Get started quickly, see results immediately, no code needed.

Accretion Dilution Analysis: What Is It? (Complete 101 Guide)

Accretion dilution analysis provides a quantitative framework for analyzing how a merger or acquisition will impact a company’s earnings per share and financial metrics.

By understanding the fundamentals of this analysis, stakeholders can make more informed decisions when evaluating potential deals.

Let’s delve deeper into this essential tool and explore how it can help navigate the complex landscape of corporate growth strategies.

In this article, we’re covering:

- What is an Accretion/Dilution Analysis?

- What Are the Steps Involved in Accretion Dilution Analysis?

- Why is Accretion Dilution Analysis Important?

- Using a Template for Accretion Dilution Analysis

What is an Accretion/Dilution Analysis?

An accretion/dilution analysis is a financial analysis tool used to assess the impact of a potential merger or acquisition on the acquiring company’s earnings per share (EPS). The analysis helps to determine whether the transaction will be beneficial (accretive) or detrimental (dilutive) to the acquirer’s shareholders.

To perform an accretion/dilution analysis, the acquirer’s financials, including projected earnings and outstanding shares, are compared with the target company’s financials. The analysis takes into account:

- The purchase price

- Any synergies or cost savings

- The method of financing the transaction

Uses and Implications:

- Investor Perspective: Investors use this analysis to understand the potential impact on their holdings and whether the transaction will enhance or reduce their earnings per share.

- Corporate Strategy: Companies use it as a decision-making tool to evaluate the financial benefits of pursuing a merger or acquisition.

- Negotiation Tool: Helps in negotiating deal terms by quantifying the financial benefits or costs of the transaction.

