Process Steet’s Tax Preparation Checklist has been designed to guide you through the preparation of your individual tax accounts and the preparation of your business tax accounts as required.

The Tax Preparation Checklist is designed to be used by individuals and small business owners, to be completed in advance of the tax due date.

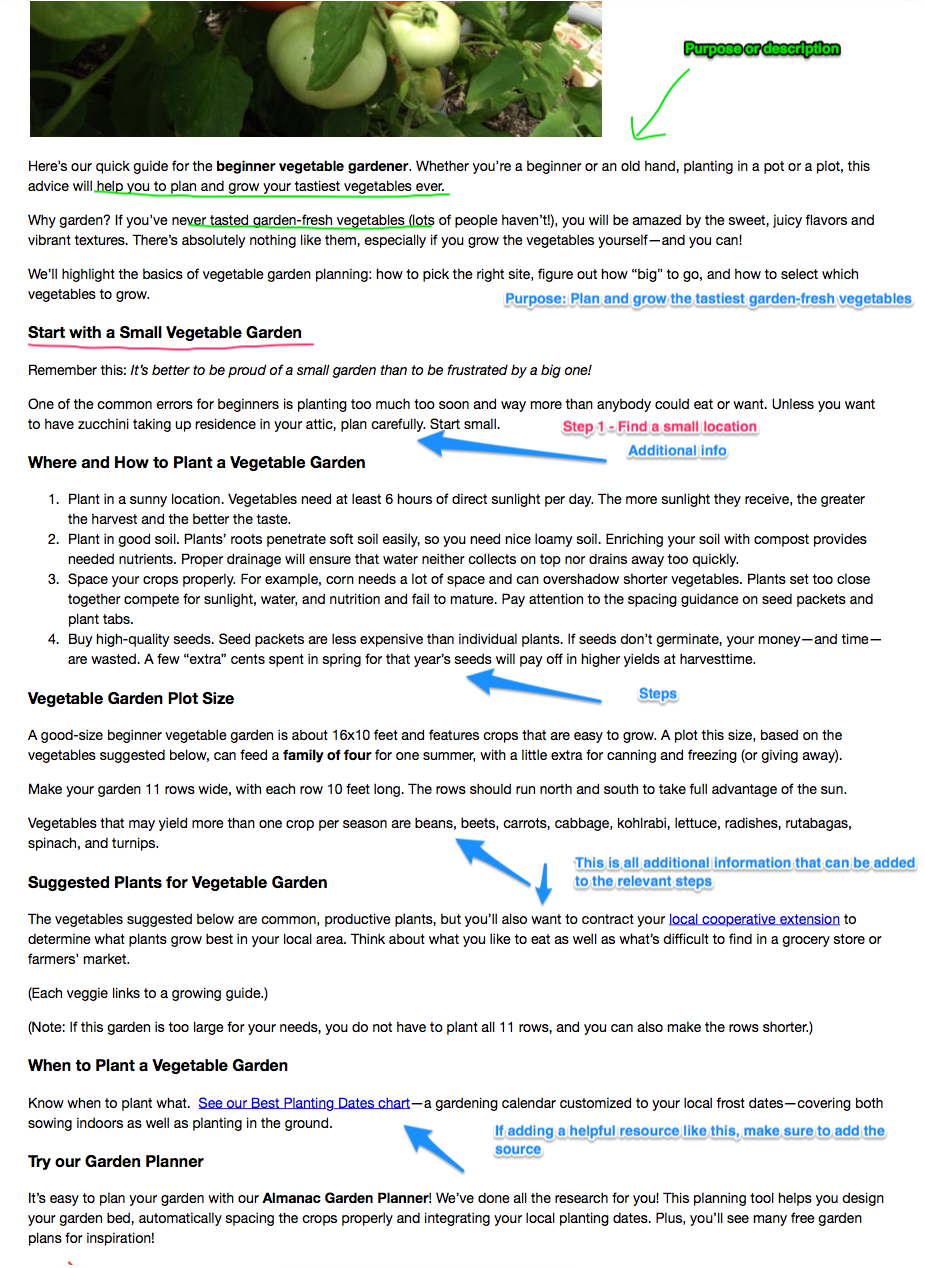

Process Steet’s Tax Preparation Checklist has simplified the preparation of your individual tax accounts and your business tax accounts into the below series of tasks:

