How do you know how much money your business might make?

How do you know how much money your business might make?

How do you know how big your business could grow to in future?

How do you explain all that to someone else in a way which makes sense?

Well, a huge part of these kinds of calculations comes down to understanding your market.

Who might need this product? Who tends to buy this type of product? How many of them can you sell to?

There are lots of questions you might ask.

These questions, once you’ve dug deep enough into them, give you your TAM SAM SOM.

In this Process Street article we’re going to look at:

- What is TAM SAM SOM?

- How to calculate TAM SAM SOM

- How you can use Process Street to understand your business

Let’s get started!

What is TAM SAM SOM?

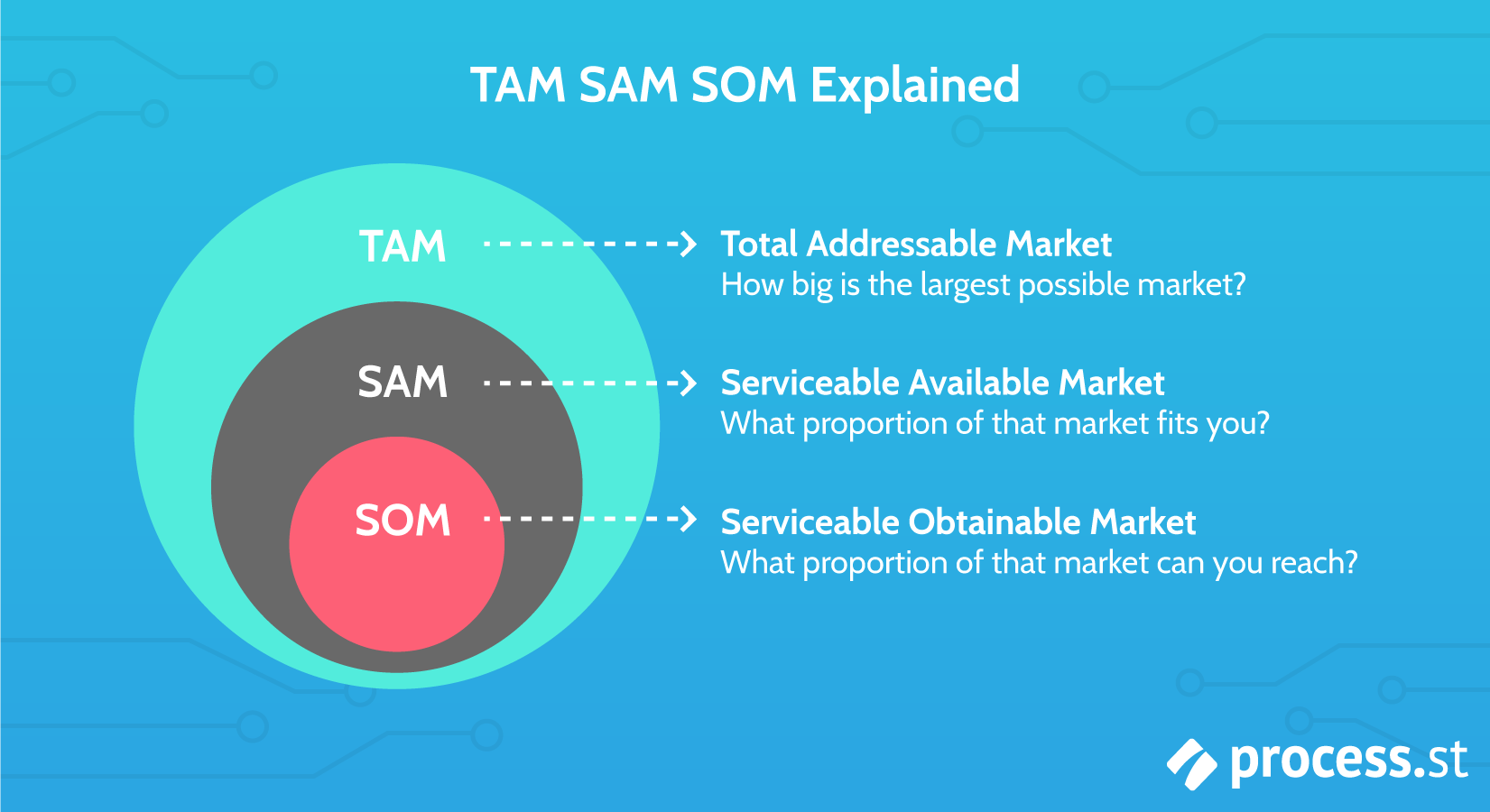

TAM SAM SOM is a way of understanding your business’ relationship to market size.

TAM SAM SOM is a way of understanding your business’ relationship to market size.

The market size for sausages globally is probably pretty huge, but if I decide to start making sausages then it’s pretty unlikely I will ever be able to reach much of that market.

So what market can I reach? This is what TAM SAM SOM can help us understand.

TAM – Total Addressable Market

Your total addressable market refers to the overall demand for the products or services your company provides.

The Corporate Finance Institute defines it as:

The Total Addressable Market (TAM), also referred to as total available market, is the overall revenue opportunity that is available to a product or service if 100% market share was achieved.

This is the more abstract of the three components of TAM SAM SOM – abstract because it depends on how you envision what your products or services really are.

Let’s take Uber.

Uber entered the market as a taxi company which tried to improve the user experience of taking a taxi and, in doing so, make fleet management more efficient. So at first glance, Uber’s TAM would be the global taxi market. A big market and a fairly quantifiable one.

But what about a company like Facebook? Instead of providing an improved provision of an existing product or service, Facebook kind of created a new one.

Sure, FriendFinder, Myspace, Bebo, etc, all existed – but the market Facebook has now is so many times larger than what all those companies had combined at the time. So how would Facebook calculate TAM? Would it be all the social interactions in the world? Probably not. Or would Facebook see themselves as an advertising company – their market being all the digital ads provided globally?

