For a long time, the world of investing was limited to those with access to significant amounts of capital.

For a long time, the world of investing was limited to those with access to significant amounts of capital.

If you wanted to invest, you needed large sums of money. If you wanted investment, you needed someone with large sums of money.

The internet is changing this.

$30 million has been put into one micro investing app, $35 million in another, and a whopping $66 million in a further one. Investors see real promise in these micro investing opportunities, and it’s easy to see why.

These apps aim to open up investing to everyone, no matter your budget.

In the first of our Process Street Future Finance series, where we look at modern tech-driven investment options and how the millennial market is shaping the scene, we’re giving the ultimate introduction to micro investing.

We’ll tell you:

- What it is.

- Why it’s hyped.

- Where it’s going.

- How you can get started.

Hold on to your 401(k)s, we’re going in!

What is micro investing? (Or, what is this, investing for ants?)

Micro investing is typically stock market based. You can buy single stocks from select companies or leave your money in the hands of investors where you control factors like risk and industry. With some, you can buy your way into IPOs; getting stocks before they are public. Gains are risky like all stock market gambling and prepackaged deals might not yield huge gains, yet micro investing has quietly grown. Fundamentally, micro investing is like regular investing but smaller.

With reputable sites like Forbes telling people they can start investing with just $5, it’s no wonder we see more and more opinion pieces on how micro investing has captured the millennial imagination – with the Financial Times leading the pack.

Micro investing is certainly enabled by technology, but it’s also motivated by other factors. Since the financial crash of 2008, economies have been gradually getting back on track but often living standards, levels of disposable income, and the asset wealth of the majority has not been rising as quickly as factors like GDP.

If people have less money, they may save less money or spend less money depending on how hard it has hit them. Research by The Money Charity has shown that 9.61m households in Britain have no savings at all. This isn’t good for those households and it also isn’t good for large investors and asset managers, who now want to incentivise people to get back into the habit of saving and investing. What they’re faced with is the challenge outlined by Mintel’s research that a third of Britons have either a “low” or “extremely low” interest in financial management. This isn’t helped by BlackRock’s research which showed that the reason 80% of the UK population don’t save is because they lack the disposable income to do so.

What they’re faced with is the challenge outlined by Mintel’s research that a third of Britons have either a “low” or “extremely low” interest in financial management. This isn’t helped by BlackRock’s research which showed that the reason 80% of the UK population don’t save is because they lack the disposable income to do so.

This is where micro investing comes in.

- Micro investing allows you to invest what you can afford at any time

- Micro investing can live in your phone so it’s integrated into your daily workflow

- Micro investing has the potential to be gamified to engage people in financial management

Micro investing will not make you magically rich overnight

So instead of moaning about why millennials aren’t buying luxury goods, or moaning about millennials buying nice things and not saving, micro investing is providing an opportunity to bring young people – and all people – back into the game. In the Avocado fiasco, millionaire Tim Gurner was asked if he thought many young people might not end up owning a home, and he commented:

In the Avocado fiasco, millionaire Tim Gurner was asked if he thought many young people might not end up owning a home, and he commented:

Absolutely, when you’re spending $40 a day on smashed avocados and coffees and not working. Of course.

Now, that seems like a fairly specific criticism to throw at all young people, and it’s unlikely many young people are doing this, but let’s humor him. The New York Times decided to see what would happen if we looked seriously at it. According to the Food Institute, millennials in the US spend an average of $3,097 a year on eating out – slightly more than their Baby Boomer counterparts by $305 for the year. If they took the same habits as Baby Boomers and saved the extra, it would take 113 years to save up enough for an average US mortgage.

Still, $3k a year isn’t just small change. If the average millennial decided to start micro investing, they could put some of that spend toward their micro portfolio. Twenty percent of that eating out spend is $600 a year, never mind any extra cash lying around. This cuts our 113 in half without including gains or spare change or anything else.

With a bit of luck, it could help in future. However, as sage as this financial advice is, the gains aren’t enough to quit work and live on a $40 a day avocado habit.

So what can micro investing do for me?