- Individual Tax Preparation

- Enter Personal Information

- Income

- Homeowners

- Education

- Family

- Donations

- Tax Deductions

- Other Deductible Expenses

- Business Tax Preparation Checklist

- Analysis Of Current And Past Financial Data

- Benefits, Loans And Transactions Documents

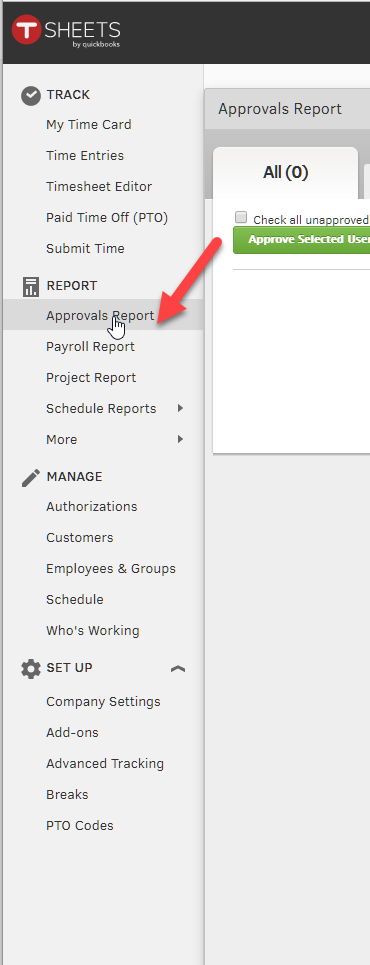

- Payroll Data

- Expense Details

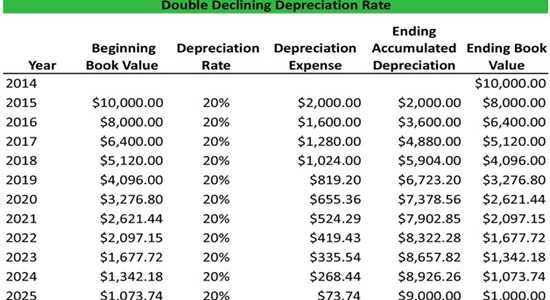

- List of Assets And Depreciation

- Final Forms

3000-2800 BC dates the first known system of taxation, developed in Ancient Egypt.

Taxation systems have advanced since the BC age, with the aim to support common resources and services for the formation of a positive, productive, and principled economy.

The World Happiness Report rated Scandinavian countries such as Finland and Denmark to be unsurpassable when it comes to happiness.

But why so happy?

When you consider the taxation system of these countries, Denmark citizens pay the highest amount of tax, averaging around 45% of Denmarks GDP from 2000-2016. This means the basic needs for the people are met with the services and resources taxation provides.

Citizens of Denmark state that they feel looked after, secure and safe knowing their basic needs will always be met.

Hence there is an obligation to support the economy, to take the time and accurately prepare your own, and/or your business taxes.

Tax preparation can be a daunting process, as it involves many steps with obligatory guidelines and regulations put in place by the IRS.

Failure to follow the required guidelines, or the complete omission of your tax payment entirely, will result in both fines and penalties and can be punishable by law.

The aim of Process Steet’s Tax Preparation Checklist is to assure the required guidelines are followed during the tax preparation for both individuals and small businesses.

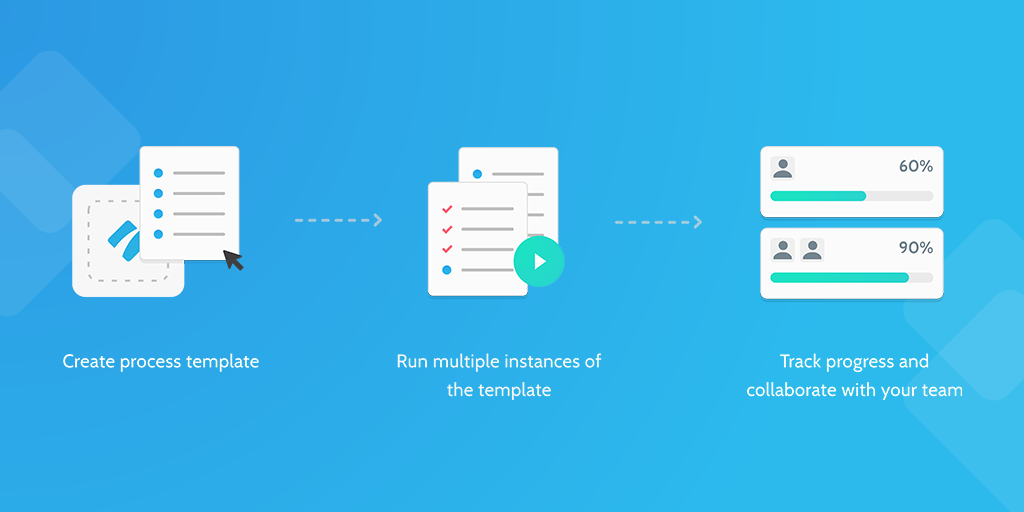

By adopting Process Steet’s checklist approach, the complexity of tax preparations is removed and the completion of critical steps is ensured.

In this template, you will be presented with specialized questions given as form fields. Different form fields are used, such as subtasks, dropdown menus, short answers, long answers, date, file upload, and weblinks.

You can populate each form field with your own specific data.

In addition, our stop task feature has been used to enforce task order when needed.

Our conditional logic feature has been used when required to guide you through the correct process path specific for your entered data.