Get started quickly, see results immediately, no code needed.

What Are the 5 Venture Capital Stages? The Ultimate Guide

Venture capital is a crucial source of funding for startups, allowing them to grow and scale their businesses. However, navigating the world of venture capital can be complex and overwhelming for many entrepreneurs. That’s why understanding the different venture capital stages is crucial to organizational success.

Each stage of venture capital funding comes with its own set of requirements and expectations, making it essential for entrepreneurs to have a comprehensive understanding of the process.

In this guide, we will break down the five venture capital stages, from seed funding to exit, providing you with valuable insights and tips to help you secure the funding you need to take your startup to the next level.

Whether you are a first-time entrepreneur or a seasoned startup founder, this guide will serve as a valuable resource to help you navigate the world of venture capital funding.

- What is Venture Capital?

- How Does Venture Capital Funding Work?

- Before Getting Venture Capital: The Pre-Seed Stage

- What Are the 5 Venture Capital Stages?

- What Happens After the Mezzanine Stage?

- Getting from Seed to IPO with Effective Process Management

What is Venture Capital?

Venture capital is a form of private equity investing that typically involves providing funding to early-stage businesses in exchange for an equity stake. This means that venture capitalists invest in a company in its early stages when it has not yet reached the stage of generating significant revenue or profits.

The role of venture capital is to support the growth and development of these early-stage businesses by providing them with the necessary capital to fuel their expansion plans. Unlike other forms of financing such as bank loans, venture capital funding offers more than just financial support.

Venture capitalists often bring their expertise, experience, and industry knowledge to the table, helping the company:

- Navigate challenges

- Make strategic decisions

- Achieve success

They also provide valuable networking opportunities, connecting the company with potential partners, customers, and other sources of funding.

How Does Venture Capital Funding Work?

Startups or early-stage businesses that have high growth potential often don’t have access to more conventional forms of capital. This is generally because:

- Early-stage startups often lack tangible assets to secure a loan, making them high-risk for traditional lenders.

- With short operational histories and limited financial records, startups find it hard to prove their creditworthiness to banks.

- Startups often have inconsistent cash flows, which do not meet traditional lenders’ criteria for steady income.

- New or unproven business models can deter conventional lenders due to a lack of familiarity.

- If startups secure loans, they often face higher interest rates and stringent terms, which can be prohibitive.

This is where venture capital comes into play. Venture capitalists provide a vital source of funding for entrepreneurs and early-stage companies with high growth potential. Beyond contributing financial resources, venture capitalists also offer strategic guidance, mentorship, and industry connections.

These partnerships formed between venture capitalists and businesses or individuals are built on a mutual understanding of risk and reward. Venture capitalists take calculated risks by investing in companies that they believe have the growth potential to generate significant returns on their investment.

Before Getting Venture Capital: The Pre-Seed Stage

Before accessing venture capital funding, startups or early-stage businesses typically go through the pre-seed stage. Also known as the bootstrapping stage, this phase is crucial for getting operations off the ground and assessing the viability of the business idea. During the pre-seed stage, entrepreneurs rely on personal resources and contacts rather than external funding in exchange for equity.

The activities and goals in the pre-seed stage include:

- Developing a product or service prototype to test the business concept.

- Formulating a winning business model that outlines how the startup will generate revenue and achieve profitability.

- Addressing partnership agreements, copyrights, and other legal considerations early to avoid future obstacles that could deter potential investors.

- Assessing the market feasibility and customer interest in the product or service through initial feedback and testing.

The most common source of funding is from the startup founder who will invest personal funds and time into getting operations up and running. Family and friends of the founder might also provide initial financial support and encouragement.

Startups at the pre-seed stage are at the highest risk of failure because they are still in the process of refining their business model and proving market viability. The sole focus is on experimentation and learning.

While pre-seed funding is not commonly available at this stage, successful management in the pre-seed phase sets the stage for attracting external investment in subsequent funding rounds like seed and Series A.

