Get started quickly, see results immediately, no code needed.

Why Form ADV Is Important for Investment Advisors

Form ADV is an important document that investment advisers must file with the U.S. Securities and Exchange Commission or state regulators as part of their registration process.

This form serves as a comprehensive disclosure tool, providing detailed information about the adviser’s business, including services offered, fees charged, potential conflicts of interest, and the background of key personnel.

For both regulators and clients, Form ADV is essential for transparency, helping to ensure that advisers operate with integrity and that clients are well-informed before making investment decisions.

In this article, we’re going to cover everything you need to know about Form ADV, including:

- What is Form ADV?

- What is Form ADV Used for?

- Who Files Form ADV?

- What is Form ADV Part 1 and Part 2?

- What is Form ADV Part 2A and 2B?

- What is SEC Form ADV Part 3?

- How to Access Form ADV

- How to File Form ADV

What is Form ADV?

Form ADV is a key regulatory document that investment advisers in the United States are required to file with the Securities and Exchange Commission (SEC) and state regulators. This form serves several critical functions, helping protect investors and ensuring transparency in the financial advisory industry.

The form consists of two main parts: Part 1 and Part 2, which we will explain in more detail further down.

SEC-registered investment advisers and advisory firms are required to update Form ADV annually and whenever significant changes occur in their business practices. This ensures that both regulators and clients have access to the most current and relevant information.

By mandating these disclosures, Form ADV plays a vital role in promoting real accountability and trust in the financial services industry, ultimately helping investors make more informed choices about their financial futures.

What is Form ADV Used for?

Form ADV, officially known as the “Uniform Application for Investment Adviser Registration and Report by Exempt Reporting Advisers,” serves several key purposes in the financial services industry, enhancing transparency and protecting investors.

Adviser Information

Primarily, Form ADV is designed to provide detailed information about an investment adviser’s business, including its:

- Services,

- Fees,

- Billing practices,

- Advisory clients,

- Investment strategies, and

- Disciplinary history.

This transparency allows potential clients to make informed decisions when selecting an adviser.

Regulations

Moreover, Form ADV plays a vital role in the regulatory framework, helping discretionary authorities monitor and assess the practices of investment advisers. By requiring advisers to disclose pertinent information for the public record, regulators can better identify and address potential misconduct. This aids in fostering a safer investment environment.

The form is also updated annually, ensuring that the information remains current and reflective of the adviser’s practices and code of ethics.

Due Diligence

In addition to registration, Form ADV acts as a key resource for investors conducting due diligence. Prospective clients can review an adviser’s Form ADV to understand their:

- Qualifications,

- Investment philosophies, and

- Any potential conflicts of interest.

As such, Form ADV not only safeguards the integrity of the investment advisory profession but also empowers investors with the knowledge necessary to navigate the complex world of financial advice.

Who Files Form ADV?

Investment advisers who manage assets for clients and provide advice on securities are typically the ones required to file Form ADV. This includes both large and small advisory firms, whether they operate independently or as part of a larger financial institution. Specifically, the filing is mandatory for any advisory personnel registered with the SEC or the state securities authorities.

State-registered advisers will file their Form ADV primarily with the states in which they operate, while those deemed federally covered advisers—typically those managing over $110 million in assets—file with the SEC.

Additionally, investment advisers who are exempt from registration—due to managing hedge funds or private equity funds, for example—may still choose to file Form ADV to enhance their credibility and transparency with prospective investors.

What is Form ADV Part 1 and Part 2?

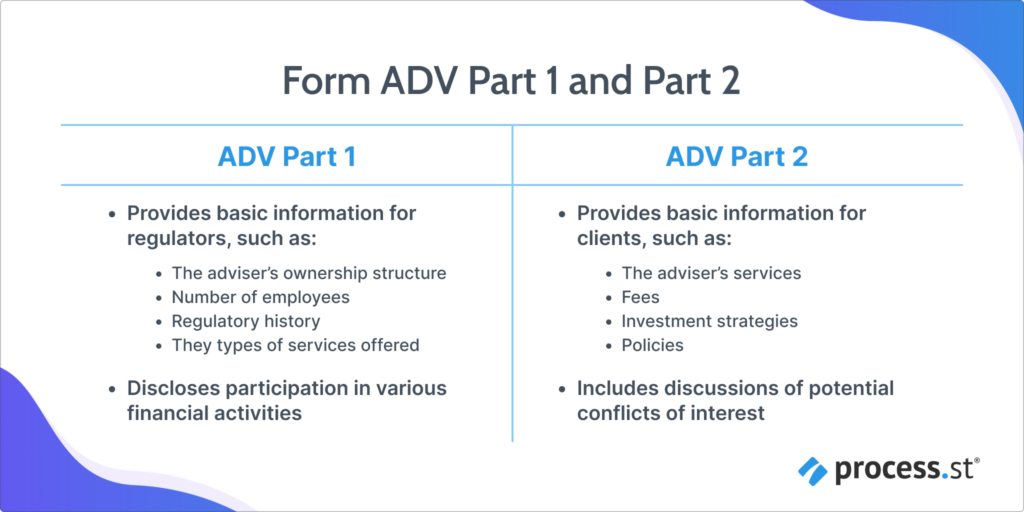

Form ADV is divided into two main parts: Part 1 and Part 2, each serving distinct purposes. Here’s the breakdown:

