Get started quickly, see results immediately, no code needed.

What You Need to Know About Generational Wealth Planning

As you think about the future, it’s important to understand the key components of generational wealth planning and how you can set up your family for long-term financial success.

Building and preserving wealth across generations is a complex undertaking that requires careful consideration and strategic planning.

Whether you are just starting to build your wealth or looking to pass on assets to the next generation, knowing the ins and outs of generational wealth planning is vital.

Let’s delve into what you need to know to create a lasting financial legacy for your loved ones.

We’ll cover:

- What is Generational Wealth?

- Why is it Challenging to Build Generational Wealth?

- Strategies for Building and Protecting Generational Wealth

- The Generational Wealth Estate Planning Process

- Using a Template for Efficient Estate Planning

What is Generational Wealth?

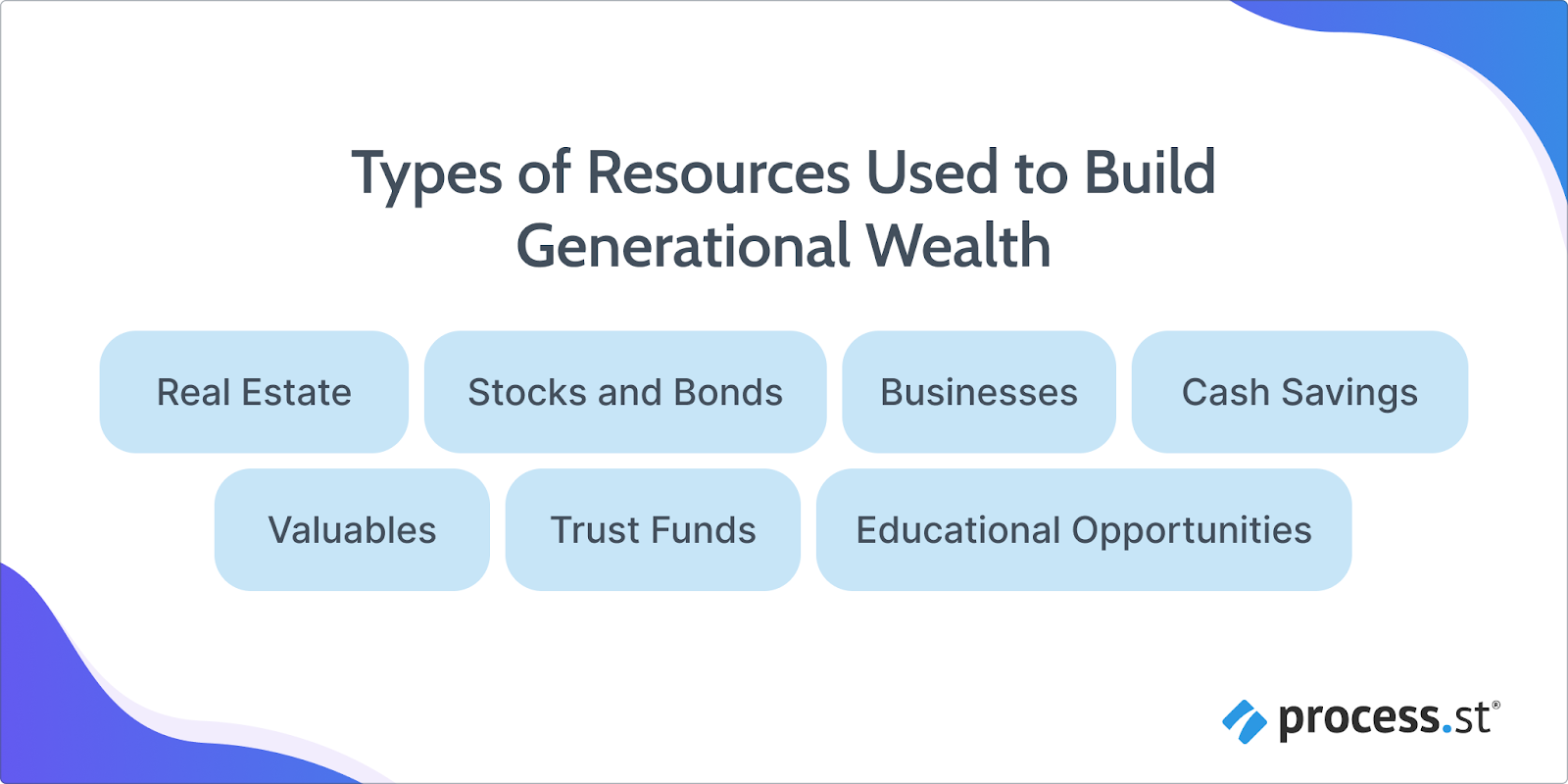

Generational wealth refers to the assets and resources transferred from one generation to the next. It encompasses a range of assets and financial advantages, including:

- Real Estate: Property ownership and investments in real estate.