It’s hard to say, and this is why your TAM ends up being quite an abstract idea and a reflection of what you really believe your product is.

If we return to Uber, its play wasn’t just to be a taxi company. Internally, Uber’s market was seen as every meter travelled. This means taxis, delivery services, haulage, and more. We’re seeing this now with UberEats and UberFreight, which is currently expanding across Europe.

The TAM for Uber then is not just the size of the global taxi market, but transportation more generally.

When you’re trying to understand your own total addressable market, you need to think of how you define your company and where you believe it can go.

SAM – Serviceable Available Market

Your serviceable available market refers to the segment of your TAM which you can reach.

If I’m starting a bar, then the total addressable market for my company looks pretty huge – but I can’t serve a beer in New York and LA at the same time.

I’m restrained by geography and have to work out how much of the total addressable market as I defined it can be accessed in my location.

As a result, your SAM might be more likely to change over time.

In a previous article of mine about how a franchise works, I discussed McDonald’s at some length. The SAM for McDonald’s probably didn’t change too much in the early years, it sured up a few locations and started to make good money.

What allowed for the SAM to grow was the mechanism McDonald’s operated with – namely, the Speedee Service System. This made McDonald’s more efficient and able to expand at a rate other restaurants couldn’t – expanding its SAM.

This is important to remember as it doesn’t matter how big your TAM is if you don’t have a mechanism to grow your SAM inside that TAM.

McDonald’s had the Speedee Service System, Facebook had its software-based network effect, and Uber had a fleet management innovation.

Those mechanisms are the reasons why these are globally known companies rather than simply a local burger joint, a Harvard networking site, or a taxi cab company.

If I’m starting a bar and I want a SAM which is higher than simply the available market in the town I’m in, then I’ll need to show I have a mechanism that allows me the growth to expand into more markets.

