Key features

Workflows

WorkflowsAutomate, track, and leverage data within your

business processes.

Forms

FormsGather valuable focused insights.

Data Sets

Data SetsUnify data across all workflows and teams.

Pages

PagesDocument and share your standard operating

procedures.

Platform

Process AI

Process AITransform your manual processes with AI.

Automations

AutomationsBoost productivity; reduce manual labor.

Analytics

AnalyticsEmpower decisions with key performance data.

Apps

AppsPower your workflows from anywhere.

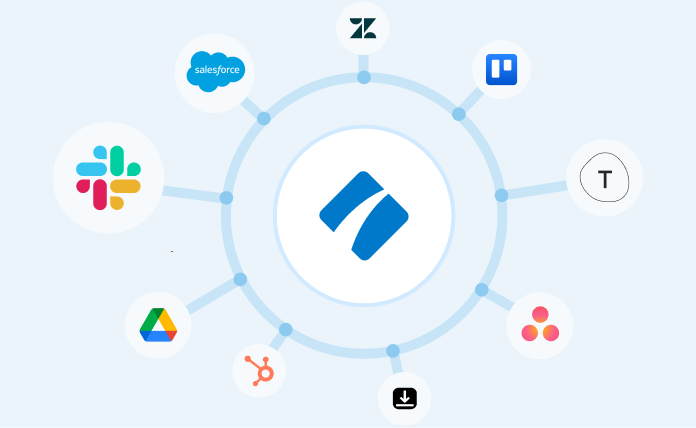

Integrations

IntegrationsConnect your favorite tools for maximum

efficiency.

Connect Process Street with your favorite tools

Learn about our integrations

Teams

Operations

Human resources

Compliance

Human resources

Compliance

Customer management

Customer management

Information technology

Investor relations

Information technology

Investor relations

Top use cases

Employee onboarding

Client onboarding

Property management

Quality assurance

Content marketing

“With Process Street we've been able to bring documentation to life, improve governance and

achieve consistent results”

Linda White

Head of Technology Services, Colliers

More customer testimonials

Product

Solutions

Industries

Teams

Top use cases

Employee

onboarding

Project

management

Compliance

Due diligence

Mergers & acquisitions

Customer management

“With Process Street we've been able to bring documentation to life, improve governance and

achieve consistent results”

More customer testimonials

Resources

Learn

Connect

Property management

Property management