Form ADV Part 1

Part 1 is primarily a quantitative and structured document that provides regulators with key information about the investment adviser’s business operations. It includes details such as:

- The adviser’s ownership structure,

- Number of employees,

- Regulatory history, and

- The types of services offered.

Additionally, Part 1 requires advisers to disclose participation in various financial activities, custody of client assets, and any disciplinary history that could impact their ability to serve clients effectively. This part is not directly intended for clients; rather, it assists regulators in the oversight and enforcement of industry standards.

Form ADV Part 2

Part 2, on the other hand, is designed specifically for clients and prospective clients. It functions as a narrative brochure that highlights:

- The adviser’s services,

- Fees,

- Investment strategies, and

- Policies.

Advisers are required to present this information in plain language, ensuring it is accessible and easily understandable. Part 2 is essential for fostering transparency and trust, as it aims to provide clients with a clear understanding of what they can expect from the adviser and the associated risks. This part often includes discussions of conflicts of interest, making it easier for clients to make informed decisions regarding their investments.

What is Form ADV Part 2A and 2B?

Now that you know the differences between Part 1, and Part 2, let’s take a closer look at the latter. This form is divided into several parts, with Part 2A and Part 2B being particularly significant, as they are designed to ensure that investors have access to important details regarding the adviser’s business practices, qualifications, and the potential risks involved in their investment strategies.

Form ADV Part 2A: The Brochure

Form ADV Part 2A, commonly referred to as the “brochure,” is a comprehensive disclosure document that outlines the investment adviser’s services, fees, strategies, and business practices. It serves as a critical resource for potential clients, providing insights that can help them make informed decisions. Key elements included in Part 2A are:

- Adviser information: Details about the firm, including its business structure, ownership, and history.

- Fees and compensation: A clear breakdown of the fees the adviser charges, including management fees, performance fees, and any other costs associated with investment services.

- Investment strategies: An overview of the investment strategies employed by the adviser, as well as the risks associated with those strategies.

- Disciplinary history: Disclosure of any criminal or regulatory actions against the adviser or any affiliated individuals, which is crucial for evaluating the integrity of the adviser.

- Client testimonials: A prohibition against misleading statements and a lack of reliance on client testimonials, ensuring that marketing materials are transparent and factual.

Part 2A is typically required to be updated annually or whenever a significant change occurs, ensuring that investors have current information.

Form ADV Part 2B: The Brochure Supplement

Form ADV Part 2B complements Part 2A by providing specific information about the individual advisers who will be providing investment advice. This “brochure supplement” is personalized for each representative and includes important details such as:

- Education and professional background: Information about the adviser’s educational qualifications and professional experience, helping clients assess their expertise.

- Disciplinary information: Disclosure of any disciplinary actions or legal events that may affect the adviser’s ability to provide investment advice.

- Other business activities: An overview of any other business or professions that the adviser is engaged in, ensuring full transparency about potential conflicts of interest.

- Compensation: Information on how the adviser is compensated and any potential incentives that might influence their recommendations.

Together, Form ADV Part 2A and 2B fulfill a vital role in promoting transparency and ensuring that investors are equipped with the knowledge needed to make sound decisions regarding their financial futures.

By providing clear, concise, and comprehensive information about the adviser’s practices and qualifications, these forms uphold the principle of informed consent, allowing clients to understand exactly what to expect when engaging with an investment adviser.

What is SEC Form ADV Part 3?

SEC Form ADV Part 3, commonly referred to as the “Client Relationship Summary” or CRS is an important disclosure document that investment advisers and broker-dealers are required to provide to retail investors under the regulations of the SEC.

Introduced as part of the SEC’s broader initiative to enhance investor protection, Form ADV Part 3 was designed to facilitate a better understanding of the services offered by financial professionals and the associated risks.

The primary purpose of the Client Relationship Summary is to distill complex financial information into a user-friendly format that emphasizes key aspects of the relationship between the investor and the financial provider. This document must be presented clearly and in plain language, making it accessible to individuals who may not have extensive financial knowledge.