Of course, we’re not only dealing with products and services relevant to physical geographies but ones which might be location-agnostic and digital ones too. For which we can get a little quote from Stanford:

The part of the TAM for which your business model’s value proposition is strongest.

So that’s the audience who you should be able to serve best, assuming you were able to reach them.

SOM – Serviceable Obtainable Market

Your serviceable obtainable market is kind of like your actual goal. This is how much of the market in your location you can realistically reach.

My hypothetical bar I’m starting in my town is not going to be the only place someone can go to have a beer. There will be loads of other bars a potential customer could choose.

To evaluate this, you’ll need to have both a strong understanding of your local market and a deep knowledge of your own company and what you can deliver. This could be impacted by something as simple as how high the throughput traffic is on the road where you’re starting your business – which might be a key factor for my bar.

However, we also have to think about how geographies can be limiting in the context of digital space.

I don’t really have a bar, but I do have a language learning software called Idyoma. We’re not held back by locations but that doesn’t mean that we can somehow reach our entire SAM.

Idyoma is an app for language exchange so part of the limitation might be how many keywords we can rank for in the Appstore or PlayStore, how competitive those keywords are, and how many people search those terms. These will be impactful factors on organic downloads.

Beyond that, what kind of budget are you working with? If you started a Facebook competitor, you’re going to have a tough time to reach big numbers as a lot of other sites are eating up the digital space you want to be in.

The digital geographies contain many of the same restrictions as the physical ones. So it’s important to factor this in.

How to calculate TAM SAM SOM

I was at a SaaStr conference recently in Paris and wrote about the business growth lessons learned from it.

Christian Lanng from Tradeshift gave a talk there where he said that he thinks each B2B vertical is a $10b space. So let’s start here.

We’re taking a little inspiration from the people at The Business Plan Shop with this example.

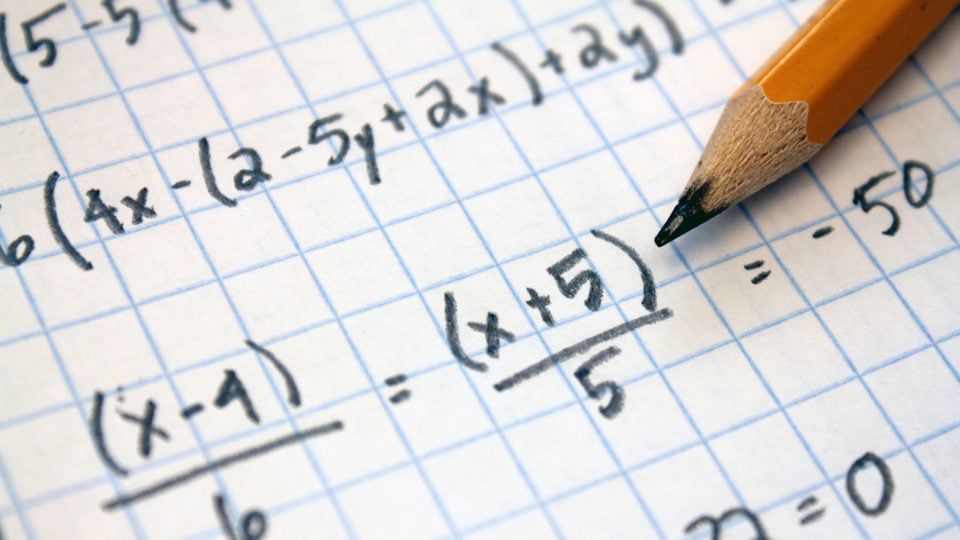

We’ll assume that you’re starting a SaaS business doing something B2B. You’ve done the research and agree with Lanng’s suggestion that the market size is about $10b. Your SAM looks like a particular niche in that market for your kind of product and you’ve seen a few industry reports which estimate its value at around $100m.