Brandon Krieg, co-founder and CEO of Stash, presents two positives to micro investing and explains why. Like BlackRock and the broader industry, Krieg recognized that investing was just not on the millennial radar. People weren’t interested in the stock market, and if they were they didn’t think it was possible for them to enter the game.

Krieg claims to have identified the problem when he found himself continually hearing the same answers from people when discussing the topic of investing:

I know I need to start investing but I have no idea how to start. I want to do it, but it’s so confusing. I need to be rich to start.

As this continual flow of anxiousness built up, Krieg was able to see that there was a clear market opportunity for meeting those needs.

If we break the quote down we see two distinct problems, not just one.

- People don’t know enough about investing to want to try

- People don’t think they have enough money to begin investing

This presents the rationale behind Stash, and how their company began to operate and move forward.

Krieg uses the part-sales-part-financial-advice mantra that you only need $5 to start investing. This is based partly on $5 being a very affordable amount, and partly on starting people off small. The same way companies are willing to spend large amounts of money on getting customers to make that first purchase. Once you’re in the email list, once you’ve bought from the site, once you’re using the services, you’re hooked.

This psychology of starting someone off small and gradually building it up is seen to be one of the key mechanisms which will drive micro investing in the future. Eventually, these millennials won’t be struggling as much anymore, and they’ll have larger paychecks. By that point, you’ve already coaxed them into the routines and patterns of utilizing your investment services. Designing a sleek app which can reinforce this mechanism and sit every day in the user’s pocket helps make this process fluid and effective. Further to this, there is the attempt to build that trust amongst a new market through education around financial markets and terminology. Stash want to inject a kind of positivity into their audience by making them more comfortable with the idea of investing.

Further to this, there is the attempt to build that trust amongst a new market through education around financial markets and terminology. Stash want to inject a kind of positivity into their audience by making them more comfortable with the idea of investing.

This builds trust and also raises the stakes as the user feels more confident about investing higher amounts, and recognizes the long term benefits of investing in their future.

So using Stash, according to Krieg, helps you both understand and improve your financial situation.

Krieg recommends starting off by introducing yourself into the platform slowly. Put in a small amount of money and read through the guides and the advice to feel comfortable with how it all operates. The more you know, the more in control you are.

From there, you can start to set up automatic deposits. You can look at your bank balance and work out how much you can chip in each month. Again, you can start small. A $20 a month recurring payment will gradually start adding up. Or, if you see that you have an extra $100 a month you can include, then go for it. How micro the investment is depends on how micro you want it to be; you can drop a few grand in there each month if you want.

The important thing to recognize is that saving is a long term approach. Even if you’re only putting $20 a month in with the occasional one-off extra at the moment, you might start depositing more in future. Maybe that monthly amount will go up each year? Within these different apps, you can manage your own money and choose the risk portfolio which is right for you.

Within these different apps, you can manage your own money and choose the risk portfolio which is right for you.

Moreover, with the extra engagement with your finances and the additional educational materials, you may find that you could budget better in your daily life. Sure, maybe you’re not spending $40 a day on avocados, but there are probably many of you reading this know who know their finances are a little erratic.

Did you need to order in that pizza, or could you have made something yourself? I’m not judging. You do you. But consider it, yeah?

Is micro investing going to catch on?

You don’t want to start throwing your money into schemes which could collapse. I get that.

So don’t worry, these platforms have been around for a few years now, and new ones like Acorn are backed by bigger fish like Paypal. This is legit.

But is it going to take off? Are we all going to be living in a future where we sit on our phones playing Angry Birds XII: Who Can Short The Pound? – Soros Edition in our underwear?

Maybe. Maybe not.

According to Tisa research, 90% of people state that they would be comfortable using technology to manage their finances. Most people I know already have a banking app on their phone, sometimes Paypal or TransferWise too. There is a host of different ways people are already using technology to manage their finances. Why wouldn’t people want to invest from their phones too?

Thanks to research done by Deloitte, we know that 90% of millennials check their phones within the first 15 minutes of waking up. The role of our phones in our lives has rocketed and being a part of that flow is the holy grail for companies. But there are obstacles. The Financial Times report on Tony Stenning, the head of retirement for BlackRock, who made a speech in November 2016 about recommended regulatory changes to allow an increase in micro investing. His focus was on “nudge theory”. This idea mirrors the app Acorn, who take a little bit of spare change every time you make a transaction. If your coffee is $1.90 it will round it up to $2 and add the 10 cents to your investment.