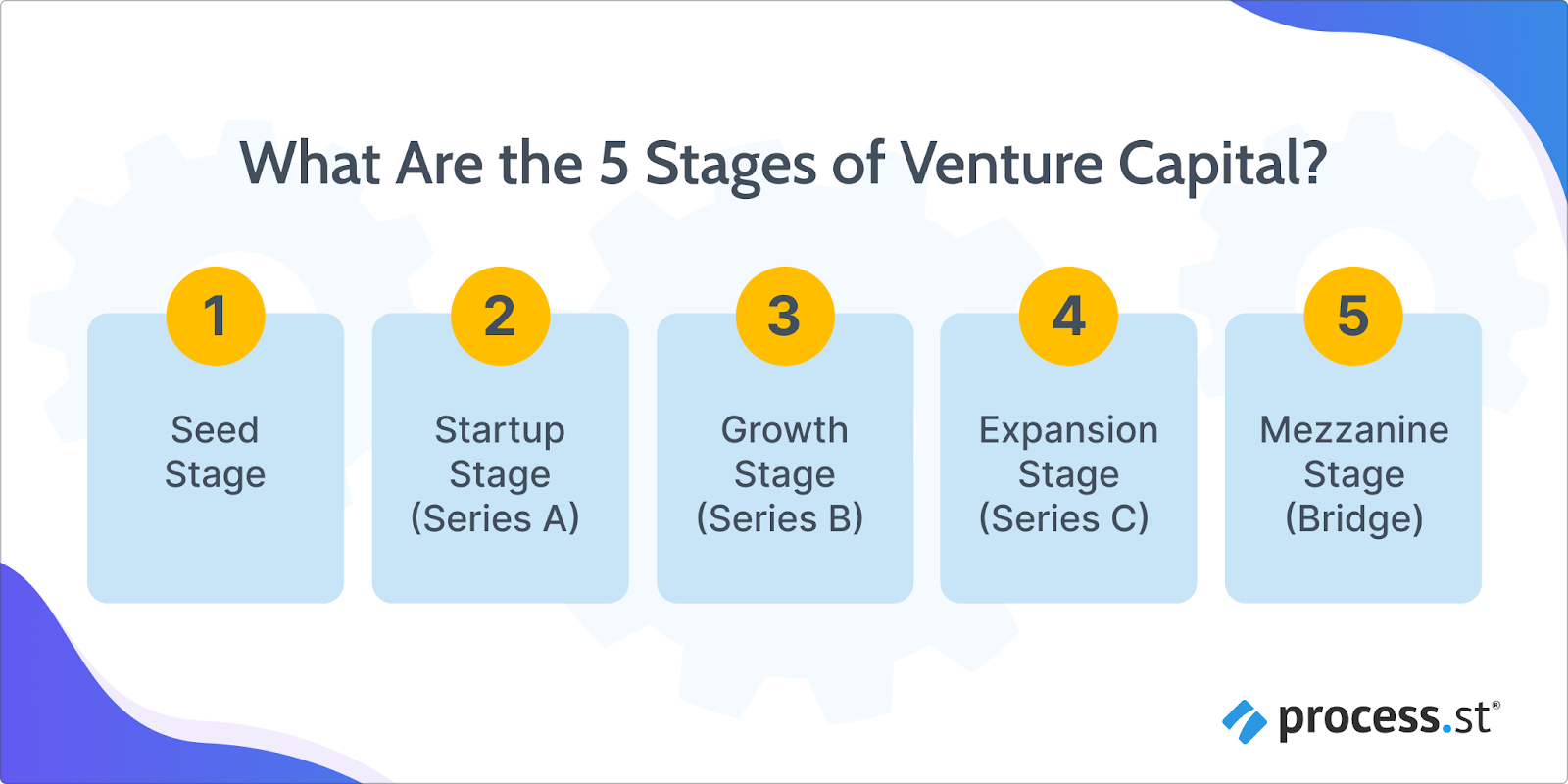

What Are the 5 Venture Capital Stages?

There are 5 distinct stages in the venture capital process, each characterized by specific objectives and challenges. Understanding these stages and the processes involved in each stage is essential for entrepreneurs and investors alike, as it enables them to maximize opportunities for success.

1. Seed Stage

The seed stage marks the transition from idea validation to early-stage growth. Startups at this stage have typically proven some level of market fit and are looking to scale their operations and attract investment.

