This is a guest post by Caitlin Reimers Brumme, Managing Director of MassChallenge Boston. Prior to MassChallenge, Caitlin led the Impact Collaboratory at the Harvard Business School, a multi-faceted effort to develop world class academic leadership on the topic of “Investing in the 21st Century” including sustainable, ESG and impact investing. Caitlin holds an MBA with high distinction from Harvard Business School, where she was a Baker Scholar, and a B.A. with honors from The Woodrow Wilson School of Public and International Affairs at Princeton University.

Accelerating a startup is like pouring rocket fuel into the tank of some crazy, untested contraption. If the engine is strong and built for speed, there’s potential for an explosive reaction.

It’s the job of accelerators to make sure the company they’re funding and mentoring will create the right kind of explosion. Because funding can hurt a company, and mentoring can go to waste if the foundations of a startup aren’t solid.

That’s why some select accelerator success stories like Stripe, Mopub, and SendGrid have graduated and gone on to raise record amounts, go public in record time, or be acquired for vast sums of money.

It’s also the reason why some never make it.

Accelerators are hyper-competitive because they’re looking for startups that have a lot of the scaling infrastructure or potential already in place. With the funding, mentoring, and connections they provide, a startup with a great idea and MVP can break through from obscurity and see headline-grabbing success in a matter of months.

But exactly how likely is it that your startup will get accepted into an accelerator? What are the processes that underpin accelerator programs, and the resources these organizations offer startups that makes it possible to scale so rapidly?

In this article, we take a look at startup acceleration by the numbers, starting with a brief note on what an accelerator actually is.

First of all… what is a startup accelerator?

Startup accelerators are organizations that have connections to investors, ex-founders, business partnerships, and capital. They run fixed-term, cohort-based programs for the most promising startups.

The aim is to quickly equip companies with everything they need to scale. This includes providing seminars, investor pitches, and help fine-tuning the product and business model.

One main draw of accelerators is the network that they introduce you to. It’d be hard to get a meeting with a top founder like Jared Friedman, or a VC like Thomas Korte, without the backing of an accelerator; it’s just an opportunity most businesses don’t get at the vital early growth stages when direction really matters.

In exchange for a short (3-6 month) program and chunk of startup capital, accelerators often take a slice of equity, usually ranging from 7 to 10%. Others don’t take equity or may provide less initial capital.

The amount of capital or the intensity of the program is often seen as a differentiator between accelerator programs and incubators. Incubators are geared to help very early stage startups, often in an idea or testing phase; maybe getting their first few clients. Whereas an accelerator provides the resources to help that small startup grow into one which has proof-of-concept, market validation, and an understanding of what it should do next.

In the US and Canada, 186 accelerators have invested a total of $107.3m in 3,296 companies. Of these 186 organizations, well-known examples include Y Combinator, Angel Pad, Techstars and MassChallenge.

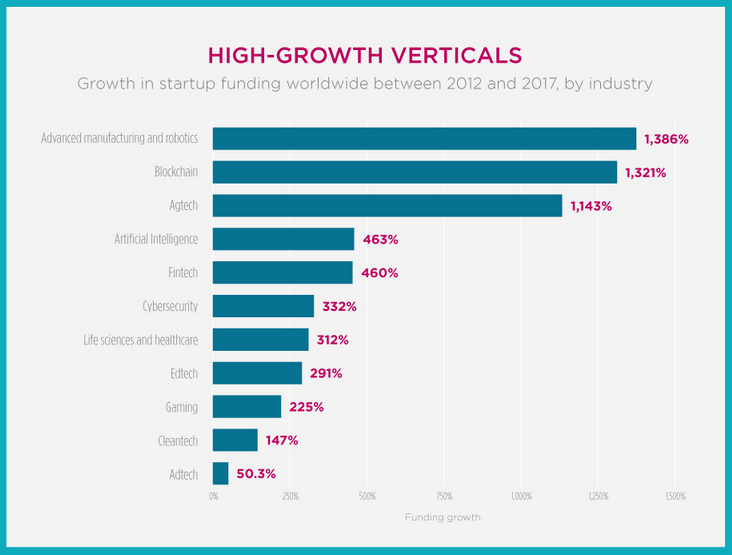

Which verticals get the most funding?

It’ll come as no surprise that all 11 of the highest-growth verticals (by funding) are technology companies.

Between 2012 and 2017, robotics, blockchain and agtech each grew by over 1,000%. The next biggest three verticals were AI, fintech, and cybersecurity. This reflects the high-tech future we’re headed towards:

Which US accelerators have had the most exits?

Exit count is one the best metrics to use to measure an accelerator’s effectiveness because it represents how willing other companies are to acquire their accelerated startups; the amount of exits generally speaks to the quality of an accelerator’s network, judgement, and mentoring.

Top 10 startup accelerators by exits:

- Y Combinator. Investments: 1,834. Exits: 192

- 500 Startups. Investments: 1,694. Exits: 162

- Techstars. Investments: 1,557. Exits: 134

- Plug and Play. Investments: 731. Exits: 60

- MassChallenge. Investments: 1,376. Exits: 47

- SSOV. Investments 1,152. Exits: 23

- Startupbootcamp. Investments: 424. Exits: 21

- Internet Initiatives Development Fund (IIDF). Investments: 335. Exits: 21

- Wayra. Investments: 960. Exits: 18

- Start-Up Chile. Investments: 837. Exits 16

That data should be accurate to early 2019, but these things are always changing – so read the data as illustrative!