The Financial Times report on Tony Stenning, the head of retirement for BlackRock, who made a speech in November 2016 about recommended regulatory changes to allow an increase in micro investing. His focus was on “nudge theory”. This idea mirrors the app Acorn, who take a little bit of spare change every time you make a transaction. If your coffee is $1.90 it will round it up to $2 and add the 10 cents to your investment.

Stenning recommended that we establish a digital passport for finance. This would serve as a way to make sure regulatory bodies were still able to operate effectively while removing the barriers to entry for micro investors.

It would hold information about investors across banking, insurance and fund products and it would have all of the information that a fund manager might need to put an investor’s money in a fund — meaning anyone could invest at the tap of a screen. No paperwork needed.

With regulatory changes which benefit both the financial institutions and the consumers, there seems to be very little opposition to moving forward in the direction of an expanding micro investing industry.

If we’re going to invest, what do we use to do so?

Top 5 micro investment apps to download now

Betterment

Betterment is one of the more established players on the market. They’re currently managing over $5 billion in funds and have over 100,000 users signed up.

Betterment is one of the more established players on the market. They’re currently managing over $5 billion in funds and have over 100,000 users signed up.

Like many of the others, Betterment looks to provide financial advice alongside the ability to invest as you see fit. They charge an annual 0.35% on account balances below $10,000, so you don’t have to worry about charges eating into your savings.

You can set up the auto-investing options to take bits of money here and there from your account to keep your savings healthy and balanced, or you can work with them to start more traditional 401 (k) or IRA accounts.

With no minimum investment, Betterment has helped push forward the idea of micro-investing.

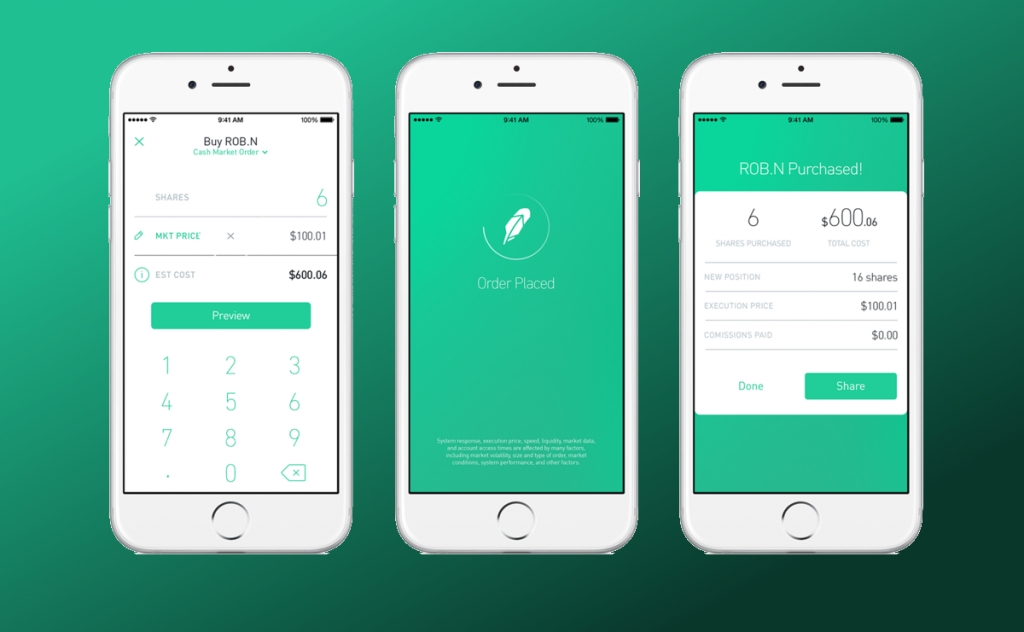

Robin Hood

Robin Hood is a bit of a bare bones concept. Instead of selling itself on having a cool funky concept, Robin Hood looks to try to put you on Wall Street without the costs.

