Engage, retain, & satisfy customers with our easy-to-use no-code platform.

Customer Onboarding Software For Banks: Unlock Customer Satisfaction!

Customer onboarding software for banks revolutionizes how financial institutions engage with their clients, streamlining the onboarding process considerably.

As banks strive to meet the evolving needs of their clients, implementing robust customer onboarding software has become a game-changer.

By leveraging customer onboarding, you will enhance your onboarding processes, deliver exceptional customer experiences, and position yourself for success in the competitive banking industry.

Let’s dive deeper into the world of customer onboarding software and discover how it can transform the way banks engage with their clients.

3 Best customer onboarding software

Customer onboarding software plays a crucial role in streamlining the customer onboarding process for banks.

It automates and optimizes various stages of onboarding, ensuring a seamless and efficient experience for both banks and customers.

To help you search for the best software, we’ve tested the ten most popular tools and chose three that we believe are the best.

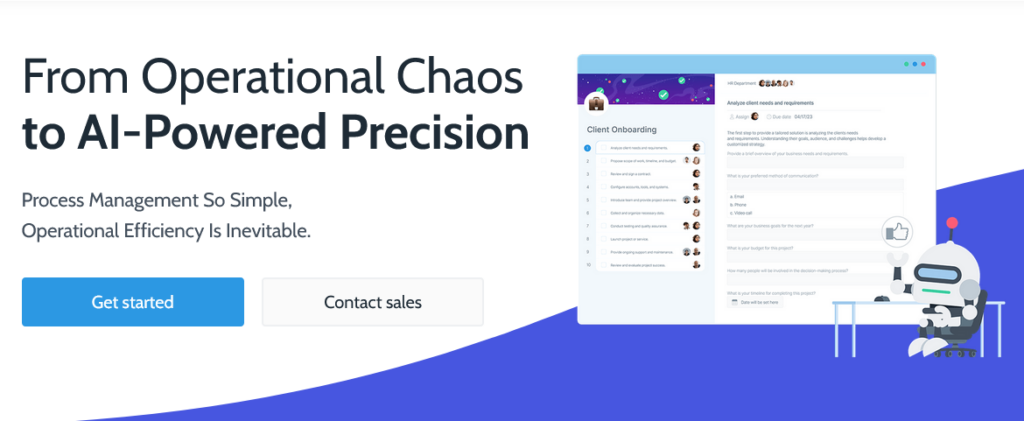

Process Street

Process Street is a leading customer onboarding software that offers a comprehensive solution for managing and optimizing onboarding processes.

Process Street stands out as the best choice due to its comprehensive feature set, ease of use, and powerful automation capabilities.

It offers a user-friendly experience and enables banks to create efficient onboarding processes that can be customized to their specific requirements.

Main features:

- Customizable checklists and templates for consistent onboarding processes

- Task management and automation for assigning and tracking onboarding tasks

- Collaboration tools for team coordination and communication

- Integration capabilities with other software systems

- Analytics and reporting to track onboarding performance and identify areas for improvement

Pros:

- Intuitive interface and easy-to-use functionality

- Robust checklist and task management capabilities

- Powerful automation features for enhanced efficiency

- Integration options with popular software platforms

- Advanced analytics and reporting for data-driven insights

Cons:

- Can be pricey for small teams

WalkMe

WalkMe is a customer onboarding software that offers a range of interactive guidance and self-service tools.

It provides on-screen walkthroughs, tooltips, and contextual help to guide customers through the onboarding process seamlessly.

Main Features:

- WalkMe offers interactive on-screen guidance, providing step-by-step instructions to users during the onboarding process

- The software includes a self-service knowledge base where customers can access relevant information and find answers to common questions

- WalkMe provides analytics and insights into customer behavior, allowing banks to identify bottlenecks, optimize the onboarding journey, and enhance user experience

Pros:

- Interactive user experience

- Self-service support

- Data-driven optimization

Cons:

- Implementing WalkMe may require some initial effort and technical expertise to integrate it seamlessly with existing systems

- Administrators might need some time to master the features and functionalities of the software to create effective onboarding experiences.

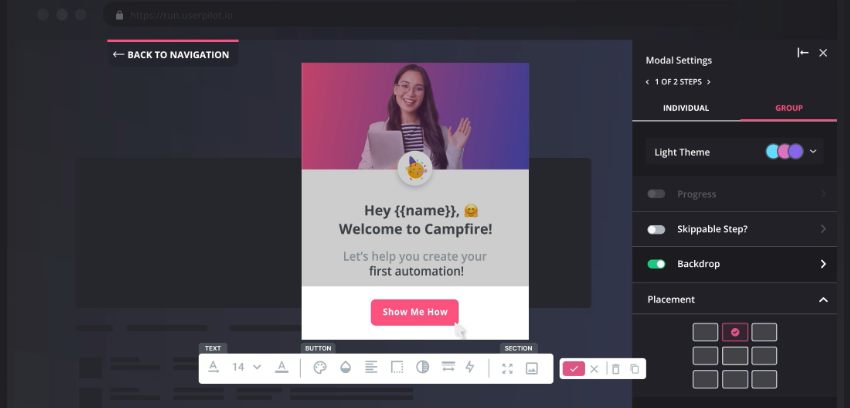

Userpilot

Userpilot is a user onboarding software designed to create personalized onboarding experiences for customers.

It allows banks to deliver targeted in-app messaging, tooltips, and feature tutorials during onboarding.

Main Features:

- Personalized onboarding experiences

- In-app messaging and tooltips

- A/B testing and analytics

Pros:

- Personalization capabilities

- Real-time insights

- Easy integration

Cons:

- Complexity for elaborate workflows

- Limited advanced functionality

Streamlining customer onboarding with onboarding software

Customer onboarding software for banks revolutionizes traditional onboarding processes by leveraging advanced technology.

