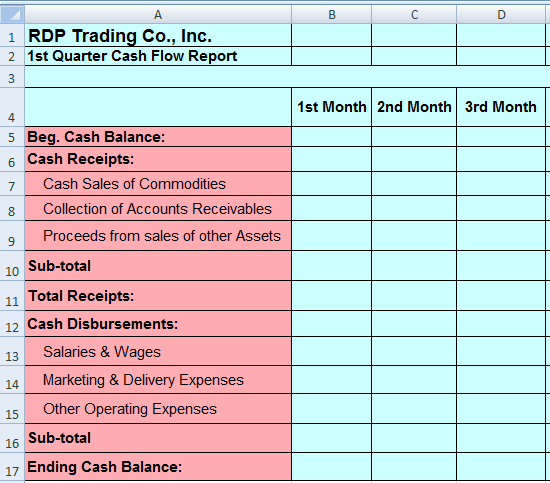

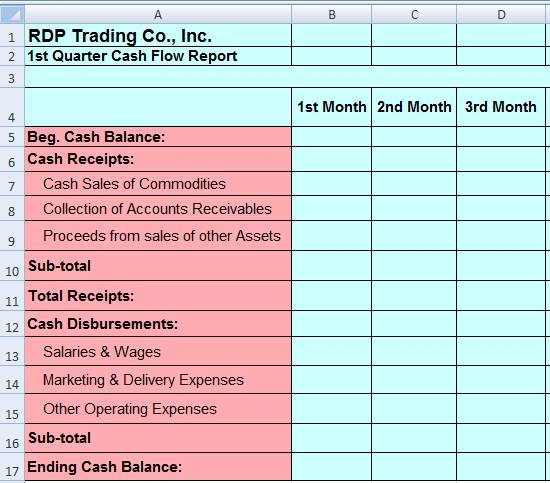

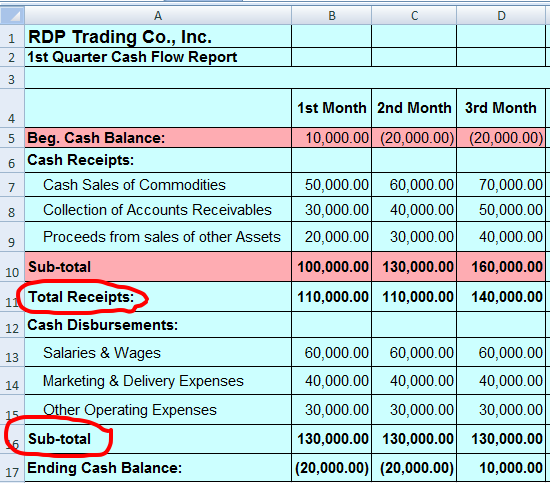

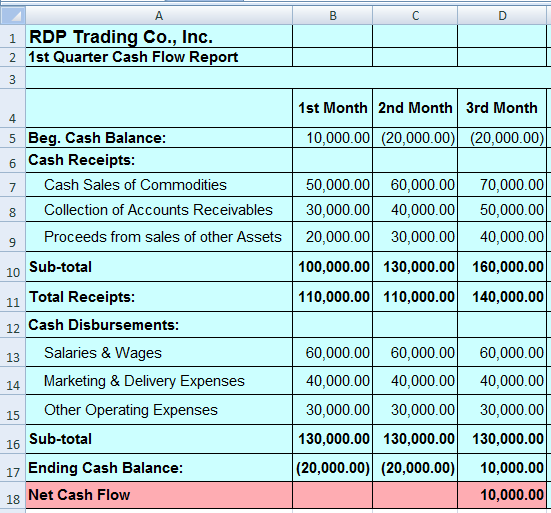

Generating a cash flow report every month enables you to compare data over time and plan your future cash flow.

While a monthly cash flow plan is useful for both business and personal accounting. If you are a business the report generated from this monthly cash flow plan, along with the income statement and balance sheet, contributes to your business's financial statement or annual report.

The primary concern of the monthly cash flow plan is to present an overview of the financial activity experienced throughout the month.

In this checklist, you'll be guided through the structure and method of creating a monthly cash flow plan.

Before you get stuck in, here is a little bit about us:

Process Street is super-powered checklists. It’s the easiest way to manage your recurring tasks, procedures, and workflows.

