Get started quickly, see results immediately, no code needed.

What is Comparable Company Analysis? A Simple Intro to CCA

Comparable company analysis (CCA) is a fundamental technique used in the field of finance to assess the value of a company by comparing it to other similar companies in the market. This analysis involves scrutinizing various financial metrics and ratios to gain insights into the company’s performance and potential.

Being familiar with comparable company analysis can provide you with valuable insights into the competitive landscape of a specific industry and help you make well-informed investment choices. In this article, we will delve deeper into what comparable company analysis entails, why it is important, and how it can be effectively utilized in investment decision-making processes.

We’re covering:

- Defining Comparable Company Analysis

- Why Should You Do a Comparable Company Analysis?

- What Are the Steps Involved in Performing Comparable Company Analysis?

- What Are the Disadvantages of Comparable Company Analysis?

- Benefits of Performing Comparable Company Analysis

- Enterprise Value vs. Equity Value Multiples: What Are the Differences?

- Comparable Company Analysis Template

Defining Comparable Company Analysis

Comparable company analysis (CCA), also known as “comps,” is a valuation method used to evaluate a company by comparing it to similar businesses in the same industry. The key idea is that similar companies in the same industry will have similar valuation multiples.

Example of CCA

Suppose we are valuing a software company. We might look at other publicly traded software companies that have similar business models, revenue levels, and growth rates.

- Comparable Companies: Identify 5-10 similar software companies.

- Metrics: Use P/E ratio and EV/EBITDA as valuation metrics.

- Data Collection: Gather recent financial statements and stock prices of the comparable companies.

- Valuation Multiples: Calculate the P/E and EV/EBITDA ratios for each of the comparable companies.

- Application: Determine the average or median P/E and EV/EBITDA multiples from the comparable companies and apply these to the target company’s earnings and EBITDA.

- Adjustments: Make any necessary adjustments for differences such as market position, product diversity, or growth prospects.

Why Should You Do a Comparable Company Analysis?

Companies should perform a comparable company analysis (CCA) for several strategic, financial, and operational reasons. Here are the key motivations for conducting a CCA:

Valuation Accuracy

Comparable company analysis provides a market-based valuation that reflects current market conditions, offering a realistic benchmark for the company’s value. By using actual data from publicly traded peers, companies can achieve a more accurate and realistic valuation.

This method helps determine the company’s worth by comparing it with similar firms, ensuring that the valuation aligns with what investors are currently willing to pay for comparable businesses. This accuracy is crucial for making informed financial decisions and maintaining investor confidence.

Strategic Decision-Making

CCA is invaluable in strategic decision-making, particularly in the context of mergers and acquisitions. It helps determine a fair value for target companies, supporting better negotiation and decision-making during M&A transactions.

Additionally, it assists in identifying investment opportunities by comparing valuation multiples and identifying companies that are undervalued or overvalued. This strategic insight enables companies to make informed decisions about potential acquisitions, investments, or divestitures, optimizing their growth and expansion strategies.

Performance Benchmarking

By comparing performance metrics with those of similar companies, CCA allows businesses to conduct a thorough competitive analysis. This comparison helps identify areas of strength and areas needing improvement, providing valuable insights into operational efficiency.

Understanding how a company measures up against its peers in terms of profitability, growth, and other key performance indicators can drive strategic adjustments and operational improvements, enhancing overall performance and competitiveness in the market.

Investor Relations

CCA enhances transparency with investors and stakeholders by providing a clear, market-based rationale for the company’s valuation. This transparency builds investor confidence, as it shows that the company’s valuation aligns with market standards and industry norms.

By backing up valuation claims with robust market data, companies can foster trust and credibility with their investors, facilitating smoother communication and stronger relationships with the investment community.

What Are the Steps Involved in Performing Comparable Company Analysis?

Performing a comparable company analysis (CCA) involves a series of systematic steps to ensure a thorough and accurate valuation. Here are the detailed steps:

1. Identify the Target Company

Begin by clearly defining the company you are valuing. Understand its business model, industry, market position, financial health, and growth prospects. This foundational understanding is crucial for selecting appropriate comparable companies and relevant valuation metrics.