Robin Hood is a bit of a bare bones concept. Instead of selling itself on having a cool funky concept, Robin Hood looks to try to put you on Wall Street without the costs.

There are no initial costs and no fees. Which sounds too good to be true, but they make their money on the overall interest of the money in their accounts and by providing loans and other means.

Robin Hood is very close to being a traditional brokerage, just a digital one that stops you incurring the overheads. Electronic trading firms can trade on Wall Street without having to pay any fees, so essentially Robin Hood are just passing that ability on to you.

This isn’t just micro investing, this is trading. If you want to be a bit riskier and take control of your bets, this might be the option for you.

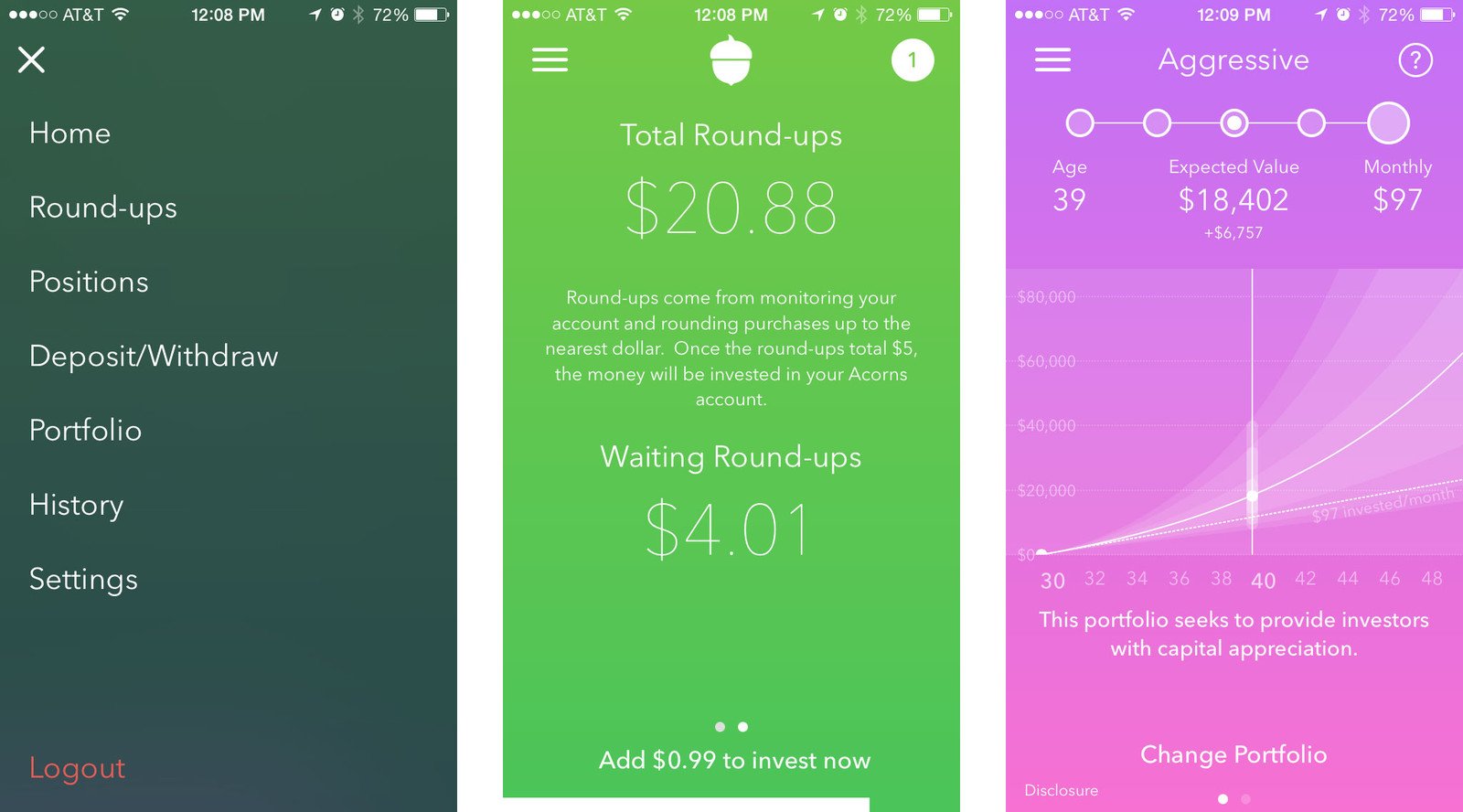

Acorns

The core concept of Acorns is to invest your change. That’s how they sell themselves and how they enact the nudging methodology mentioned earlier. We all know that little bit of change we’re carrying around in our pocket isn’t a big deal. Would I miss that 42 cents? Probably not.