The activities and goals in the seed stage include:

- Expanding the team, refining the product or service, and investing in initial marketing and sales efforts to capture early adopters and generate traction.

- Focus shifts towards acquiring paying customers and demonstrating early revenue streams.

- Further validating the business model and proving scalability potential based on initial market response and customer feedback.

Startups at the seed stage have reduced risk compared to the pre-seed stage because they have validated their initial assumptions to some extent. However, these startups still face uncertainties related to scaling operations and achieving sustainable growth due to the unproven nature of the business.

Venture capital investments in the seed stage often come from angel investors, seed funds, or early-stage venture capital firms. Valuations can range from a few hundred thousand dollars to a few million dollars, with typical funding amounts between $500,000 to $2 million. These investors are willing to take on higher risk in exchange for equity in the company. Investors often also provide mentorship and industry connections to support the startup’s growth.

Common processes include:

- Market Research: Understanding market needs, customer segments, and competitive landscape.

- Business Plan Development: Creating a detailed business plan outlining the company’s strategy, goals, and financial projections.

- Building a Founding Team: Recruiting key team members with the necessary skills and expertise.

- Product Development: Developing a minimum viable product (MVP) to validate the concept.

- Pitch Preparation: Creating a compelling pitch deck for potential investors.

Templates might include :

- Business Strategy Plan Template: This business plan template includes sections for market analysis, business models, financial projections, and funding requirements.

- Market Research Template: This market research strategy template helps organize data on market size, target audience, and competitors.

- Product Development Process Template: The product development process template outlines product features, development timelines, and milestones.

- Seed Stage Venture Capital Pitch Deck Evaluation Template: This seed stage venture capital pitch deck evaluation template details tasks for company research, feasibility study, financial analysis, growth potential, risk assessment, and investment decision-making.

2. Startup Stage (Series A)

The Series A stage builds upon the seed stage where the startup has validated its business model and achieved some level of market traction. It marks a significant milestone where the focus shifts from initial validation to scaling operations and accelerating growth. Founders will be looking at developing their products and entering the market more aggressively to capture a larger share of the market.

The activities and goals in the Series A stage include:

- Investing in infrastructure, technology, and human resources to support rapid growth and meet increasing demand.

- Expanding into new geographic markets or customer segments to drive revenue growth and diversify the customer base.

- Continuing to iterate on the service or product development based on customer feedback and market dynamics to maintain competitiveness.

Series A startups have reduced risk but face challenges related to scaling operations effectively and achieving sustainable growth. These startups typically attract venture capital firms specializing in early-stage investments, with funding amounts significantly larger than those in the seed stage.

Investors look for strong management teams and scalable business models, and startups need to demonstrate traction and a clear path to profitability. That’s why achieving key milestones such as customer acquisition and revenue targets is essential during this phase.

Common processes include:

- Product Refinement: Improving the product based on initial customer feedback.

- Customer Acquisition: Developing and implementing strategies to attract and retain customers.

- Scaling Operations: Expanding the team and operational capabilities to support growth.

- Additional Research: Conducting further market and customer research to support scaling efforts.

- Fundraising: Preparing for and conducting Series A fundraising rounds.

Templates might include:

- Customer Acquisition Strategy Template: This customer acquisition strategy template details strategies for reaching and engaging potential customers.

- Financial Model Template: This financial model template projects revenue, expenses, cash flow, and funding needs.

- Startup Balance Sheet Template: This startup balance sheet template provides a systematic method for creating, reviewing, and finalizing a startup’s financial statement.

3. Growth Stage (Series B)

The Series B stage builds upon the foundation laid in Series A, focusing on scaling the business to dominate its market segment. Startups at this stage have established a strong market presence and are poised for accelerated expansion.

The activities and goals in the Series B stage include:

- Expanding into new geographic markets or customer segments to drive revenue growth and diversify the customer base. This may involve international expansion, partnerships, or acquisitions to strengthen market position.

- Continuously improving and diversifying the product or service portfolio to meet evolving customer needs and stay ahead of competitors.

- Startups may start preparing for potential liquidity events such as IPOs or strategic acquisitions as they solidify their market position and attract interest from larger investors.