2. Select Comparable Companies

Choose a group of companies that are similar to the target company. These companies should operate in the same industry and have similar size, growth rates, and geographic reach. Common sources for identifying comparable companies include industry reports, financial databases, and stock market listings.

3. Gather Financial Data

Collect relevant financial data for both the target company and the comparable companies. This data typically includes:

- Market Capitalization

- Enterprise Value (EV)

- Revenue

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

- Net Income

- Earnings Per Share (EPS)

- Book Value of Equity Sources for this data include company financial statements, annual reports, and financial databases like Bloomberg, Reuters, or Capital IQ.

4. Normalize Financial Data

Adjust the financial data to ensure comparability. This might involve:

- Adjusting for Non-Recurring Items: Removing one-time expenses or revenues.

- Converting to the Same Currency: Ensuring all data is in the same currency to avoid discrepancies.

- Aligning Fiscal Periods: Adjusting for differences in fiscal year-end dates.

5. Calculate Valuation Multiples

Determine the relevant valuation multiples for the comparable companies. Common multiples include:

- Price to Earnings (P/E) Ratio: Market Price per Share / Earnings per Share

- Enterprise Value to EBITDA (EV/EBITDA): Enterprise Value / EBITDA

- Price to Sales (P/S) Ratio: Market Capitalization / Revenue

- Price to Book (P/B) Ratio: Market Capitalization / Book Value of Equity Calculate these multiples for each of the comparable companies.

6. Analyze the Multiples

Analyze the calculated multiples to understand the central tendency and range. Often, the median or mean of the multiples is used as a representative benchmark. It’s also useful to consider the distribution and any outliers that may distort the averages.

7. Apply the Multiples to the Target Company

Use the representative multiples derived from the comparable companies and apply them to the target company’s financial metrics. For example:

- To estimate the target company’s value using the P/E ratio, multiply its earnings per share (EPS) by the median P/E ratio of the comparables.

- To estimate using EV/EBITDA, multiply the target’s EBITDA by the median EV/EBITDA ratio.

8. Adjust for Differences

Consider any qualitative and quantitative differences between the target company and the comparables that might affect valuation. Adjustments might be needed for:

- Growth Rates: If the target company has significantly different growth prospects.

- Risk Profile: Differences in risk due to market conditions, regulatory environment, or operational factors.

- Size and Scale: Adjustments for size-related economies of scale or operational efficiencies.

9. Finalize the Valuation

Summarize the valuations derived from different multiples to arrive at a final valuation range for the target company. This range provides a comprehensive view, accounting for various financial aspects and comparable benchmarks.

10. Document and Present Findings

Document the analysis process, the selected comparables, the financial data used, and the rationale behind any adjustments. Present the findings in a clear and structured manner, including the final valuation range and any insights derived from the analysis. This transparency ensures that stakeholders understand the basis for the valuation and can trust its accuracy.

What Are the Disadvantages of Comparable Company Analysis?

Here are some of the most common disadvantages associated with using comparable company analysis:

Influenced by Non-Fundamental Factors

One of the major drawbacks of CCA is that it can be influenced by non-fundamental factors. The market sentiment and investor sentiment towards a particular industry or sector can greatly impact how the comparable peers are valued. This can lead to inaccuracies in determining a company’s true value as it may be subject to market volatility or irrational pricing.

Difficulty in Finding Relevant Data

Another disadvantage is the difficulty in finding relevant data for comparison. The quality and availability of financial information for comparable peers can vary significantly, making it challenging to find reliable data for analysis. This can lead to inaccuracies and inconsistent results in the valuation process.

Limited Applicability to Companies with Few Comparable Peers

Furthermore, CCA has limited applicability to companies with few comparable peers. In industries or sectors where there are only a few similar companies, it becomes difficult to make meaningful comparisons and draw conclusions about a company’s value relative to its peers.