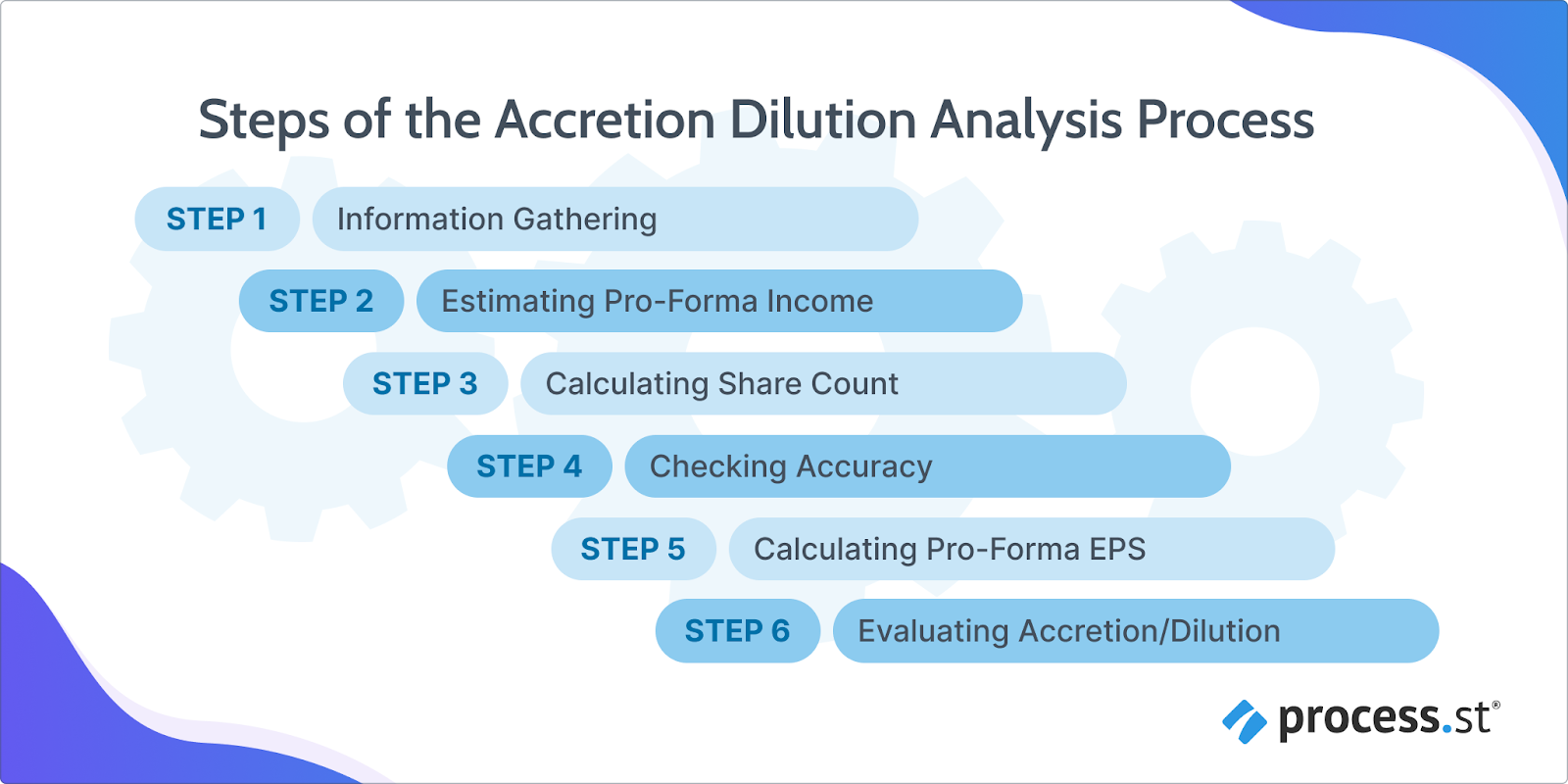

What Are the Steps Involved in Accretion Dilution Analysis?

Accretion/dilution analysis helps investors and analysts assess the impact of a transaction on a company’s earnings and determine whether it is value-enhancing or value-destroying.

This analysis enables better decision-making for potential mergers, acquisitions, or other corporate transactions by providing a clear, quantitative measure of the transaction’s effect on EPS.

Here are the most common steps to performing accretion dilution analysis:

Step 1: Information Gathering

Gather all relevant details about the transaction, including:

- Target Company’s Financial Statements: Obtain the income statement, balance sheet, and cash flow statement of the target company.

- Purchase Price: Determine the total cost of acquiring the target company, including any premiums paid over the market value.

- Deal Terms: Review the structure of the deal (e.g., cash, stock, or a combination) and any contingencies.

- Financing Options: Identify how the transaction will be financed, whether through debt, equity, or a mix.

- Capital Structure Information: Understand the current and post-transaction capital structure, including any changes in debt levels or equity issuance.

Step 2: Estimating Pro-Forma Income

Adjust the target company’s financial statements to reflect the anticipated effects of the transaction:

- Revenue Synergies: Estimate potential increases in revenue due to cross-selling opportunities, expanded market reach, or other synergies.

- Cost Savings: Identify and quantify expected cost savings from operational efficiencies, reduced overhead, and other cost-cutting measures.

- One-Time Expenses: Account for any one-time integration costs, restructuring charges, or other non-recurring expenses associated with the transaction.

- Tax Implications: Consider changes in tax rates or tax benefits resulting from the merger or acquisition.

Step 3: Calculating Share Count

Determine the number of shares that will be issued or retired as part of the transaction:

- New Shares Issued: Calculate the number of new shares that will be issued if the acquisition is funded with stock.

- Share Repurchases: Account for any shares that will be repurchased or retired as part of the transaction.

- Convertible Securities: Include any convertible bonds, warrants, or options that might be exercised as a result of the deal.

- Weighted Average Shares Outstanding: Ensure the share count reflects a weighted average if the transaction occurs partway through the fiscal year.

Step 4: Checking Accuracy

Verify the accuracy of the pro-forma income projections and share count calculations:

- Cross-Verification: Cross-check calculations with multiple sources or departments (e.g., finance, accounting, M&A advisory).

- Scenario Analysis: Run different scenarios (e.g., best case, worst case) to test the robustness of the projections.

- Audit: Conduct an internal audit or seek third-party validation to ensure all relevant data has been considered and errors are rectified.

- Consistency Check: Ensure consistency in accounting methods and financial metrics used in the analysis.

Step 5: Calculating Pro-Forma EPS

Divide the estimated pro-forma income by the total number of shares outstanding after the transaction:

- Formula:

Pro Forma EPS = Pro Forma Net Income/Pro Forma Shares Outstanding

- Adjustments: Make necessary adjustments for non-recurring items to get a clearer picture of ongoing earnings potential.

- Sensitivity Analysis: Perform sensitivity analysis to understand how changes in key assumptions (e.g., revenue growth, cost synergies) impact pro-forma EPS.

Step 6: Evaluating Accretion/Dilution

Compare the pro-forma EPS to the pre-transaction EPS:

- Formula:

Pre-Transaction EPS = Acquirer’s Net Income/Acquirer’s Shares Outstanding

- Comparison: Compare the pro-forma EPS to the pre-transaction EPS. If the pro-forma EPS is higher, the transaction is accretive; if lower, the transaction is dilutive.

- Analysis of Impact: Assess the long-term strategic and financial benefits or drawbacks of the transaction beyond just the immediate EPS impact.