The core concept of Acorns is to invest your change. That’s how they sell themselves and how they enact the nudging methodology mentioned earlier. We all know that little bit of change we’re carrying around in our pocket isn’t a big deal. Would I miss that 42 cents? Probably not.

Acorns takes your spare change and deposits it into a fund being managed by their team. You can choose certain parameters like risk to make sure your money is being handled the way you want it to be.

Backed up with $30 million in investment from Paypal, Acorns is one of the hottest players on the scene and its nifty concept is a great way to onboard new users.

It doesn’t just take your change, though. You can set up auto-investing too with monthly contributions and other options available. A very sleek app with a bright future.

MoneyBox

MoneyBox is a kind of British equivalent to Acorns. It works by the same concept of rounding up to the nearest pound and investing the leftovers.

MoneyBox is a kind of British equivalent to Acorns. It works by the same concept of rounding up to the nearest pound and investing the leftovers.

If you’ve clicked through any of the above Financial Times links, you will undoubtedly have seen MoneyBox mentioned. The darling of UK FinTech, it seems.

MoneyBox has three main funds at the moment which you can choose to invest into. What you’re basically doing with the money is putting it into a stocks-and-shares ISA which is spread over 6,000 different companies. They count Netflix, Unilever, and Disney amongst their investments.

They center their marketing materials around your cash performing better in the FTSE 100 than in your regular account. Which is all well and good, but let’s hope Brexit doesn’t mess that up, yeah? (Dear Brexiteers: I’m only joking…ish)

Right now you can choose one of three risk factors, but being a new product you should expect more options to be added. Check it out for some British charm.