Limited Availability of Data for Private Companies

Lastly, CCA has limited availability of data for private companies. Private companies often do not disclose their financial information publicly, making it challenging to find comparable data for valuation purposes. This limitation restricts the use of CCA in assessing the value of private companies accurately.

Benefits of Performing Comparable Company Analysis

Insights into Relative Performance

Performing a comparable company analysis provides valuable insights into a company’s relative performance compared to its industry peers. By examining key financial and operational metrics of similar companies, CCA allows for a better understanding of the company’s position within the market.

Aid in Valuation

One of the main benefits of CCA is its ability to aid in the valuation of a company. By comparing financial ratios such as price-to-earnings (P/E) or price-to-sales (P/S) ratios, analysts can determine if a company is overvalued or undervalued relative to its competitors. This information is crucial for investors and decision-makers when considering buying or selling shares.

Benchmark Data for Goal-Setting

CCA offers benchmark data, enabling companies to set realistic goals and targets. By identifying the performance of its peers, a company can assess its strengths and weaknesses and make strategic decisions accordingly. For instance, if a competitor has a better profit margin, the company may focus on improving its operations or cost efficiency to remain competitive.

Support for Strategic Decisions

CCA helps in making strategic decisions, such as entering new markets or formulating pricing strategies. By analyzing how similar companies have performed in those areas, a company can gain valuable insights into potential risks and opportunities.

