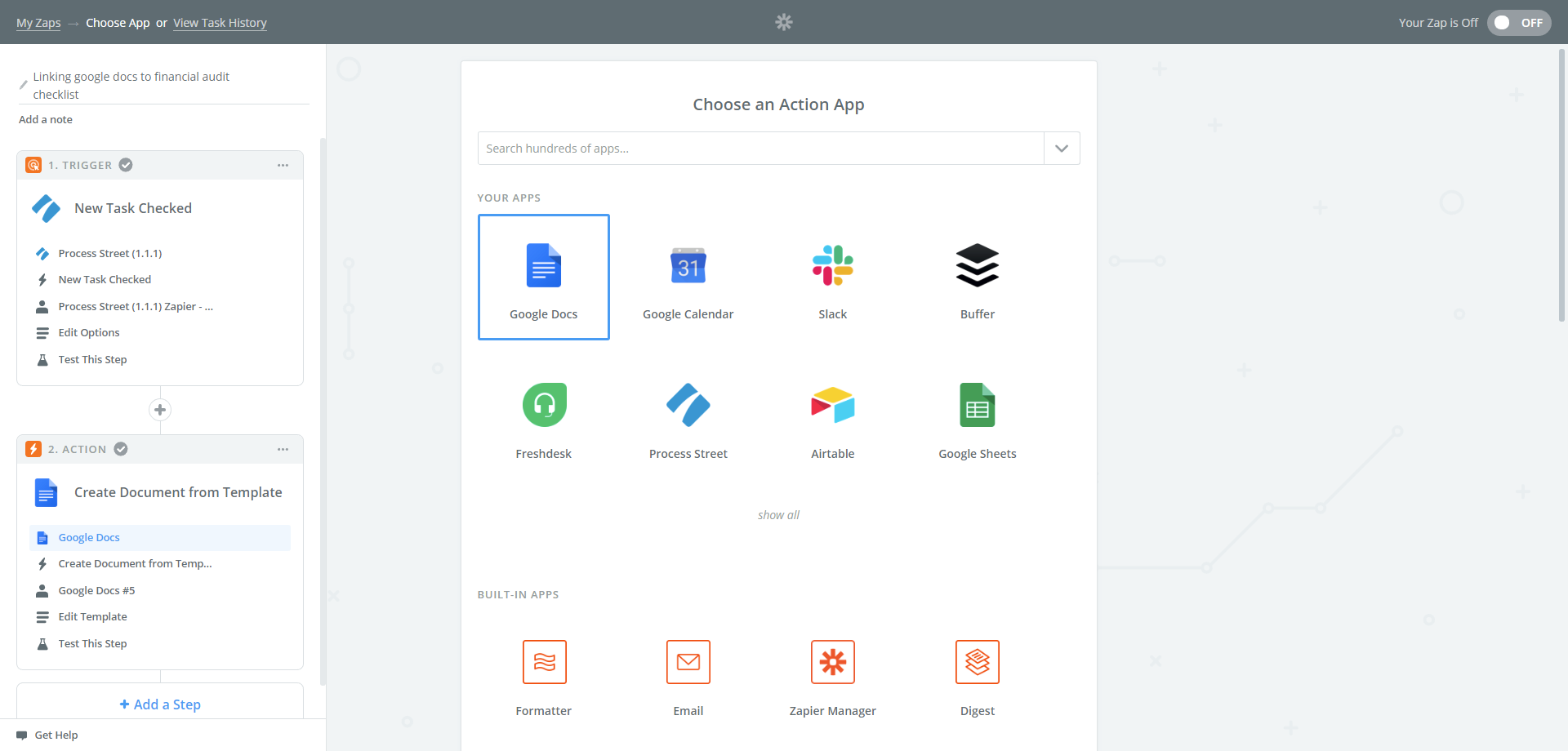

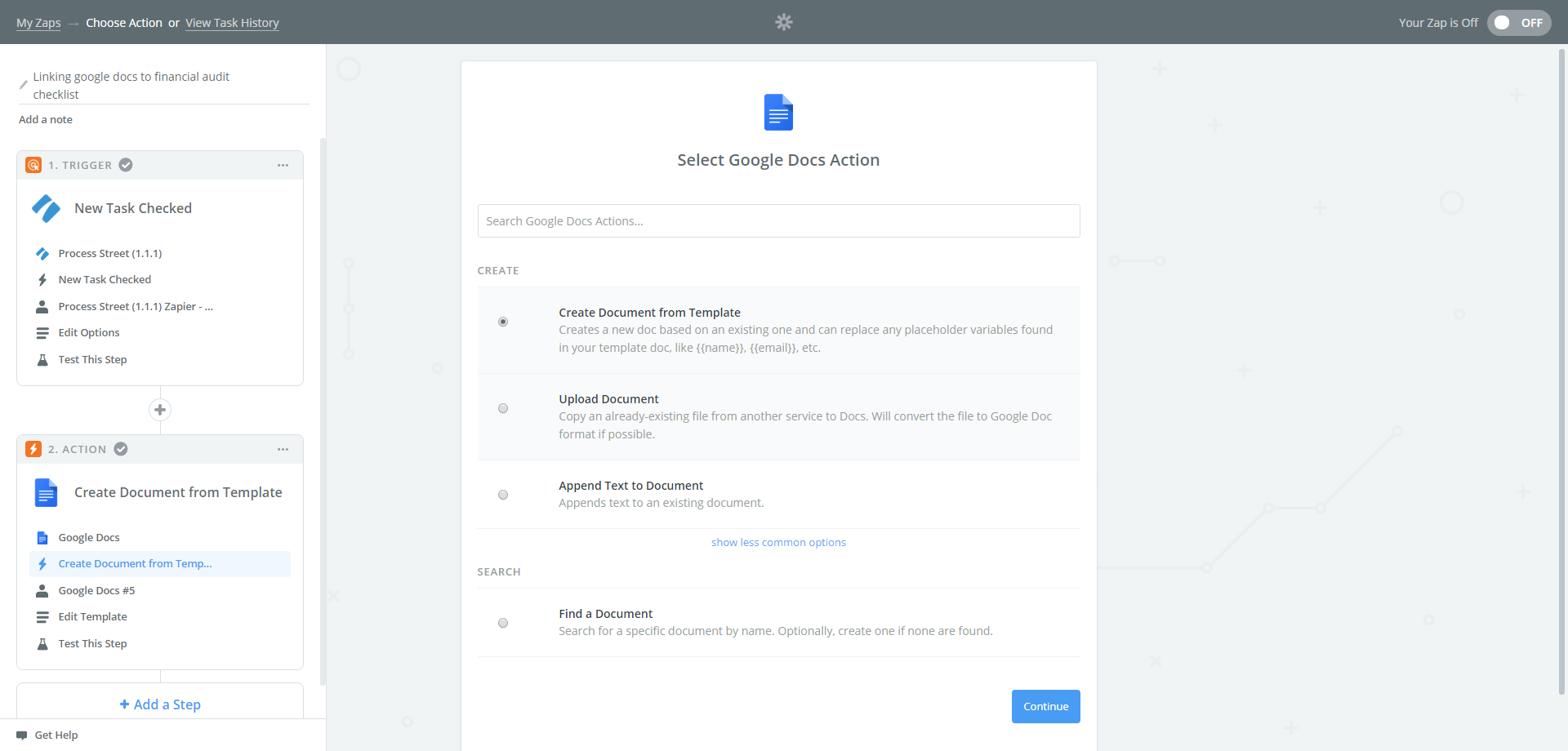

On completion you are presented with the option to export the generated final report as a document. This is a conditional step, however, using our conditional logic feature. If this step is not required, you will not be directed to the relevant tasks.

In addition, our stop task feature has been used to enforce task order when needed.