- Investor Communication: Prepare to communicate the results and implications of the analysis to investors, highlighting the rationale behind the transaction and expected benefits.

Why is Accretion Dilution Analysis Important?

Accretion/Dilution analysis is important for several reasons. Some of the most common reasons are:

Assesses the Impact on EPS

Accretion Dilution Analysis is crucial in evaluating mergers and acquisitions (M&A) by providing valuable insights into the impact of the deal on the acquirer’s earnings per share (EPS). This analysis helps determine the justification for pursuing the transaction.

Firstly, the analysis assesses the impact on EPS, which is an important financial indicator for investors. By considering the effect on EPS, acquirers can gauge whether the transaction will result in an increase (accretion) or decrease (dilution) in their earnings.

This information is significant as the market closely monitors EPS changes, and any negative impact can trigger a decline in the acquirer’s stock price. Accretion dilution analysis, therefore, enables acquirers to make informed decisions regarding the potential financial benefits or drawbacks of an M&A deal.

Provides an Understanding of Financial Justification

The analysis provides acquirers with a clear understanding of the financial justification for pursuing the transaction. If the analysis indicates EPS accretion, it implies that the earnings of the combined entity will be higher than that of the acquirer as a standalone company.

This can be an indication of synergies and cost savings resulting from the merger, making the deal more financially attractive. Conversely, if the analysis reveals EPS dilution, it raises concerns about the financial feasibility of the deal and may require further evaluation and adjustments to the terms.

Enables Informed Decision-Making

Accretion dilution analysis is essential in evaluating M&A transactions. It enables acquirers to assess the impact on EPS, a critical indicator for investors, and determine the financial justification for pursuing the deal. By conducting a thorough analysis, acquirers can make informed decisions, mitigating the risks and maximizing the potential benefits of the transaction.

Assesses Shareholder Value

Accretion/dilution analysis is crucial for assessing shareholder value because it determines whether a merger or acquisition will increase (accretive) or decrease (dilutive) the acquirer’s earnings per share (EPS).

This has a direct impact on shareholder value, as accretive transactions are generally viewed favorably by investors and can lead to a higher stock price. The analysis provides a clear, quantifiable measure for management and investors to assess the financial benefits or drawbacks of the transaction, aiding in informed decision-making.

Financial Strategy and Planning

In the realm of financial strategy and planning, accretion/dilution analysis assists in evaluating the best use of a company’s resources by comparing potential transactions and their impacts on EPS.

This enables companies to prioritize deals that are likely to enhance earnings and shareholder value. Additionally, it helps identify and quantify synergies, cost savings, and potential risks, providing a comprehensive view of the financial implications of the transaction. This comprehensive understanding is essential for effective resource allocation and strategic planning.

Communication with Stakeholders

Effective communication with stakeholders is another significant aspect of accretion/dilution analysis. It provides a straightforward metric to communicate the potential financial impact of the transaction to investors, analysts, and other stakeholders, fostering transparency and building trust in management’s strategic decisions.

Furthermore, the analysis helps manage investor expectations by clearly outlining the anticipated effects on EPS, whether positive (accretive) or negative (dilutive), and explaining the strategic rationale behind the transaction. This transparency and clarity are vital for maintaining investor confidence and support.

Using a Template for Accretion Dilution Analysis

Using this investment analysis template for accretion/dilution analysis provides a structured approach to evaluating the financial implications of a merger or acquisition.

When using this template, you’ll mitigate some of the common challenges associated with accretion/dilution analysis:

Complex Data Integration

Combining and analyzing extensive financial data from both the acquiring and target companies can be overwhelming, leading to potential inaccuracies.

The template provides a structured approach to collecting and analyzing financial data, ensuring that all relevant information is considered for a more accurate EPS assessment.

Risk Assessment and Management

Identifying and managing risks associated with a transaction can be challenging, and misjudging them may lead to unexpected financial impacts.

This investment analysis template includes steps for calculating risk factors and adjusting the analysis based on market forecasts, helping to spot and address risks early.

Communication and Approval Processes

Communicating complex financial analyses and securing stakeholder approval can be difficult if the information isn’t clear.

When using the template, you gain detailed preliminary and final reports and presentations. This ensures clear communication and facilitates an efficient approval process.

Dynamic Market Conditions

Rapid changes in market conditions can impact the outcome of the transaction, making it hard to keep the analysis current.

This template includes steps to adjust the analysis based on evolving market forecasts and trends, keeping the evaluation relevant and accurate.

Consistency in Evaluation

Maintaining consistency and accuracy when evaluating multiple transactions can be difficult without a structured approach.

By following a standardized process, the template ensures consistent evaluation across transactions, aiding in reliable comparisons and decision-making.