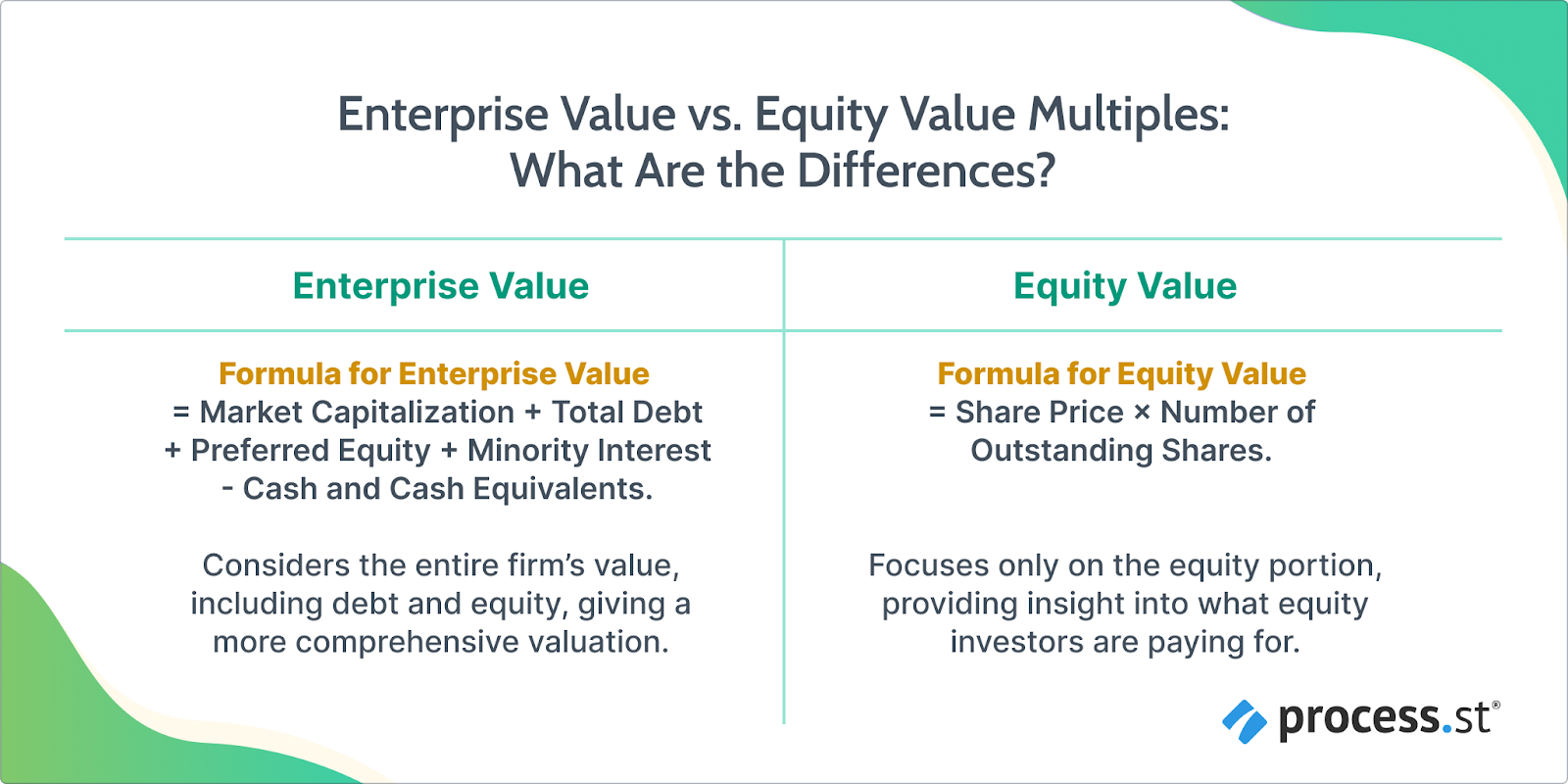

Enterprise Value vs. Equity Value Multiples: What Are the Differences?

Enterprise Value (EV) and Equity Value are two fundamental concepts in financial valuation, each with its own set of multiples. Here’s a detailed explanation of the differences between EV multiples and Equity Value multiples:

Enterprise Value (EV) Multiples

Enterprise value represents the total value of a company, including debt, preferred equity, and excluding cash and cash equivalents. It reflects the value of the entire firm, including both equity and debt holders.

Formula: Enterprise Value = Market Capitalization + Total Debt + Preferred Equity + Minority Interest – Cash and Cash Equivalents.

Common EV multiples include:

- EV/EBITDA: Enterprise Value divided by Earnings Before Interest, Taxes, Depreciation, and Amortization. This multiple measures a company’s overall value relative to its operating income.

- EV/EBIT: Enterprise Value divided by Earnings Before Interest and Taxes. This is similar to EV/EBITDA but includes depreciation and amortization.

- EV/Sales: Enterprise Value divided by Revenue. This multiple shows how much investors are willing to pay per dollar of sales.

Equity Value Multiples

Equity value represents the value of a company available to equity shareholders. It reflects the market capitalization of a company.

Formula: Equity Value = Share Price × Number of Outstanding Shares.

Common equity value multiples include :

- P/E (Price to Earnings) Ratio: Equity Value divided by Net Income. This multiple measures the price investors are willing to pay per dollar of earnings.

- P/B (Price to Book) Ratio: Equity Value divided by Book Value of Equity. This multiple compares the market value with the book value of the company’s equity.

- P/S (Price to Sales) Ratio: Equity Value divided by Revenue. This multiple shows how much investors are willing to pay per dollar of sales.

Key Differences between Evaluation Value (EV) Multiples and Equity Value

Scope:

- EV Multiples: Consider the entire firm’s value, including debt and equity, giving a more comprehensive valuation.

- Equity Value Multiples: Focus only on the equity portion, providing insight into what equity investors are paying for.

Capital Structure:

- EV Multiples: Useful for comparing companies with different capital structures, as they neutralize the effect of leverage.

- Equity Value Multiples: More affected by the company’s capital structure and financing decisions.

Financial Metrics:

- EV Multiples: Often used with metrics like EBITDA and EBIT that are available to all capital providers.

- Equity Value Multiples: Used with metrics like Net Income and Book Value, which are available only to equity holders.

Applicability:

- EV Multiples: Preferred in valuation when comparing companies with different debt levels or capital structures.

- Equity Value Multiples: Useful for analyzing companies with similar capital structures or when focusing on equity returns.

Comparable Company Analysis Template

This comparative market analysis template helps businesses systematically approach a comparable company analysis by organizing data collection, calculation, and interpretation into a structured process. By following this template, businesses can achieve a comprehensive and reliable valuation, facilitating informed decision-making and strategic planning.