Additionally, the document must include information on whether the adviser or broker-dealer is acting as a fiduciary, which means they are legally obligated to act in the best interests of their clients. This is particularly important as it highlights the varying levels of responsibilities that different financial professionals may have.

As part of ongoing compliance, financial firms are required to update their Form ADV Part 3 annually and whenever there are material changes to the information presented. This ensures that clients have access to the most current information regarding their relationship with their financial adviser or broker-dealer.

How to Access Form ADV

Required by the Investment Advisers Act of 1940, this form serves as a comprehensive disclosure report that provides important information about an advisory firm, including its services, fees, management, and any potential conflicts of interest. Here’s how you can easily access Form ADV to make informed investment decisions.

Understanding the Two Parts of Form ADV

Form ADV consists of two main parts: Part 1 and Part 2. Part 1 requires advisers to disclose information about their business, ownership, clients, and any disciplinary actions.

Part 2, often referred to as the “brochure,” provides a narrative that gives a clearer picture of the adviser’s approach to investments, fees, and conflicts of interest. Familiarizing yourself with both parts is essential before you start your search.

Utilizing the SEC’s Investment Adviser Public Disclosure Website

The most straightforward way to access Form ADV is through the SEC Investment Adviser Public Disclosure (IAPD) website. Here are the steps to follow:

- Visit the IAPD website: Go to www.adviserinfo.sec.gov.

- Search for the adviser: Use the search feature by entering the firm’s name, the name of the individual adviser, or their Central Registration Depository (CRD) number if you have it.

- Access form ADV: Once you locate the adviser, you can view their Form ADV filings. Look for the links to Part 1 and Part 2 in the adviser’s profile.

Checking State Regulatory Websites

In addition to the SEC’s IAPD, many states have their own regulatory agencies that require advisers to file Form ADV. If the adviser is state-registered, you may find additional disclosures through your state’s regulatory body. Check the respective state’s securities regulator website for easy access to these documents.

Reviewing Information Periodically

It’s important to remember that Form ADV is a living document and must be updated periodically by advisers. Therefore, investors should check for the most recent version before entering any agreements or making investment decisions. Regularly reviewing this document ensures that you’re aware of any changes in the adviser’s operations or compliance history.

Seeking Guidance

Finally, if you feel overwhelmed by the information or find it challenging to interpret the disclosures, consider seeking guidance from a qualified financial planner or attorney. They can help you understand the intricacies of Form ADV and provide insights into the adviser’s credibility and fit for your investment needs.

How to File Form ADV

Understanding how to file Form ADV correctly (either through physical or electronic filing) is essential for compliance and maintaining credibility in the financial industry.

Step 1: Determine the Right Version of Form ADV

Form ADV consists of two parts: Part 1 and Part 2. Part 1 collects information such as the adviser’s business structure, ownership, and disciplinary history, while Part 2 is a narrative brochure that outlines the adviser’s services, fees, investment strategies, and potential conflicts of interest. Depending on your registration requirements—whether with the SEC or state regulators—you must determine if you need to complete Form ADV Part 1, Part 2, or both.

Step 2: Gather Necessary Information

Before filling out the form, compile all relevant information required for disclosure, including:

- Business information: Name, address, and contact information.

- Ownership structure: Details on owners, executive officers, and other key personnel.

- Advisory services: Types of services offered, advisory activities, and investment strategies employed.

- Fees and compensation: Clear breakdown of fee structures for clients.

- Disciplinary history: Any legal or regulatory issues faced by the adviser or affiliates.

Step 3: Complete the Form

Form ADV can be completed online through the Investment Adviser Registration Depository (IARD). Begin by creating an account if you do not already have one. Follow the prompts to fill out each section methodically. Ensure that all responses are accurate and complete, as errors may lead to delays or rejection of your application.

Step 4: Review and Confirm

Once the form is filled out, review all entries thoroughly. Pay attention to details, ensuring consistency and accuracy in the information provided. It is prudent to have another professional review your Form ADV before submission to catch any potential errors or omissions.

Step 5: Submit and Pay Required Fees

After confirming accuracy, submit Form ADV electronically through the IARD system. Be prepared to pay any applicable filing fees at the time of submission. These fees can vary based on the regulatory authority and the size of your firm, so check the latest fee schedule available on the IARD website.

Step 6: Maintain and Update Your Form ADV

Filing Form ADV is not a one-time task. After initial submission, you are required to update the form whenever there are significant changes in your business, such as a change of address, ownership structure, or disciplinary matters. Regularly review your Form ADV to ensure it remains current and accurately reflects your practice, as failure to do so can lead to compliance issues.