Now, you’ve also had this product on the market for long enough to understand your customers, your marketing funnel, and your current revenues. You think your startup can reach $10m revenue in 2 years and $20m in 4 years.

Don’t worry if these don’t seem like the biggest numbers in a $10b space; Salesforce grew from 0-$1b in 10 years, and in the next 10 years became a $90b dollar company.

You’re going to ask an investor for $500k and offer an investor 20% as part of a seed round. The investor wants to see a 10x on their returns. Your TAM SAM SOM will allow you to show the investor both the realistic short term benefits of the deal, and the potential long term upside.

So, from the figures we have assuming you’ll see a 25% EBITDA and working from the idea that valuations in that niche are typically 8x EBITDA, we can work out the following:

- After 2 years you’ve delivered $10m, which means 10m x 25% margin = 2.5m

- And the valuation is 8 x 2.5m = 20m

- The investor return is 20m x 20% stake / 500k investment = 8x return.

So the investor is already seeing close to the 10x return they aim for, after the first 2 year period.

But what happens after 4 years?

- You’ve delivered 20m, which means 20m x 25% = 4m

- The valuation is 8 x 4m = 32m

- The investor return is 32m x 20% / 500k = 12.8x return.

So if you’ve reached your target SOM of 20m after 4 years then the investor is pretty happy. But, if you look at the maths again you can see that if you’d only offered 10% instead of 20% equity then it wouldn’t have looked like as good a deal for the investor, and would still have been a long way from meeting their 10x target.

Moreover, the fact that your numbers were accurate and you hit your SOM shows other investors there is good reason to take you seriously. You’ve demonstrated a proven ability to reach 20% of your serviceable available market.

If you’re able to scale this up and reach the same portion of the total addressable market (even if it takes a while) then the numbers look like so:

- 20% of $10b TAM = 2b

- 2b x 25% EBITDA = 500m

- The valuation is 8 x 500m = 4b

- The investor would want a 10x return which means you could ask for up to 400m.

Now, of course, it’s not quite as simple as that when we move to the TAM, but your SAM/SOM figures were correct so you’re in a very trustworthy position.

The main point is, it helps you to understand how you’re relating to the investor.

How you can use Process Street to understand your business

So we’ve seen what these different terms mean, and you’ve probably noticed that there are a whole bunch of different areas you’ll have to research in order to build this all out properly.

At Process Street we do superpowered checklists.

You document the steps in a process to get something done and then save that as a template.

When you need to follow that process you run the template as a checklist and follow it.

This means you have a standard process for how you approach tasks or projects – a process you can improve or iterate over time! But it also means you have a single instance record for everything you did when completing that task. This way, nothing gets lost next time you come to try to do it.

Here are a load of related templates and checklists we have which you can check out. It’s free to sign up for Process Street so you can just add the template you like to your account, edit it, and start running checklists!

- SWOT Analysis Template

- Warren Buffet’s Investment Checklist

- Purchase of a Business

- Stock Purchase Due Diligence Checklist

- Private Equity Due Diligence Checklist

- Business Partnership Due-Diligence Checklist

- Product Strategy Template

- Company Research Checklist

- Product Launch Checklist

- Sales Pitch Planning Checklist

- Investor Pitch

- Financial Planning Process

- Annual Financial Report Template

- Financial Management For New Projects

- Startup Due Diligence for a Venture Capitalist

- Financial Plan Template

So there you go!

Add whichever templates you want to your new free Process Street account and get started!

Have you struggled trying to understand your TAM SAM SOM? What have been the main hurdles you’ve faced in working out your markets? Let us know in the comments below!

Adam Henshall

I manage the content for Process Street and dabble in other projects inc language exchange app Idyoma on the side. Living in Sevilla in the south of Spain, my current hobby is learning Spanish! @adam_h_h on Twitter. Subscribe to my email newsletter here on Substack: Trust The Process. Or come join the conversation on Reddit at r/ProcessManagement.