However, exits are not the only metric by which you can measure success. There’s also the amount of money received in those exits: the aggregate size of the exits. And that changes the data.

Top 10 startup accelerators by aggregate amount of dollars in exits:

- Y Combinator – $5B

- Techstars – $1B

- AngelPad – $493M

- DreamIT Ventures – $397M

- fbFund – $359M

- LaunchpadLA – $185M

- SeedCamp – $137M

- NYC SeedStart – $130M

- Amplify.LA – $57M

- Wayra – $44M

This data comes from Seed-DB and should be seen as accurate to late 2018.

Top startup accelerators: AngelPad

Angel Pad doesn’t appear in the first top 10 list, partly down to making significantly fewer investments than some of the other players on the list. Despite that, AngelPad finds itself 3rd on the second list for large exits.

This shows us that AngelPad is careful with where it invests its money and looks for startup opportunities which are likely to have a big impact in a large market. Process Street came through the AngelPad accelerator and can attest to the rigor of the program.

Top startup accelerators: MassChallenge

MassChallenge is a Boston-based accelerator with programs globally. Focusing on high-growth verticals like health and fintech, MassChallenge has made 1,376 investments and seen 47 exits, making it the #5 accelerator in the US.

Unlike other large accelerators, MassChallenge doesn’t operate by taking equity. With a 0% equity cut, startups don’t dilute equity early and still remain attractive to investors and top talent later down the line. Across all programs, MassChallenge awards $3,000,000 in cash prizes to startups as they compete over the course of 3 months.

Top startup accelerators: Y-Combinator

Y Combinator was founded by Paul Graham, Jessica Livingston, Trevor Blackwell and Robert Tappan Morris — investors, founders, and entrepreneurs with backing from Sequoia Capital. Y Combinator has worked with startups like Coinbase, Optimizely, Airbnb and Heroku. For $150,000 capital, Y Combinator takes a 7% equity cut.

Top startup accelerators: Techstars

Techstars is a Colorado-based accelerator founded by David Cohen, Brad Feld, David Brown, and Jared Polis. The program offers $120,000 in exchange for 7-10% equity.

Well-known Techstars alumni include Sendgrid, Digital Ocean, and Localytics.

What do top accelerator program application processes look like?

Because of the fact that accelerators are responsible for doing a good job in exchange for the equity they ask – and the sheer number of startups that apply – accelerators are very picky with who they choose. The average acceptance rate for all of the top 5 listed in this article is only around 1-2%.

Case study: MassChallenge

Data from MassChallenge reveals the nuances of the application funnel, showing that out of the 3,000 applications they receive only 150 make it through the assessment stage. After 25-minute interviews with those promising teams that make it through the first round, between 45 and 90 companies are admitted.

In the application stage, startups fill out a form about their background, product, and funding. This allows MassChallenge to filter out companies that aren’t at the right stage of development or don’t have strong founding teams.

The 150 teams that are selected for interview are first evaluated on the specifics of their business model, alignment with investment vertical, experience, and revenue. The interview round that follows is more to judge the character of the founding team than to assess the data provided, and to ask follow-up questions.

At each stage of the funnel, accelerators make judgements on whether the startup’s idea evolves or disrupts the industry enough to make the cut.

Preparing for application: what you’ll need

There’s certain criteria every investor runs through when evaluating whether a deal’s worth it, or whether an idea will fly. Warren Buffett’s investing checklist, for example, includes tests on whether a business’ profit margins are high, whether the idea is simple, whether the business has a consistent history, and a bunch more.

You can see Warren’s investing checklist here, in the form of a Process Street template.

Process Street is a workflow management software that makes recurring tasks simple and easy. In the template above, the investment checklist process is broken down into manageable tasks, with form fields to capture important data. This streamlines the whole process, and will save you a great deal of work in the long-run.

Accelerators maybe aren’t as strict on whether your business has stood the test of time, but they will want proof that your idea is valid, your founders are capable, and your traction is quantifiable.

Implementing processes in your startup to ensure the smooth-running of daily recurring operations goes a long way to demonstrate the competency of your organization as a whole. Processes like these, for example: The 12 Startup Procedures Every Founder Should Master.

Make sure to be able to clearly articulate the problem your product solves, and why your particular product is the solution – the solution that is significantly better and differentiated from the status quo.

On the legal side, prepare your operating agreement, accounting processes & compliance, company structure, and consider trademark protections. Documentation and data are equally important – it showing sincerity and a well-informed approach to the business. You’d not want to freeze up when asked how much revenue or profit you make, or the rate of churn.

Consider implementing a quality management system, even informally. You can perform an internal self-audit, and the documentation yielded by that kind of process would be useful evidence for showing competence.

A note about teams: if you’re a solo founder, it’s unlikely that you’ll be eligible for application to most accelerators. Before applying, find a co-founder or skeleton team. Usually, a tech startup’s founding team will be a CEO and CTO, with the CEO focused early on marketing and product and the CTO building the solution.

See the infographic below from the team at MassChallenge for more tips on the application process and an overview of how their accelerator program functions and what they look for.

Best of luck!

Have any startup accelerator war stories? Do you have an accelerator program you were part of and want to recommend to others? Let us know in the comments below!

Oliver Peterson

Oliver Peterson is a content writer for Process Street with an interest in systems and processes, attempting to use them as tools for taking apart problems and gaining insight into building robust, lasting solutions.