Create a checklist template and run individual checklists for each member of your team. You can check tasks off as you work through them, set deadlines, add approvals, assign tasks, and track each team member's progress.

You can also connect to thousands of Apps through Zapier and automate your workflows even more.

Let's get started!

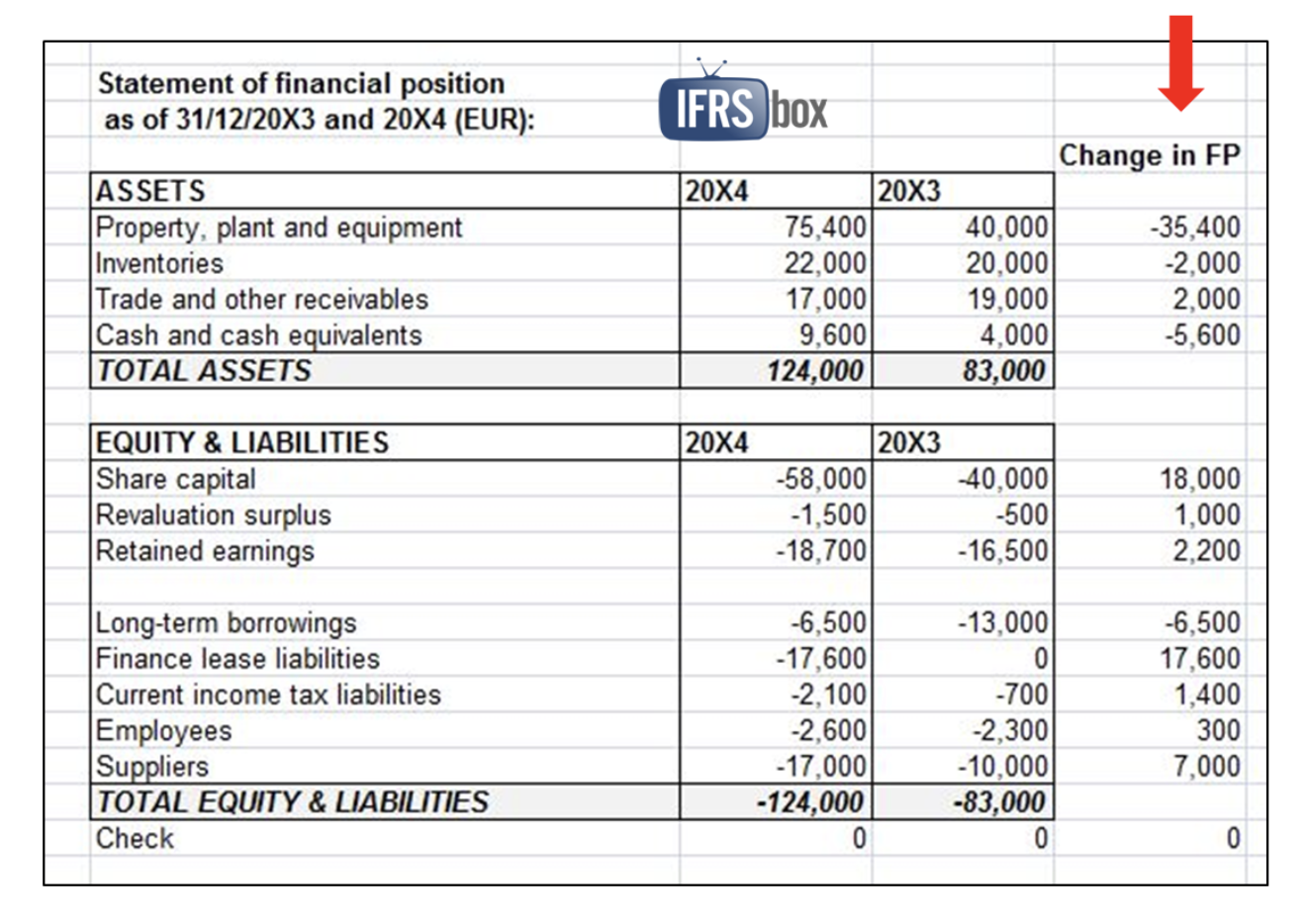

Watch the short video below for a brief overview of the cash flow statement.