It automates and integrates various stages of onboarding, such as:

- Account opening

- Compliance checks

- Document verification

- Client communication

This software acts as a centralized platform, enabling banks to manage the entire onboarding journey seamlessly.

Enhancing risk management with customer onboarding software

In the banking sector, risk management is of utmost importance.

Financial institutions need robust risk management tools and techniques to safeguard their operations and protect their customers’ assets.

Customer onboarding software for banks goes beyond just facilitating onboarding; it also incorporates comprehensive risk management capabilities.

With features such as:

- Financial risk management tools and techniques

- Enterprise risk management software

- Investment risk management software

Relevant software equips banks with the necessary tools to identify, assess, and mitigate risks associated with customer onboarding.

It enables banks to implement effective risk management strategies and comply with regulatory requirements.

Managing portfolio risks effectively

Portfolio risk management is another crucial aspect for banks, especially when dealing with diverse investment portfolios.

Customer onboarding software empowers banks with portfolio risk management software, enabling them to analyze and monitor risks associated with different investments.

By integrating risk management software for banks into their onboarding processes, financial institutions can proactively identify potential risks and take appropriate measures to mitigate them.

Centralized risk management system

A robust customer onboarding software for banks acts as a centralized risk management system.

Banks can maintain a comprehensive risk register, capturing all potential risks throughout the onboarding journey.

By utilizing risk register software, banks can monitor risks in real-time, track mitigation actions, and maintain an audit trail for regulatory compliance.

Key elements of an effective customer onboarding process

The customer onboarding process is crucial in establishing a successful relationship between banks and their clients.

It involves welcoming and guiding new customers through the initial stages of their banking journey, ensuring a smooth transition, and building a strong foundation for future interactions.

Customer onboarding software for banks and dedicated customer onboarding tools play a pivotal role in optimizing this process.

Let’s delve deeper into the key components of an effective customer onboarding process.

1. Seamless onboarding experience

A seamless onboarding experience sets the tone for the entire customer relationship.

By leveraging customer onboarding software for banks, institutions can design a streamlined process that eliminates complexities and reduces manual effort.

From the initial account opening to conducting necessary checks and verifications, this software automates and accelerates the onboarding journey, ensuring a positive experience for both customers and bank personnel.

2. Client onboarding portal

A client onboarding portal serves as a centralized hub where customers can access relevant information and complete necessary tasks during the onboarding process.

Banks can provide step-by-step guidance, interactive tutorials, and personalized assistance to new customers through this portal.

Integrating customer onboarding software with a client onboarding portal enhances user experience, ensuring that customers feel supported and engaged from the start.

3. Leveraging user onboarding tools

User onboarding tools such as Intercom and Userpilot offer valuable features that optimize the onboarding process.

These tools allow banks to proactively engage with customers, provide real-time support, and gather feedback to enhance their onboarding experience.

Institutions can foster trust, understanding, and satisfaction among new customers by leveraging these tools in conjunction with customer onboarding software for banks.

An effective customer onboarding process is vital for banks to drive customer retention, increase cross-selling opportunities, and establish a positive brand image.

Benefits of digital customer onboarding in banking

Let’s explore the significance and benefits of digital customer onboarding in the banking industry.

Streamlined onboarding process

Digital customer onboarding simplifies traditional manual processes by digitizing and automating various stages of onboarding.

Through digital onboarding, banks can eliminate paperwork, reduce manual errors, and expedite the process of opening accounts and verifying customer information.

The integration of customer onboarding software enables banks to streamline the onboarding journey, ensuring a frictionless customer experience.

Enhanced customer experience

Digital customer onboarding offers customers a seamless and user-friendly experience, allowing them to complete the onboarding process at their convenience, anytime and anywhere.

It eliminates the need for physical visits to the bank, allowing customers to submit required documents electronically and interact with the bank through secure online channels.

This digital-first approach enhances customer satisfaction, as it provides a more efficient and personalized onboarding experience.

Customer onbarding software for banks: Free template!

Having an effective client onboarding process is essential for banks to ensure a smooth and efficient transition for new clients.

To facilitate this process, customer onboarding software for banks, along with a comprehensive client onboarding checklist, can be invaluable.

Let’s take a closer look at our client onboarding checklist and how it can benefit you in your onboarding efforts.

This client onboarding checklist is an effective tool that guides banks through each step of the onboarding process.

It encompasses all the necessary tasks and considerations to ensure a thorough and organized onboarding experience for clients.

The checklist covers a wide range of areas, including:

- Gathering client information

- Conducting due diligence

- Establishing accounts

- Addressing compliance requirements

- Risk assessment

- Document verification

- Client communication

By following this checklist, you will create a consistent onboarding process, reducing the risk of oversight or missed steps.

This client onboarding checklist offers several benefits for banks:

- Serves as a step-by-step guide

- Ensures thorough evaluation of risks associated with new clients

- Includes tasks addressing regulatory compliance

- Helps streamline the onboarding process, making it more efficient

By leveraging customer onboarding software in conjunction with our client onboarding checklist, you will establish a robust onboarding process attractive to potential customers.

Embrace the power of customer onboarding software for banks!

By automating various stages of onboarding, customer onboarding software for banks streamlines accounts opening, document verification, compliance checks, and risk assessment.

Powerful tools like Process Street, with its comprehensive client onboarding checklist, further streamline and standardize the onboarding process. By following a structured checklist, you will ensure consistency, mitigate risks, and adhere to compliance requirements.

Customer onboarding software for banks empowers institutions’ onboarding processes, drive operational efficiency, and delivers exceptional customer experiences.

By leveraging the capabilities of these software solutions, banks can position themselves for success in a competitive industry and foster long-lasting relationships with their clients.