Series B funding typically comes from venture capital firms specializing in growth-stage investments, along with institutional investors and sometimes corporate venture arms. Venture capital financing amounts are often in the tens of millions of dollars, with an emphasis on achieving rapid growth and operational efficiency.

Investors at this stage look for companies with proven business models and strong growth trajectories. Companies often need to demonstrate profitability or a clear path to profitability and may engage in strategic partnerships and acquisitions to fuel growth.

Series B funding enables startups to execute strategic initiatives aimed at strengthening market leadership and sustainable growth.

Common processes include:

- Market Expansion: Entering new markets or geographic areas.

- Product Scaling: Increasing production capacity and enhancing product features.

- Sales and Marketing Enhancement: Boosting sales efforts and marketing campaigns to drive growth.

- Performance Monitoring: Tracking key performance metrics to measure success and make data-driven decisions.

- Team Expansion: Hiring additional staff to support growth in various departments.

Templates:

- Growth Stage Venture Capital Expansion Capital Allocation Template: This growth stage venture capital expansion capital allocation template is designed for optimizing business enlargement plans and ensuring profitable outcomes.

- Sales Plan Template: This sales plan template details sales targets, strategies, and team structure.

- Growth Stage Venture Capital International Expansion Strategy Template: This growth stage venture capital international expansion strategy template details the strategy for entering new markets, including market research and logistics.

4. Expansion Stage (Series C)

The Series C stage aims at further expanding the business to achieve market domination, diversify product lines, and potentially prepare for an IPO or strategic acquisition. Startups at this stage are well-established with proven success and stable revenue streams.

The activities and goals in the Series C stage include:

- Entering international markets and scaling operations globally.

- Acquiring other companies to expand capabilities, enter new markets, or eliminate competition.

- Launching new product lines or services to cater to a broader audience and increase revenue streams.

Investors perceive lower risk compared to earlier stages due to the startup’s established position and consistent revenue streams. Funding typically comes from late-stage venture capitalists, private equity firms, hedge funds, investment banks, and sometimes large corporate investors.

Capital infusions are often large, ranging from tens to hundreds of millions of dollars, focusing on strategic growth initiatives and maximizing shareholder value.

Companies should have a history of significant growth and profitability. Investors seek high returns and may start planning for exit strategies, with an emphasis on achieving dominant market positions and a strong brand presence.

Common processes include:

- New Product Development: Creating and launching additional products or services.

- Geographic Expansion: Further expanding into new regions or countries.

- Strategic Partnerships: Forming alliances with other companies to enhance market reach and capabilities.

- Mergers and Acquisitions: Acquiring other businesses to accelerate growth and expand market presence.

- Infrastructure Scaling: Enhancing infrastructure to support large-scale operations.

Templates might include:

- Process of New Product Development Template: This process of new product development template outlines the process for researching, developing, and launching new products.

- Resource Planning Template: This resource planning template provides a comprehensive tool for optimizing resource allocation, budgeting, and contingency planning.

- Corporate Venture Capital Market Analysis Template: This corporate venture capital market analysis template provides tasks for strategic investment insights, risk assessment, and deal execution.

5. Mezzanine Stage (Bridge)

The mezzanine stage focuses on preparing the company for a liquidity event such as an initial public offering (IPO) or acquisition. This stage often involves finalizing the business model and operations to attract public or large private investment.

The activities and goals in the Mezzanine stage include:

- Strengthening the balance sheet, repaying debts, and ensuring the company is financially robust.

- Finalizing any remaining operational or product enhancements to maximize appeal to potential acquirers or public investors.

- Increasing marketing and PR efforts to build brand recognition and attract potential investors for the upcoming liquidity event.

Companies at this stage are highly mature with stable revenues, profitability, and a strong market position. Unlike the expansion stage, which focuses on growth, the mezzanine stage is about refining the business for an optimal exit.

Companies should have a proven track record of growth and profitability, with investors looking for strong financial health and market leadership. This stage is critical for maximizing returns on earlier investments and ensuring a smooth transition to public markets or acquisition.

Common processes include:

- IPO Preparation: Preparing for an initial public offering, including regulatory compliance and financial audits.

- Exit Strategy Planning: Developing strategies for a potential exit, such as an acquisition or IPO.