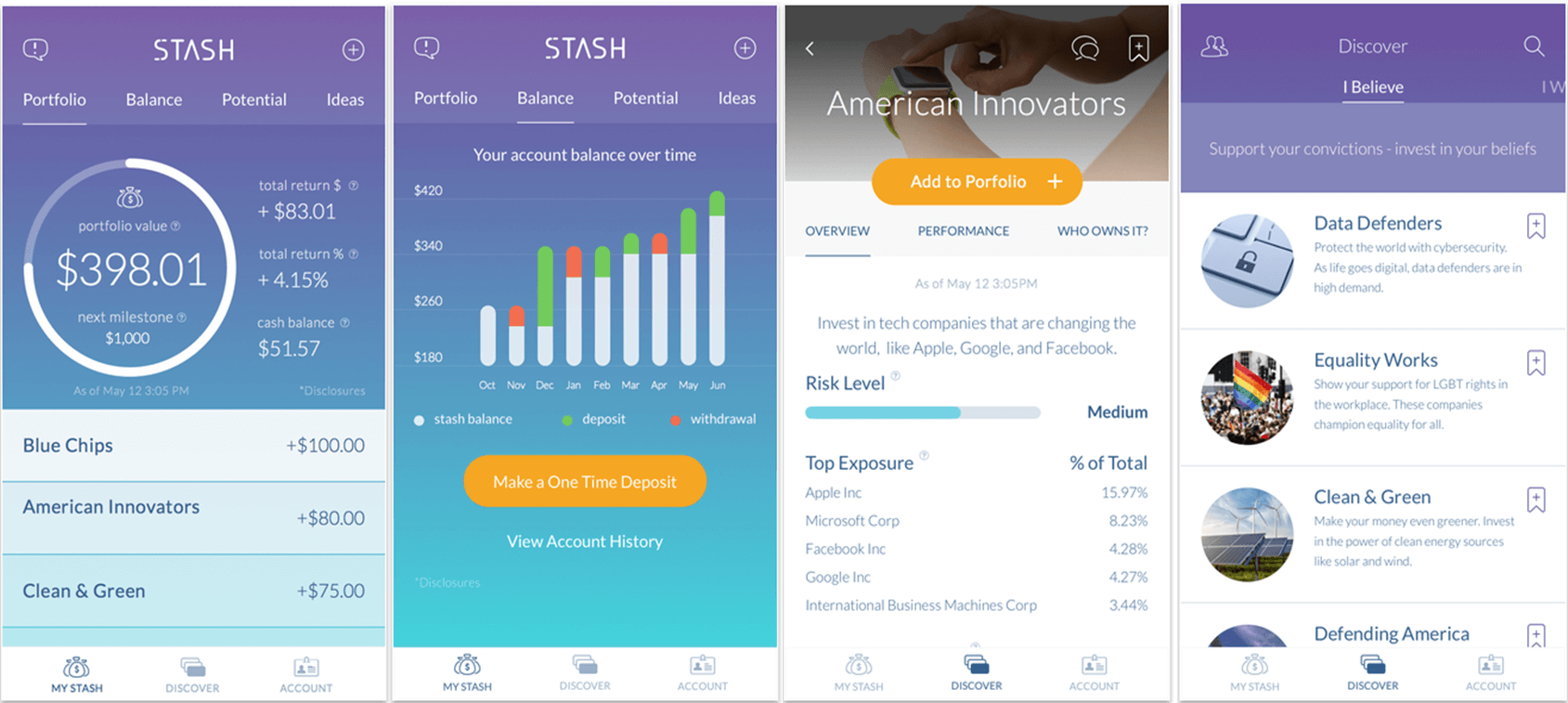

Stash

Stash has a very sleek app and a good amount of control over how your money is invested.

Stash has a very sleek app and a good amount of control over how your money is invested.

It feels like everything you expect from a micro investing app, but without the clever twist of Acorns.

For me, the selling point of Stash is that other people are expertly managing your money while you have significant control over what kinds of things are being invested in – and I don’t just mean risk.

Stash has come up with a smart means to target millennials. They offer a series of investment packages called EFTs:

- The Activist: This fund invests in clean and renewable energy to make you feel good about where your money is going.

- The Techie: American innovation is the buzzword for this fund. Holdings in it include Apple, Facebook, and Microsoft.

- The Globetrotter: We’re looking at a fund focused on companies which provide or facilitate entertainment. Think airlines and Hollywood studios.

- The Trendsetter: Social media focused, this fund looks to jump on board emerging social companies. It still includes Facebook but also Alphabet and Twitter.

There’s a clear effort to engage the millennial audience within these. But there are plenty more to choose from, Defending America is an EFT focused on defense companies, while Rolling With Buffett invests in Berkshire Hathaway – if Warren Buffett gets rich, so do you.

You have to start saving some day

Saving isn’t always the sexiest game in town, but these apps are really trying to make it that way.

Think about it this way. If you’re only saving money which you can afford not to have, if you get to control what kind of risk it will be exposed to, and if you can choose to see it invested in an industry which you’re passionate about… what’s not to like?

There will come a day when you’ll thank yourself for taking your finances seriously.

It could be soon; when you want to make a big purchase like a house (or a new house). Or, maybe you won’t touch your nest egg until retirement. Maybe it’s just sat there for a rainy day which hopefully will never come.

The point is it’s there. And it’s so easy to get started. What are you waiting for?

Have you used micro investing platforms? What do you think of them? Let us know in the comments below and we might follow up with you to find out more!

Workflows

Workflows Projects

Projects Data Sets

Data Sets Forms

Forms Pages

Pages Automations

Automations Analytics

Analytics Apps

Apps Integrations

Integrations

Property management

Property management

Human resources

Human resources

Customer management

Customer management

Information technology

Information technology

Adam Henshall

I manage the content for Process Street and dabble in other projects inc language exchange app Idyoma on the side. Living in Sevilla in the south of Spain, my current hobby is learning Spanish! @adam_h_h on Twitter. Subscribe to my email newsletter here on Substack: Trust The Process. Or come join the conversation on Reddit at r/ProcessManagement.