- Stocks and Bonds: Investments in the stock market and other financial securities.

- Businesses: Ownership of family businesses or stakes in companies.

- Cash Savings: Savings accounts and liquid cash.

- Valuables: Precious metals, art, jewelry, and other valuable possessions.

- Trust Funds: Financial instruments specifically designed to manage and transfer wealth.

- Educational Opportunities: Funding for education, which can increase earning potential and economic mobility for future generations.

Generational wealth allows subsequent generations to have a financial head start, enabling them to pursue higher education, invest in businesses, and have a safety net during economic downturns. This can contribute to greater economic stability and social mobility within families, and it often plays a significant role in the broader economic disparities observed across different demographic groups.

Why is it Challenging to Build Generational Wealth?

Building generational wealth is fraught with systemic barriers that exacerbate the racial wealth gap. In 2019, data revealed stark median wealth differences among racial groups, with white families possessing significantly more assets than black and Hispanic families.

By the fourth quarter of 2023, these disparities persisted, underscoring the challenges faced by marginalized communities.

Homeownership disparities play a critical role in this ongoing issue. Historically, racial minorities have faced barriers to homeownership—from discriminatory lending practices to lack of access to affordable housing—limiting their ability to accumulate equity.

Moreover, access to financial services remains uneven, with many marginalized families lacking the resources and banking relationships necessary to secure loans or investment opportunities.

Both wealthy and marginalized families encounter difficulties in preserving wealth across generations. Wealthy families may face the burden of maintaining assets amidst economic fluctuations, while marginalized families often grapple with economic challenges that hinder their ability to save and invest for future generations.

Together, these factors highlight the complexities of generational wealth building, perpetuating the racial wealth gap and limiting opportunities for financial stability across communities.

Strategies for Building and Protecting Generational Wealth

Building and protecting generational wealth involves a comprehensive approach that starts with establishing a solid financial foundation through early saving and investing.

Early Saving and Investing

Starting to save and invest as early as possible is critical for taking advantage of compound interest. Compound interest allows earnings to generate their own earnings over time, exponentially growing wealth. This can be illustrated by the Rule of 72, a simple formula to estimate the time it takes for an investment to double.

By dividing 72 by the annual rate of return, one can estimate the doubling period. For example, with an 8% return, an investment can double in just nine years (72 ÷ 8 = 9). Early investments in retirement accounts, stocks, and other financial instruments can lead to significant wealth accumulation over a lifetime.

Instilling Good Financial Habits in Children

Educating the next generation about financial responsibility is essential for maintaining and growing wealth. Teaching children the value of saving, budgeting, and investing prepares them to manage their finances effectively.

Encourage them to set financial goals, save a portion of their allowance or earnings, and understand the basics of investing. Providing real-life examples and involving them in family financial planning can instill lifelong habits that promote financial stability and growth.

Diversification

Diversification is a key strategy to mitigate risk and enhance returns over time. By spreading investments across various asset classes such as stocks, bonds, real estate, and commodities, families can protect their wealth from market volatility.

Each asset class reacts differently to economic conditions, so a diversified portfolio can reduce the impact of adverse market movements on overall wealth. This strategy not only safeguards assets but also opens opportunities for higher returns through exposure to different sectors and markets.

Professional Advice and Long-Term Planning

Seeking professional financial advice is crucial for developing a sustainable long-term investment strategy that aligns with family goals. Financial advisors can provide tailored guidance based on individual risk tolerance, financial objectives, and market conditions.

They can help create a diversified investment portfolio, optimize tax strategies, and plan for major life events such as retirement or education expenses. Regular consultations with financial professionals ensure that the family’s financial plan adapts to changes in the market and personal circumstances, maintaining the course towards generational wealth.

Comprehensive Estate Planning

Effective estate planning is essential for ensuring that wealth is transferred according to your wishes and minimizing tax liabilities. Creating a will is the first step in outlining how assets should be distributed after death.

Trusts can be established to manage and transfer wealth, avoid probate, and provide tax advantages. Life insurance policies can offer financial security for surviving family members, covering expenses and maintaining their standard of living.

The Generational Wealth Estate Planning Process

The generational wealth estate planning process involves a series of strategic steps designed to ensure that wealth is transferred smoothly and efficiently to future generations while minimizing tax liabilities and protecting assets. Here’s a comprehensive overview of the process:

1. Assessing and Inventorying Assets

The first step in the estate planning process is to assess and inventory all assets. This includes:

- Real Estate: Homes, rental properties, land, and other real estate holdings.