- Debt Financing: Securing bridge financing to support operations until the liquidity event.

- Performance Optimization: Fine-tuning operations and financial performance to maximize valuation.

- Investor Relations: Maintaining transparent and proactive communication with existing and potential investors.

Templates might include:

- Late-Stage Venture Capital Pre-IPO Preparation Template: This late-stage venture capital pre-IPO preparation template ensures all necessary steps are taken to prepare for going public.

- Corporate Venture Capital Exit Strategy Planning Template: This corporate venture capital exit strategy planning template outlines the strategy and timeline for achieving a successful exit.

- Late-Stage Venture Capital Investor Relations Management Template: This late-stage venture capital investor relations management template details communication strategies and schedules for engaging with investors.

What Happens After the Mezzanine Stage?

After the mezzanine (bridge) stage, a company typically transitions to a liquidity event. This stage is characterized by a significant financial milestone that provides a return on investment for the company’s stakeholders. The primary pathways for liquidity events are:

Initial Public Offering (IPO)

During an IPO, the company offers its shares to the public on a stock exchange for the first time. This process involves rigorous regulatory scrutiny, preparation of detailed financial disclosures, and compliance with securities laws.

Some of the common activities during this phase include:

- Financial Audits: Extensive financial audits to ensure transparency and compliance with regulatory requirements.

- Prospectus Preparation: Creating a detailed prospectus that outlines the company’s business model, financial performance, and growth prospects.

- Roadshows: Executing roadshows to attract potential investors and build market interest in the IPO.

The goals of an IPO involve capital raising and public market valuation. The company wants to generate substantial capital from public investors to fund further growth, research, development, and expansion.

This also provides an exit strategy for early investors, founders, and employees by allowing them to sell their shares. Finally, the company can establish a public market valuation.

A successful IPO offers companies:

- Enhanced visibility and credibility

- Increased capital for growth initiatives

- Liquidity for early investors and employees through the sale of shares

Mergers and Acquisitions (M&A)

During an acquisition by another company, the startup is acquired by a larger company, often within the same industry. This generally happens when the larger company is seeking to integrate the startup’s technology, talent, or market share.

Some of the common activities during this phase include:

- Negotiations: Engaging in negotiations to agree on the terms of the acquisition, including valuation and integration plans.

- Due Diligence: Conducting thorough due diligence to ensure all aspects of the business are accurately represented and understood.

- Integration Planning: Developing plans to integrate the acquired company into the parent company’s operations.

The objectives of mergers and acquisitions include growth acceleration and value realization. With this acquisition or merger, the strengths of both companies are leveraged to create synergies and improve market positioning. The M&A also provides a return on investment for shareholders and investors. By using the resources of the acquiring company, growth and market reach is accelerated.

A successful M&A typically results in:

- Immediate liquidity for shareholders

- Enhanced capabilities and market presence for the acquiring company

- Potential retention of key employees and continuation of brand identity under new ownership

Private Equity Buyout

During a private equity buyout, a private equity firm acquires the company. This is typically with the intent to improve operations, increase profitability, and eventually sell the company at a higher valuation.

Some of the common activities during this phase include:

- Operational Improvements: Implementing strategies to optimize operations, reduce costs, and increase profitability.

- Financial Restructuring: Refinancing existing debt and improving the company’s financial structure.

- Growth Strategies: Identifying and executing growth strategies to enhance the company’s market position.

The goals of a private equity buyout involve enhancing the company’s value through operational improvements and strategic initiatives. Another objective is to provide a future exit. This plans for a future exit, either through a secondary sale, another M&A, or an IPO.

A successful private equity buyout typically results in:

- Potential for significant value creation and enhanced profitability.

- Liquidity event for current shareholders.

- Increased focus on long-term strategic growth.

Getting from Seed to IPO with Effective Process Management

Navigating the journey from seed funding to an initial public offering (IPO) requires strategic planning, disciplined execution, and effective process management.

Effective process management through each of these stages is crucial for transforming a promising startup into a successful public company.

By leveraging structured processes, startups can overcome the challenges of growth and acquire the necessary venture capital funding to scale and achieve their ultimate goal of going public or securing a lucrative exit.