- Financial Investments: Stocks, bonds, mutual funds, retirement accounts, and other investment vehicles.

- Business Interests: Ownership stakes in family businesses or other enterprises.

- Valuables: Art, jewelry, collectibles, and other significant personal property.

- Cash and Bank Accounts: Savings accounts, checking accounts, and other liquid assets.

- Insurance Policies: Life insurance policies and annuities.

2. Establishing Goals and Objectives

Clearly defining your goals and objectives is crucial for effective estate planning. Consider the following:

- Legacy Wishes: How you want your assets to be distributed among your heirs.

- Charitable Contributions: Any donations you wish to make to charitable organizations or causes.

- Educational Funds: Setting aside funds for the education of children or grandchildren.

- Business Succession: Planning for the continuation or sale of family businesses.

3. Creating Legal Documents

Proper legal documentation is essential to ensure your wishes are followed. Key documents include:

- Will: A legal document that outlines how you want your assets distributed after your death.

- Trusts: Legal entities that hold assets on behalf of beneficiaries. Trusts can help avoid probate, provide tax benefits, and protect assets from creditors. Common types include:

- Revocable Living Trusts: Can be altered during your lifetime and help manage and distribute assets after death.

- Irrevocable Trusts: Cannot be changed once established and offer greater tax benefits and asset protection.

- Generation-Skipping Trusts: Designed to pass wealth directly to grandchildren, bypassing the children to minimize estate taxes.

- Durable Power of Attorney: Appoints someone to manage your financial affairs if you become incapacitated.

- Healthcare Proxy and Living Will: Documents that outline your medical treatment preferences and appoint someone to make healthcare decisions on your behalf if you are unable to do so.

4. Tax Planning

Effective tax planning can significantly impact the amount of wealth transferred to the next generation. Consider strategies such as:

- Annual Gift Exclusion: Leveraging the annual gift tax exclusion to transfer wealth tax-free. As of 2023, individuals can gift up to $17,000 per recipient per year without incurring gift taxes.

- Lifetime Gift Tax Exemption: Using the lifetime gift tax exemption, which allows for the transfer of a larger amount of wealth tax-free over your lifetime.

- Estate Tax Exemptions and Strategies: Utilizing estate tax exemptions and strategies, such as setting up trusts, to minimize estate taxes.

- Generation-Skipping Transfer Tax (GSTT): Planning for GSTT if assets are being transferred to grandchildren or later generations.

5. Regular Review and Updating

Estate planning is not a one-time event. Regular reviews and updates are necessary to ensure that the plan remains aligned with your goals and current laws. Major life events that may necessitate a review include:

- Births and Deaths: Changes in family dynamics, such as the birth of a child or the death of a beneficiary.

- Marriages and Divorces: Changes in marital status can significantly impact your estate plan.

- Changes in Financial Situation: Significant changes in wealth or financial circumstances.

- Legislative Changes: Updates to tax laws and estate planning regulations.

6. Communication with Family Members

Open communication with family members about your estate plan can help avoid misunderstandings and conflicts. Discuss your wishes and the reasons behind your decisions with your heirs to ensure they understand and respect your intentions.

7. Choosing and Working with Professionals

Work with a team of qualified professionals to ensure your estate plan is comprehensive and legally sound. This team may include:

- Estate Planning Attorneys: Specialize in creating and maintaining estate plans.

- Financial Advisors: Provide guidance on investment strategies and financial planning.

- Tax Advisors: Offer expertise on tax implications and strategies.

- Trustees and Executors: Individuals or institutions responsible for managing and distributing your assets according to your wishes.

By following these steps, you can create a robust estate plan that protects your wealth, ensures it is distributed according to your wishes, and minimizes the tax burden on your heirs. This process not only secures your financial legacy but also provides peace of mind knowing that your family’s future is safeguarded.

Using a Template for Efficient Estate Planning

This 7 Steps Estate Planning Process Template provides a clear, structured approach to estate planning. By following this template, you can ensure that every aspect of your estate plan is thoroughly considered and executed. The template helps to:

- Organize and inventory assets: Keep track of all your assets in a systematic manner.

- Define and document goals: Clearly outline your objectives and how you wish to achieve them.

- Draft and review legal documents: Ensure that all necessary legal paperwork is accurately prepared and approved.

- Implement and update the plan: Put your plan into action and keep it current with regular reviews.

- Facilitate communication: Ensure that your family understands your plan and their roles in it.

By integrating this template into your estate planning process, you can effectively build and protect generational wealth, ensuring a secure financial legacy for your descendants.